Will Negative Swiss Rates Reduce CHF Demand?

MarketPulse | Dec 18, 2014 07:22AM ET

- SNB Goes Negative in January

- Market assess policy moves by Fed and SNB

- EUR under pressure from intervention demands

- JPY bears relieved with higher U.S yields

Over the past 24-hours, Capital Markets have managed to navigate the last of the significant Central Bank scheduled meetings for this calendar year – the FOMC yesterday and this morning’s defensive SNB meeting. Investors must expect the outlier Central Banks, like the PBoC and CBR to remain “the” unknown factor as they simply dance to their own monetary schedules. Apart from a few remaining economic releases, fear and innuendo, coupled with lack of market participation during the festive season should manage to keep market volatility ticking over, through the ‘turn’ and into the New-Year.

Ms. Yellen’s dollar rally, ignited by yesterday’s Fed statement that signaled policy makers are shifting to a more “hawkish” stance while expressing caution about the economy, continues to benefit from an ideal mix of global/domestic equity gains and a gradual rise in U.S yields. While others, like the Yuan ($6.1381) continue to buckle under reports of a more flexible currency regime. The EUR (€1.2300) has its own issues; it’s currently being ‘jobbed’ by various Central Banks who are in fact natural sellers of the single-unit to rebalance their reserves after various global interventions – think of the SNB and Russia’s defense of its own rouble ($62).

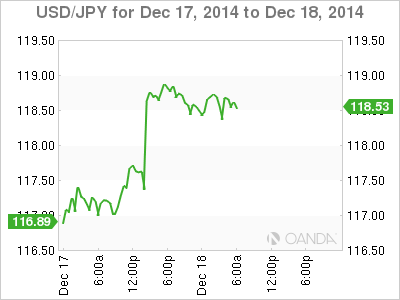

A Strong Yen No More

The Fed’s remarks on policy intentions for next year seem to have finally helped to put a stop to the downward reversal in USD/JPY (¥118.50). Once again the yen ‘bear’ seems to be trading in familiar territory after the FOMC replaced the “considerable time” component of its statement with the pledge to be “patient in beginning to normalize the stance of monetary policy,” while recognizing further improvement in U.S labor market conditions. In terms of economic projections, the Fed raised this year’s outlook while lowering their unemployment estimates for the next three-years. They also lowered their median fed funds rate forecasts by 20bps, 37.5bps, and 7.5bps respectively.

The market to date has been looking for a hint on timing, and they may have got it, or they think they have. During Ms. Yellen’s testimony she indicated that “patient” means the policy makers will not begin the normalization process “at least for the next couple of meetings.” When questioned during her press conference, to Ms. Yellen a couple means “two”. The fixed income traders have taken her at her word and are pricing in higher U.S rates to begin as early as in April. The potential of rate divergence sooner from the Fed’s perspective will only continue to support the dollar on pullbacks against the majors.

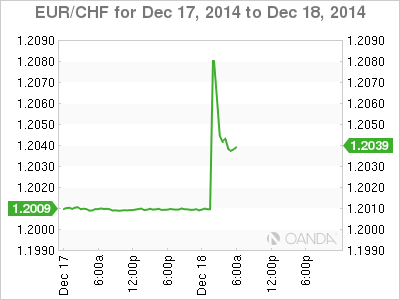

SNB Pulls the Negative Trigger

Swiss National Bank (SNB) moved to negative interest rates (-0.25%) on sight deposit account balances at this morning’s central bank meeting. Policy makers again repeated that the CHF currency cap (€1.2000) remains their “Key Policy Instrument,” and is prepared to take further measures if necessary – intervene and buy copious amounts of foreign currency to defend the minimum exchange rate or think and act outside the box.

The SNB Chief Jordan indicated that negative rates would apply on the same day as the next ECB meet in January 2015. This would indicate that Swiss policy makers want to be in a position to preempt any ECB move and protect the EUR/CHF floor from the prospect that any ECB action could create a strong demand for safe-haven assets like the CHF. It’s not just the ECB, developments in Russian continue to favor the CHF and without the Swiss FX floor, CHF price stability would be “seriously compromised.”

Will negative Swiss rates be a detractor?

Applying negative rates by any Central Banker is an obvious defensive move, similar to a hike (CBR to +17% earlier this week), but will it work? A small discount is not a natural detractor, nor is a massive hike – when investors loose confidence in a currency its a war, just watch the Rouble. For Swiss policy makers, they will have to gage how deep into negative territory they will be required to go to discourage the demand for safe-haven product. Low negative rates are unlikely to reduce the CHF attractiveness. On the last go around of negative rates in the 1970’s, even -10% did not reduce the demand for CHF significantly. This is reason enough for fixed income traders to begin pricing in further rate cuts by the SNB in the New-Year, especially if EUR/CHF cannot gain any traction and get off the floor (€1.2000).

Yuan Cannot Hide

The Chinese Yuan is trading atop of its six-month lows aided obviously by a stronger US Dollar across the board, and on reports that the Chinese government would be open to a more “flexible” foreign exchange rate. This would imply that policy makers should be willing to allow their currency to depreciate. The markets previous interpretations of the possibility of greater flexibility on Chinese exchange rate have predominately led to a stronger CNY. However, a few soft economic reports are beginning to change some investors’ minds (November housing figures remained weak). The lack of government and PBoC transparency will make for an interesting 2015 for the Yuan.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.