Will The Yield Curve Continue To Flatten After Today’s Rate Hike?

James Picerno | Jun 13, 2018 07:37AM ET

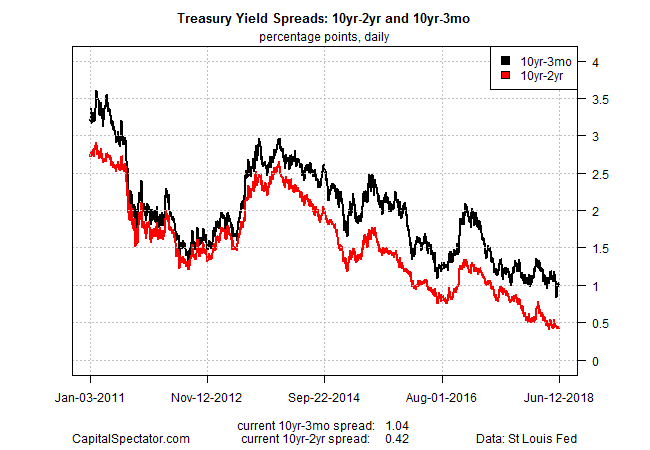

The Federal Reserve is widely expected to raise interest rates today, a policy move that may further squeeze the difference between short and long Treasury yields. If the already narrow rate spread continues to tighten, the ongoing slide will raise new questions about the outlook for the US economy, at least in the eyes of some economists and investors.

Smaller rate spreads that go negative have historically been linked with recessions. The latest numbers betray no sign that a new downturn is imminent. Nonetheless, the market will be listening for any insight offered on the subject in Federal Reserve Chairman Jerome Powell’s press conference today that follows the release of the central bank’s policy statement at 2:00 pm eastern.

In his March presser, Powell raised questions about the value of the yield curve for evaluating recession risk. Other Fed officials have delivered similar remarks. Is a repeat performance on tap for today?

The subject is sure to come up, in part because Powell’s comments were on the yield curve were brief. Journalists are sure to raise the topic anew, if only because the rate spread has continued to slide since the Fed chairman talked with the press on March 21. At the time, the difference for the 10-year Treasury yield less its 2-year counterpart was a thin 58 basis points, which has subsequently narrowed to 42 basis points as of Tuesday (June 12), based on daily data via Treausry.gov.

If and when the curve turns negative, the shift will be interpreted as a sign that a new recession is near, or so one could argue. History strongly suggests that when short rates rise above long rates, which rarely happens, it’s a warning that an NBER-defined downturn will follow in short order.

But nothing’s forever in economics and there’s been a rising chorus of analysts advising that the yield-curve’s value as a macro risk metric has been degraded, arguably because of the extraordinary events in monetary policy over the last decade that have distorted the connection between interest rates and the real economy.

Not everyone agrees, but it’s a topical subject nonetheless, in part because the Fed chairman made it so in his last outing with the press.

This is more than an academic debate, notes veteran Fed watcher Tim Duy, an economics professor at the University of Oregon.

“The question of whether an inverted yield curve, which is traditionally a very prescient recession indicator, will cause the Fed to rethink its tightening plans is shaping up to be the next big debate among policy makers, with potentially major consequences for financial markets,” Duy wrote last week. “The answer may lie in recent comments by key Fed officials who suggest an inversion may not mean what it has in the past.”

The implications for investors are two-fold. First, the Fed may be very aggressive when boosting rates over the next year. Not aggressive in the pace of rate hikes, but aggressive in the willingness to keep increasing them despite an inverted yield curve. Investors should not discount the Fed’s intentions to continue hiking rates, especially if the economic data remains strong. Second, the Fed is playing with a spark that might kindle the next recession sooner rather than later. Maybe the yield curve is not the signal it once was, but history is not on the Fed’s side with this bet.

The Wall Street Journal weighed in on Monday, advising that “the chairman of the Federal Reserve, just four months into his term, this week could be in the uncomfortable situation of signaling that a recession is coming.”

Meanwhile, it’s highly unlikely that May will mark the start of a new downturn, based on a broad review of the numbers – a view that was reaffirmed in this week’s update of The US Business Cycle Risk Report. The analysis could change, of course, and perhaps quickly, depending on what the next round of updates reveal. That’s a reminder that monitoring the business cycle, across a spectrum of indicators, never goes out of style.

For now, however, based on what we know today, growth still has the upper hand. Not surprisingly, recent estimates of second-quarter GDP growth for the US have been painting an upbeat profile. The latest Q2 projections reaffirm the sunny view. Wall Street economists, for example, are looking for output to pick up to a strong 3.7% increase in the current quarter following Q1’s subdued 2.2% rise, based on CNBC’s survey data as of June 12. The Atlanta Fed’s GDPNow data for June 8 points to an even stronger advance in Q2: a stellar 4.6% surge.

“The Fed continues to face a difficult challenge as it tries to calibrate interest rates over the coming quarters,” wrote Kathy Bostjancic, head of US macro investor services at Oxford Economics USA, in a note to clients. “The US economy is late-cycle and being stimulated by large fiscal stimulus that will, over the next few years, push it close to full capacity utilization.”

For the moment, there’s a case for maintaining a degree of skepticism about the apparent warning that’s developing in the sliding rate spread between long and short yields. The question du jour is whether the Federal Reserve chairman still favors that skepticism, and if so, why? Details, hopefully, will be forthcoming later today.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.