Are Leadership Groups Breaking Down?

Brian Gilmartin | Aug 07, 2015 01:09AM ET

Even the most skeptical of investors would have to say that biotech and Apple (NASDAQ:AAPL) have been two leadership “groups” for quite some time, years in fact.

While some might not consider an AAPL a “group”, with a 4% market cap weight, a 6% earnings weight, and a 15% weight in the QQQ, how can anyone not consider AAPL important to the stock market ?

The recent breakdown in the stock below the November ’14 $119.75 high was noted for its absence of any kind of fundamental catalyst, even earnings and revenue revisions are still positive. AAPL filled an outstanding gap yesterday near $112.50, so the correction might be over already, but if $112.50 does not hold, then the September, 2012, split-adjusted high of $100.75 comes into play from a technical perspective.

Leadership stocks never typically break down with fundamental news: look at large-cap pharma in 1997, and then technology in March of 2000.

It may be much ado about nothing, but AAPL has my attention.

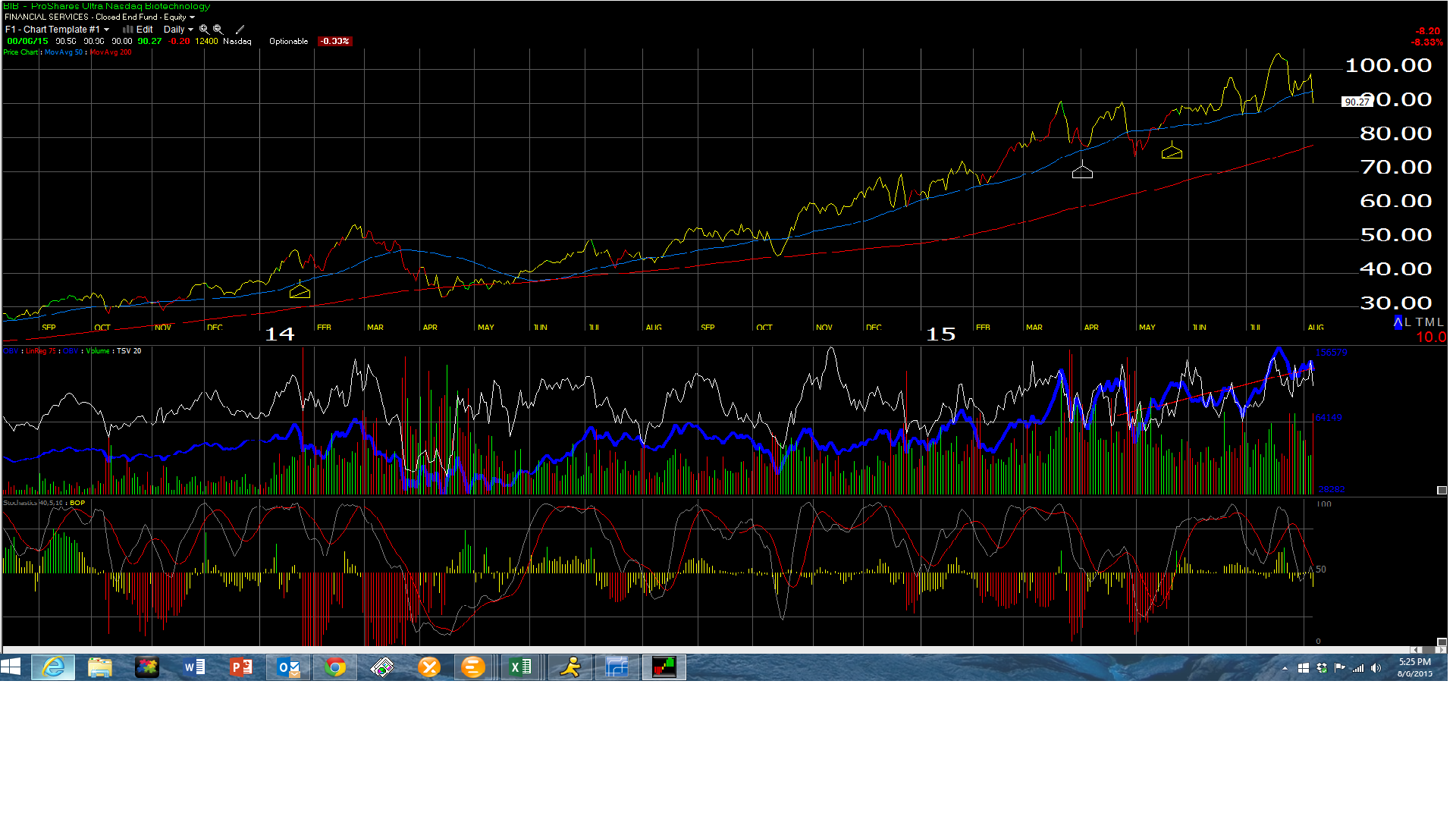

Speaking of healthcare, check the attached chart of BIB (NASDAQ:BIB) or the Ultra Nasdaq Biotechnology Index. Down 8% today, down 4% on the week, that looks like a nasty reversal. Even staid, quiet names like Amgen (NASDAQ:AMGN) fell $6 or 3.8% today. Biogen's (NASDAQ:BIIB) collapse is well known now, down from a high of $500 in mid-March ’15 to $300 as of Friday, July 24th, 2015, and although the stock has bounced a little, BIIB looks to be rolling over again.

Financial stocks have held their excellent relative strength since the late January, early February ’15 lows. Why the sector could be a safe haven today will be addressed in the next segment.

Why Won’t Interest Rate Rise?

Aside from the fact that government can’t calculate GDP data to save their collective lives (9 years after the fact, the Commerce Department is just catching onto the fact that Q1 GDP seems to be understated each year, while Q2 seems to be overstated), the best rationale I’ve heard in the last few years was from Blackrock’s Rick Reider at CFA Society of Chicago luncheon, where Rick explained that, thanks somewhat to Dodd-Frank, FSOC, CCAR and rabid regulation, there is simply less leverage in the financial system today. Hence, slower growth.

The “2nd phase” of financial leverage that Rick expected to drive US GDP growth, really hasn’t hit yet (to my knowledge). Hence investors sit and wait.

Yes, there is no real wage or price inflation thanks to the death match between Amazon (NASDAQ:AMZN) and Wal-Mart (NYSE:WMT), there is a strong US dollar, commodities are collapsing and global GDP growth remains pretty subdued.

Within client balanced accounts, clients hold some BlackRock (NYSE:BLK), Pimco (NYSE:PKO) and other short bond funds, and also held is a small short Treasury position via the TBF (NYSE:TBF), but clients with fixed-income exposure are mainly in cash, just waiting for this to play out.

A 5.3% unemployment rate, 17 million in auto sales (SAAR), the last 5 months, and pretty robust housing data, should be making the Fed nervous, but how many times has that been said the last 5 – 6 years.

The one economic release that was signalling inflation was the Employment Cost Index (ECI) and even that data has collapsed.

The July jobs report is looking for 225k jobs tomorrow morning. Long time leadership groups in the S&P 500 are starting to flag.

Investor pessimism remains pretty elevated.

My own opinion is that a strong jobs number and economic data will be a “net positive” for stock prices.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.