Will Yellen Stick To The New Normal Script?

Chris Ciovacco | Aug 24, 2016 02:26AM ET

Insight Into Jackson Hole

Janet Yellen will deliver the keynote address on the market’s calendar this week when she speaks at the Fed’s Jackson Hole conference Friday at 10:00 am ET. The Wall Street Journal’s Jon Hilsenrath has been covering the Fed for years. Earlier this week, Hilsenrath reiterated the Fed’s “new normal” narrative, which may provide some insight into Yellen’s remarks later this week. From The Wall Street Journal :

For much of the post-financial-crisis era, U.S. Federal Reserve officials have held to a belief that they could get back to their old way of doing things. Growth would resume at a modest pace, annual inflation would climb to 2% and interest rates would gradually rise from near zero to a normal level near 4% or higher. As they prepare to gather at their annual retreat in Jackson Hole, Wyo., officials are grimly coming to a view that it isn’t going to happen that way.

Yellen Acknowledged New Normal In June

Fed officials have been publicly stating the U.S. central bank may not be able to get back to the “old way” of doing things, a concept covered in detail on Reuters story published on June 15:

In a news conference following the Fed’s latest meeting, Chair Janet Yellen said the central bank was still coming to grips with the likelihood that the neutral rate - the point at which monetary policy is neither spurring nor restraining economic growth - is stuck at a historic low and could limit the central banks room to maneuver. But “there are long-lasting, more persistent factors that may be holding down the longer-run level of neutral rates,” Yellen said.

“It could stay low for a prolonged time… All of us are in a process of constantly reevaluating where the neutral rate is going, and what you see is a downward shift over time, that more of what is causing this to be low are factors that will not be disappearing.” There could be revisions in either direction,” Yellen said. “A low neutral rate may be closer to the new normal.”

QE Will Most Likely Be The Weapon Of Choice

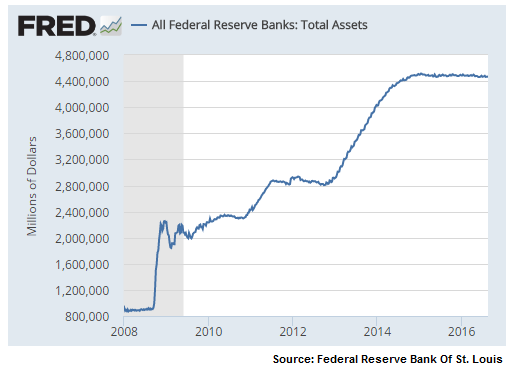

The Fed traditionally combats a recession by lowering interest rates, something that will be difficult to do in the future given interest rates remain near zero. Therefore, knowing negative rates have had mixed results in Japan, the Fed will most likely print more money, via quantitative easing (QE), in an attempt to keep debt-burdened financial markets elevated during the next recession. From The Wall Street Journal :

A research paper by Fed senior economist David Reifschneider argues that bond purchases and low-rate promises ought to be enough for the Fed to manage even a “fairly severe recession” that drives the unemployment rate up to 10%. Doing so would require the Fed to expand its securities portfolio by $2 trillion, and possibly as much as $4 trillion, the analysis shows.

Talk Of One More Rate Hike

Is it possible the Fed raises rates one more time? Sure, in fact it is likely, at a minimum, the Fed strongly considers another hike over the next four to six months. In terms of the September Fed meeting, the market currently puts the odds at 82% the Fed does nothing (18% they raise rates). From The Wall Street Journal :

This isn’t to say the Fed won’t raise short-term rates again sometime this year. Many officials expect it will. The Fed boosted its benchmark federal-funds rate—a rate on overnight loans between banks—by a quarter percentage point from near zero in December. But it does mean it isn’t likely to raise them much beyond its next few moves in the months and years ahead. “We probably don’t have a lot of monetary policy tightenings to actually do over time,” William Dudley, president of the Federal Reserve Bank of New York, told Fox Business Network.

Million Dollar Question

If the Fed raises rates and also sends a message rates will remain low longer-term, will the market sell off or focus on the longer-term new normal? Ultimately, the market will decide. However, given the facts we have in hand now, asset class behavior seems to be following the lower-rates-longer script.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.