Will U.S. Retail Sales Move The Needle?

MarketPulse | Mar 14, 2018 08:00AM ET

Wednesday March 14: Five things the markets are talking about

US equities are under performing for a second consecutive day as markets continue to digest Monday’s economic and political news. The 10-Year Treasury yield is lower while the dollar holds somewhat steady.

While yesterday’s US inflation report reinforced the sense that economic growth is picking up without runaway price increases, energy shares weighed on the S&P 500 Index as oil declined on concern that global demand might not absorb growing US supplies.

The Fed need not get overly aggressive at next week's monetary policy meeting after yesterday’s US consumer price index print, which rose slightly in February and core-CPI stayed flat, meaning inflation fears were averted. Still, the Fed is widely expected to raise interest rates at the meeting.

However, today’s US retail sales and crude inventory numbers may offer more clues on the future of the economy.

On Tap: At 8:30 am EDT, US retail sales for February are released, with expectations for a +0.3% growth in both headline and ex-autos data. At the same time, PPI for February is also published.

China data on industrial production (IP), retail sales and fixed-asset investment are all out later this evening and are expected to point to slower growth.

1. Stocks under pressure

In Japan, the Nikkei slide overnight on US protectionism fears and on Rex Tillerson dismissal. Leading the drop were chip-related stocks, while shares of companies linked with defence attracted buying. The Nikkei ended -0.9% lower, while the broader Topix was -0.5%.

Down-under, Aussie shares closed lower, with losses led by financials, while the departure of yet another senior official from the Trump White House further dampened sentiment. The S&P/ASX 200 index ended -0.7% lower. In S Korea, the Kospi declined -0.7%.

In Hong Kong, stocks snap a four-day rising streak on trade war fears. The Hang Seng index fell -0.5%, while the Hang Seng China Enterprise (CEI) lost -0.6%.

In China, tech firms dragged down regional bourses. At the close, the Shanghai Composite index was down -0.6%, while the blue-chips Shanghai Shenzhen CSI 300 index ended -0.4% lower.

In Europe, regional bourses trade mostly higher across the board with the exception of the Spanish IBEX 35 which trades lower as its being weighed down by some disappointing earnings reports.

US stocks are set to open in the black (+0.3%).

Indices: STOXX 600 +0.3% at 376.4, FTSE +0.3 at 7162, DAX +0.3% at 12255, CAC 40 +0.2% at 5255, IBEX 35 -0.2% at 9678, FTSE MIB +0.3% at 22768, SMI +0.3% at 8907, S&P 500 Futures +0.3%

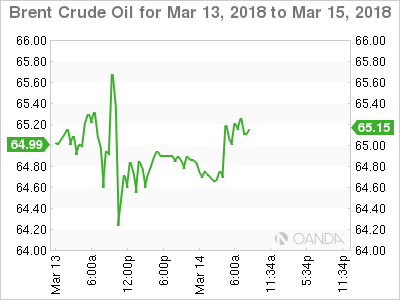

2. Oil rises as Chinese factory data boosts commodities, gold unchanged

Oil has edged higher ahead of the US open as strong Chinese factory activity encouraged investor inflows into industrial commodities. Nevertheless, fast-growing US crude output is expected to cap price gains.

Note: Beating expectations, China reported a +7.2% y/y increase in IP in the first two-months of 2018 – the data showed that crude production fell -1.9%.

Brent crude is up +27c at +$64.92 a barrel, while US West Texas Intermediate (WTI) futures are up +31c at +$61.02 a barrel.

Brent crude has fallen around -1% this week, as traders have grown increasingly doubtful that coordinated supply cuts by OPEC may not be enough to offset the rise in US crude production.

Expect investors to take their cue from this morning EIA inventory report at 10:30 am EDT.

Ahead of the US open, gold prices are trading flat, hovering atop of its one-week high on a weaker dollar following US Secretary of State Rex Tillerson’s dismissal, which has strengthened concerns of protectionist policies hampering global risk appetite. Spot gold is unchanged at +$1,325.93 per ounce.

3. Yields little changed

Norway’s Norges Bank meets tomorrow and the consensus believes that just because the inflation target has suddenly been reached after the central bank lowered its inflation target to +2% does not mean that central bankers will hike its key rate imminently so that that the NOK (€9.5537) has to appreciate.

Norwegian policy makers continue to emphasize the continued need for an expansionary monetary policy. Nevertheless, the new inflation target would suggest that the central bank can emphasize that a first rate hike could take place in Q3 with more credibility.

Also on Thursday, the Swiss National Bank (SNB) will deliver its new monetary policy assessment (MPA). Market expectations are firmly centered on a no change to either the -1.25% – -0.25% target band for three-month libor or the key deposit rate, pegged at -0.75% since January 2015.

Elsewhere, the yield on 10-Year Treasuries fell -3 bps to +2.84%, the biggest drop in more than a week. In Germany, the 10-Year Bund yield fell -1 bps to +0.62%, the lowest in almost seven-weeks, while in the UK, the 10-Year Gilt yield has dropped -1 bps to +1.487%.

4. Dollar under pressure

The ‘mighty’ US dollar has again come under renewed pressure after yesterday’s tame US inflation report and on looming trade and political woes.

The EUR/USD (€1.2374) is softer as ECB chief Draghi and chief economist Praet’s rhetoric is consider as being ‘dovish’ as both individuals stressed “patience” as the ECB needed to see more evidence that inflation was rising before ending QE. The currency pair remains contained within its 2018 trading range. Dealers have noted that recent ECB rhetoric on FX volatility rather than the outright level could eventually propel the ‘single’ to fresh 2018 highs.

The SEK (€10.1510) is a tad softer as Swedish inflation remains below the Riksbank +2% target.

Elsewhere, the pound has climbed +0.4% to £1.3959, the strongest level in two-weeks, while the Japanese yen has decreased -0.1% to ¥106.54.

5. Euro Industrial production fell

Data this morning from Eurostat showed that seasonally adjusted industrial production (IP) in January fell by -1.0% in the euro area (EA19) and by -0.7% in the EU28. In December 2017, IP rose by +0.4% in the Euro area and by +0.3% in the EU28.

In January 2018 y/y, IP increased by +2.7% in the euro area and by +3.0% in the EU28.

Digging deeper, the decrease in the euro area is due to production of energy falling by -6.6%, durable consumer goods by -1.9% and intermediate goods by -1.0%, while production of capital goods rose by +1.2% and non-durable consumer goods by +0.1%.

In the EU28, the decrease is due to production of energy falling by -3.3%, durable consumer goods by -1.4%, intermediate goods by -0.6% and non-durable consumer goods by -0.3%, while production of capital goods rose by +1.2%.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.