Will Upcoming Inflation Take Gold With It?

Sunshine Profits | Apr 09, 2021 12:01PM ET

Inflation is coming. Gold may benefit from it, especially if inflation turns out to be more long-lasting than central bankers and markets believe.

Brace yourselves, their projections increased significantly in the last three months, when they amounted to 1.8%.

And remember, we are talking here about the official inflation figures. The real inflationary pressure, which also affects asset prices, is much stronger. Furthermore, the pandemic changed the composition of consumption, as people are buying more goods and fewer services. And guess what, the prices of goods are rising more than the prices of services, so many people’s actual consumption baskets have become more expensive than official ones, implying that true inflation is higher than the officially reported one, as the IMF has recently admitted .

Does this mean that the Fed believes that inflation will be temporary, caused by the base effects (very low inflation readings in the second quarter of 2020) and by the reopening of the economy that will trigger higher consumer spending and some increases in prices.

The U.S. central bank might be right. After all, there will be some temporary forces at play. There always are, but – oh, what a funny thing! – the Fed always cites “transient effects on inflation” when it’s increasing, but not when it’s declining. The problem is, however, that the markets don’t believe the U.S. central bank. Please take a look at the chart below, which displays inflation expectations over the next five and 10 years.

As you can see, both medium-term and long-term inflation expectations have significantly increased in the last few months. It means that investors don’t only expect a temporary rise in inflation – on the contrary, they forecast a more persistent increases in prices. Indeed, Mr. Market believes that inflation will be, on average, 2.5% in the next five years and almost 2.3% in the next 10 years, significantly above the Fed’s target of 2%.

Of course, it might be the case that Mr. Market is wrong, and in the 1970s. Gold shined at that time.

Then, as today, the central bank focused more on the maximum employment than inflation, believing that it can always control the latter by raising the Robert J. Barro, from Harvard University, points out: “the problem is that hiking short-term rates will have little impact on inflation once high long-term expected inflation has taken root.”

And the recent Fed’s actions, including the new monetary framework, according to which the U.S. central bank tries to overshoot its target for some time, may easily waste the reputational capital that was created by Paul Volcker and de-anchor inflation expectations.

In other words, a negative shock can be accommodated by the central bank without long-lasting effects, as people understand that it’s a unique one-off event, after which everything will return to normal. But the Fed is far from normalizing its monetary policy . On the contrary, it has recently signalled that it wouldn’t raise interest rates preemptively to prevent inflation, as it could hamper the economic recovery. The risk here is that if people start to view exceptional as the new normal, their inflation expectations could shift, and become unanchored.

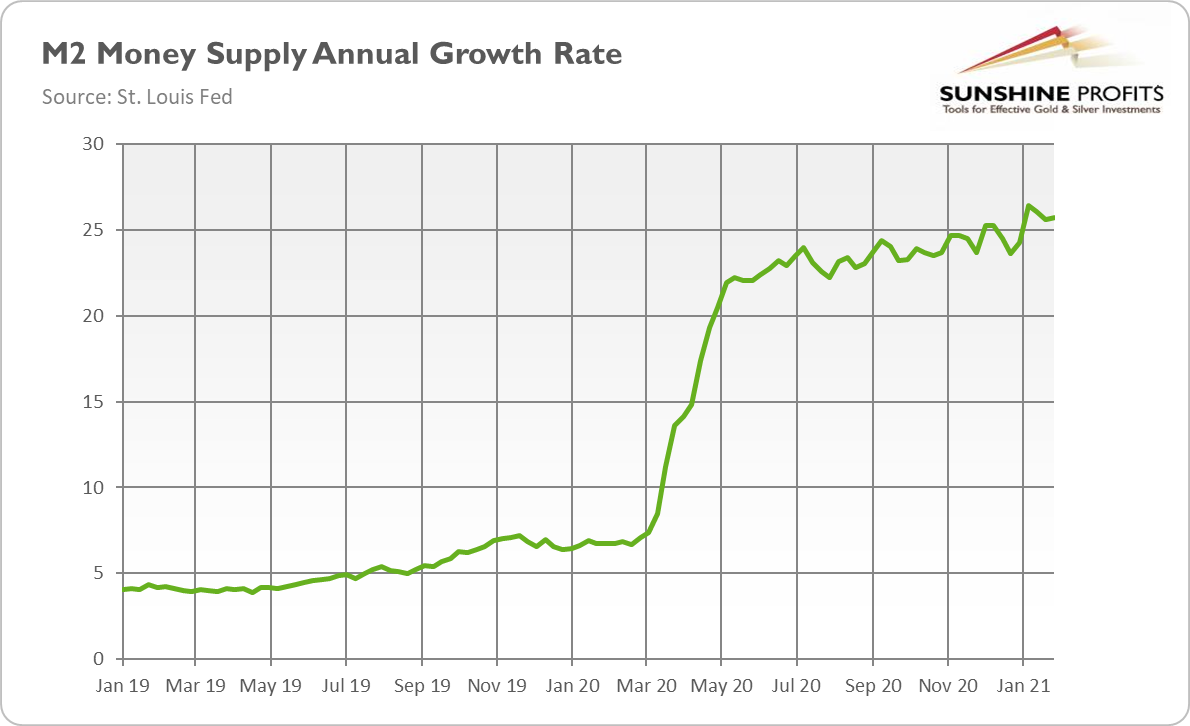

To sum up, it might be the case that markets are overstating short-term inflation risks. But it’s also possible that politicians and central bankers understate the longer-term inflationary dangers as money supply also soared this time – and it’s still increasing, as the chart below shows.

In other words, while all the created liquidity after the global pandemic , it flowed into the real economy to a much larger extent, which can create more inflationary pressure.

What’s more, the easy monetary policy is now accompanied by a very loose fiscal policy and the unprecedentedly large fiscal deficits, which could push the economy deeper into the debt trap. This could undermine the central-bank independence and prevent a timely normalization of interest rates, not to mention the weakening of globalization’s downside impact on inflation, caused partially by demographic factors and reshuffling in supply chains. Last but not least, the rising commodity prices and international transport costs, accompanied by the weakening U.S. dollar, may be harbingers of an approaching inflation monster.

What does it all mean for the gold market? Well, the jump in inflation in 2021 should be positive for the yellow metal, which could gain as an bond yields may counteract this effect. But if Powell is right and inflation turns out to be only temporary, then gold may be hard hit, and we could see a goldilocks economy again (i.e., fast economic growth with low inflation). However, if markets are right, or if the long-term inflationary risks materialize, which even investors may understate, gold should shine.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.