Xi Wants Huawei Ban Lifted; EU Throws Iran A Bone

MarketPulse | Jun 27, 2019 07:57AM ET

U.S. stocks index futures were initially climbing on optimism that U.S. President Trump will delay additional tariffs and that the world’s two largest economies will have a reset in trade talks. Last month, talks were close to a deal after both sides seemed to be agree on Chinese purchases of U.S. goods, intellectual property rules and market access. It all fell apart after China backed out of making changes to their law and that was a deal breaker for Trump as he wants to see structural reform in China.

Just as important for China is the optics of how a deal is reached. They do not want to appear weak and succumbing to U.S. pressure. U.S. officials are trying to temper expectations from becoming too optimistic, but with stocks near record territory, it appears markets are fairly convinced some good will come out of Osaka this weekend.

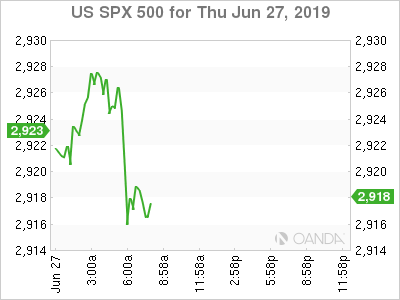

Equities took a small reversal after the Wall Street Journal reported “Beijing is insisting U.S. remove its ban on the sale of U.S. technology to Chinese telecommunications giant Huawei Technologies Co. Beijing also wants the U.S. to lift all punitive tariffs and drop efforts to get China to buy even more U.S. exports than Beijing said it would when the two leaders last met in December.” It seems like this could easily get shot down by President Trump and U.S. indexes returned near the lows of the day.

Iran

European governments do not want Iran to abandon the 2015 nuclear deal and seem prepared to offer a credit line to help a special mechanism to enable trade with the West. Iran’s economy has been crippled by U.S. sanctions and the resumption of making weapons-grade material next month has motivated Europe to provide Tehran with an offer. If Iran violates the old agreement, the EU will threaten to remove this barter-like solution that would alleviate a lot of economic pain in the short-term.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.