Will Fiscal Revolution Raise Gold To The Throne?

Sunshine Profits | Apr 23, 2021 10:40AM ET

Revolution, baby! There is growing acceptance for an aggressive fiscal policy, which could be supportive for gold prices from the fundamental, long-term point of view.

We live in turbulent times. The pandemic is still raging and will most likely have lost lasting effects on our society. But a revolution is also happening right before our eyes. And I don’t mean another storming of the U.S. Capitol or the clash of individual investors with big fish on Wall Street. I have in mind something less spectacular but potentially more influential: a macroeconomic revolution.

I refer here to the growing acceptance of easy quantitative easing . It has become a new norm since then.

But fiscal policy was another kettle of fish. Although almost nobody cared about balanced government budgets, people at least pretended to worry about overly large financial crisis of 2007-09, Congress passed a package of about $800 billion, as Republicans opposed larger spending. But in March 2020, Congress passed the CARES act worth about $2 trillion (and additional significant stimulus in December 2020), with the full support of Republicans.

Even Germany – the country famous for its fiscal conservatism – ran a fiscal deficit in 2020 and – what’s more – agreed to issue bonds jointly with other EU countries, although it was previously a taboo. The economic crisis .

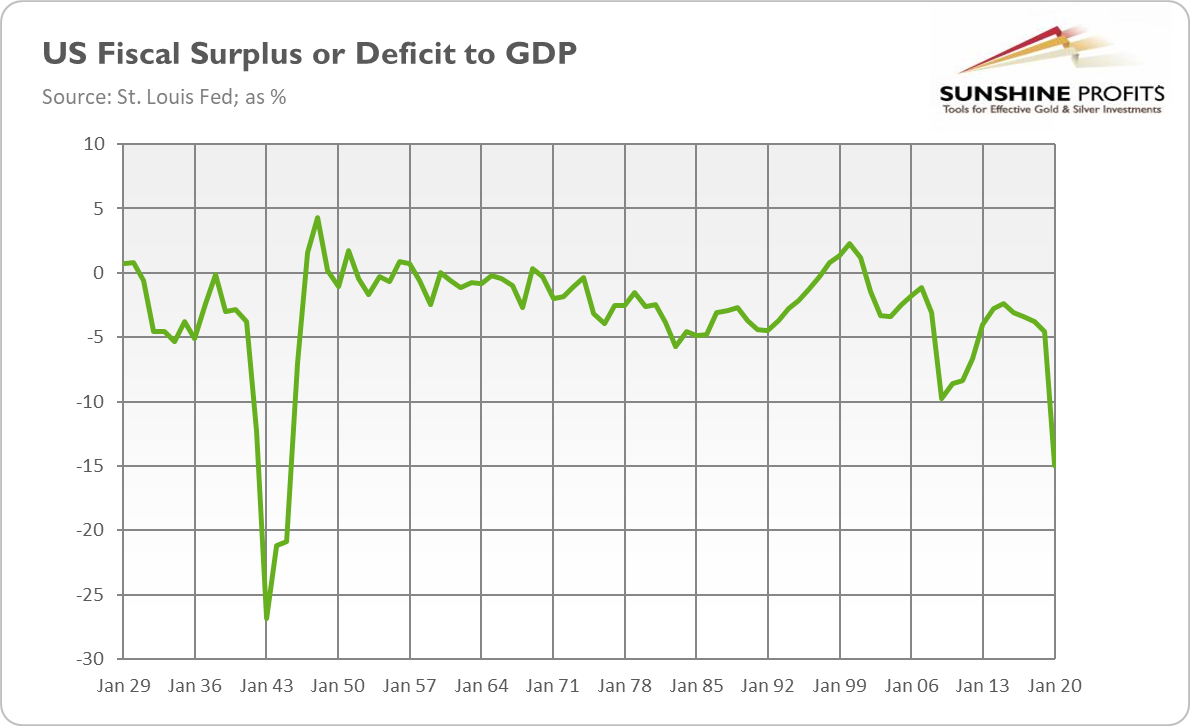

And this fiscal revolution is already seen in data. As the chart below shows, the U.S. fiscal deficit has increased from 4.6% of GDP in 2019 (which was already at an elevated level) to 15 percent of GDP in 2020, the highest level in the post-war era.

According to the GDP , on average, in advanced economies, in 2021, a spike from 3.3% seen in 2019. As a consequence, the gross global debt approached 98% in 2020 and it’s projected to reach 99.5% of the world’s GDP by the end of this year.

What is important to note here is that government support wasn’t limited mainly to the financial institutions and big companies (such as automakers), as was the case in 2009, but it was distributed more widely. There was a huge direct money transfer to Main Street, including checks for practically all citizens. This is important for two reasons.

First, money flowing into the economy through non-financial institutions and people’s accounts may be more inflationary. This is because money doesn’t stay in the financial market where it mainly raises asset prices, but it’s more likely to be spent on consumer goods, boosting the inflation hedge .

Second, the direct cash transfer to the people creates a dangerous precedent. From now, each time the economy falls into crisis, people will demand checks. It means that fiscal responses would have to be increasingly larger to meet the inflated expectations of the public. It also implies that we are approaching a universal basic income, with its mammoth fiscal costs and all related negative economic and social consequences.

Summing up, we live in revolutionary times. The old paradigm that “central banks are the only game in town” has been replaced by the idea that fiscal policy should be more aggressively used. Maintaining balanced budgets is also a dead concept – who would care about deficits when interest rates are so low?

However, assigning a greater role to fiscal policy in achieving macroeconomic goals increases the risk of higher inflation and macroeconomic instability, as politicians tend to be pro-cyclical and reckless. After all, the economic orthodoxy that monetary policy is better suited to achieve macroeconomic stability didn’t come out from nowhere, but from awful experiences of the fiscal follies of the past. I’m not a fan of central bankers, but they are at least less short-sighted than politicians who think mainly about how to win the next election and stay in power.

Hence, the growing acceptance of easy fiscal policy should be positive for gold prices , especially considering that it will be accompanied by an accommodative monetary policy. Such a policy mix should increase the public debt and inflation, which could support gold prices. The caveat is that investors have so far welcomed more stimulus flowing from both the Yellen increases the longer-term risk for the economy, which could materialize – similar to the pandemic – sooner than anyone thought.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.