Will Yen Signal The Correction?

Michael A. Gayed | Sep 14, 2014 02:08AM ET

“Traffic signals in New York are just rough guidelines.” - David Letterman

In the pre-Abenomics era, the Japanese Yen would often serve as a strong indicator of heightened volatility and stock market correction risk. The Yen tended to rally as a haven for scared money during such periods, while a depreciating Yen often meant risks were easing and risk-taking in overall asset markets was returning. However, much of the relationship of the Yen to risk sentiment appears to have changed following aggressive actions by the Bank of Japan to target a lower currency in an effort to force reflation.

Having said that, there may yet be a point where the Yen may indeed be a warning sign of heightened market stress ahead. Consider the fact that many areas of the market which tend to do well preceding harsher conditions have indeed done so in 2014, with long duration Treasuries and Utilities most notably abnormally strong. Equity volatility has remained subdued despite their out-performance, however persistent leadership likely can only be ignored for so long. Perhaps the final confirmation comes from the Yen trying to push higher despite downward pressure from Kuroda. Our own equity sector ATAC Beta Rotation Fund (BROTX) appears poised to take on a more consistent defensive all-in sector stance given recent intermarket weakness.

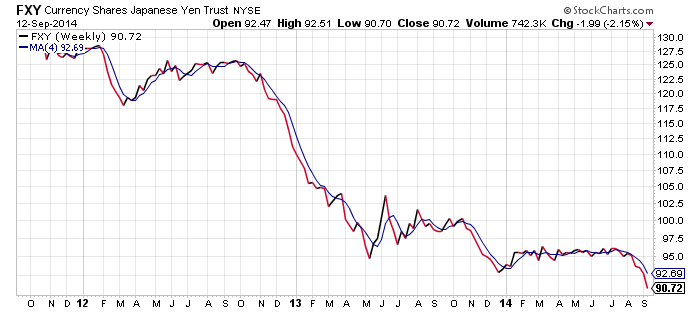

Take a look below at the Currency Shares Japanese Yen Trust ETF (ARCA:FXY) in dollar terms. Note that in late-February 2012, the Yen began rallying ahead of the April-May correction in stocks at the time, before suffering an unrelenting period of decline thanks in large-part to the election of Shinzo Abe and the aggressive stance he began taking on changing inflation expectations.

There was a minor period of strength in January 2014 in what appeared to be the first signs of a correction before markets V-ed right back to higher highs. The Yen on the far right seems to want to resume its decline, which might be indicative of another pulse in risk-taking. However, if the Yen stabilizes at these levels and begins to stage a recovery as it did in January, that, combined with negative seasonality for stocks in the September/October period, and persistent leadership in Treasuries/Utilities may finally be a true warning sign that conditions are about to change.

Disclosure: The fund as of 09/13/2014 does not invest in any of the following investments: FXY. Fund holdings are subject to change and are not recommendations to buy or sell any security. Current and future holdings are subject to risk. The Fund’s investment objectives, risks, charges, expenses and other information are described in the statutory prospectus, which must be read and considered carefully before investing. You may download the statutory or summary prospectus or obtain a hard copy by calling 855-ATACFUND or visiting www.atacfund.com. Please read the Prospectuses carefully before you invest. Mutual fund investing involves risk. Principal loss is possible. Because the Funds invest primarily in ETFs, they may invest a greater percentage of its assets in the securities of a single issuer and therefore is considered non-diversified. If a Fund invests a greater percentage of its assets in the securities of a single issuer, its value may decline to a greater degree than if the fund held were a more diversified mutual fund. The Funds are expected to have a high portfolio turnover ratio which has the potential to result in the realization by the Fund and distribution to shareholders of a greater amount of capital gains. This means that investors will be likely to have a higher tax liability. Because the Funds invest in Underlying ETFs an investor will indirectly bear the principal risks of the Underlying ETFs, including but not limited to, risks associated with investments in ETFs, large and smaller companies, real estate investment trusts, foreign securities, non-diversification, high yield bonds, fixed income investments, derivatives, leverage, short sales and commodities. The Fund will bear its share of the fees and expenses of the underlying funds. Shareholders will pay higher expenses than would be the case if making direct investments in the underlying funds. The Beta Rotation Fund is new with no operating history and there can be no assurances that the fund will grow or maintain an economically viable size. Beta is a measure of the volatility, or systematic risk, of a security or a portfolio in comparison to the market as a whole. Duration is a measure of the sensitivity of the price (the value of principal) of a fixed-income investment to a change in interest rates. Duration is expressed as a number of years.

MA(4) = 4 week moving average

References to other securities should not to be interpreted as an offer of these securities. ATAC Beta Rotation Fund is distributed by Quasar Distributors, LLC. No other products mentioned are distributed by Quasar Distributors, LLC.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.