Does Walmart Stand A Chance Against Amazon?

Estimize | Aug 18, 2016 12:12AM ET

Wal-Mart Stores (NYSE:WMT), Consumer Discretionary - Food and Staples Retailing | Reports August 18, Before Market Opens

Key Takeaways

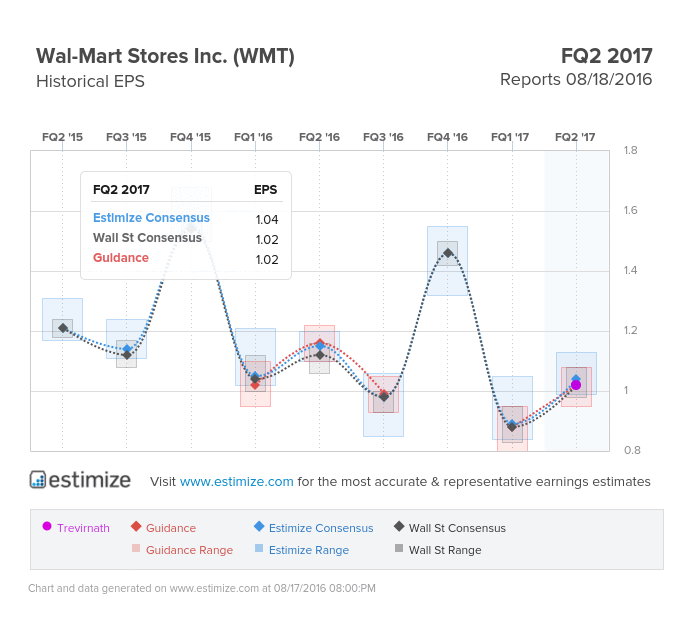

- The Estimize consensus is calling for earnings per share of $1.04 on $120.35 billion, 2 cents higher than Wall Street on the bottom line and $250 million on the top

- Walmart recently acquired Jet.com in an effort to take on Amazon (NASDAQ:AMZN) in dominance for online retail

- Fresh food and groceries continues to be the upperhand Walmart has over online retailers

- What are you expecting for

Walmart is prepared to announce its fiscal second quarter earnings early Thursday morning. The world’s largest retailer is coming into its report on a high note after agreeing to purchase Jet.com for $3.3 billion earlier this month. This marks the largest purchase to date of an e-commerce startup.

Clearly the move is intended to help WMT catch up with online giant Amazon which continues to outpace the overall retail sector. That isn’t to say Walmart is doing poorly. The company is coming off a better than expected first quarter with expectations for another one tomorrow.

Analysts at Estimize are calling for earnings per share of $1.04, 4% lower than the same period last year. That estimate has increased 3% since Walmart’s most recent report in May.

Revenue is anticipated to come in flat at $120.35 billion, consistent with the improving trends in the retail environment. Shares are up 18% year to date but historically have declined by 1% following a report.

It has been no secret that Walmart is trailing Amazon as an ecommerce retailer. Its acquistiion of Jet.com is a direct message to Amazon that they are coming for them. Most experts don’t believe Jet’s platform will close the gap but moving Marc Lore to lead its e commerce efforts might help.

Last quarter online sales rose a sluggish 7%, consistent with the slowdown over the last year. Along with boosting online sales the company is focused on creating a better customer experience and lowering prices even further. These initiatives might generate sales but it will also pressure margins.

Walmart’s biggest advantage over Amazon and other online retailer is its expansive grocery and fresh food offerings. Walmarts are often considered one stop shops for families to do their weekly grocery shopping and to pick up anything else they might need.

The adoption of these services amongst online retailers have yet to gain traction. Amazon is of course testing this out as part of its Amazon Prime services. In the meantime, Walmart, Target Corporation (NYSE:TGT) and Costco (NASDAQ:COST) will have the upperhand in this segment.

Do you think WMT can beat estimates?

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.