Will Euro And Gold Go Up With Pandemic Upturn In EU?

Sunshine Profits | Apr 27, 2021 02:32PM ET

The worst may already be behind the euro area’s economy. This bodes well as both the euro and gold can benefit from it.

The governing council of the monetary policy unchanged. The inaction was widely expected. The June meeting could be much more interesting, as the ECB will have to decide whether or not to slow its bond buying under the Pandemic Emergency Purchase Program that was accelerated in the second quarter of the year. Given the dovish stance of the European policy-makers, and the bank’s pledge to provide the markets with favorable financing conditions during the pandemic, we shouldn’t expect any tapering soon.

Certainly, there are important dovish parts of the GDP declined by 0.7% in the fourth quarter of 2020, and it is expected to decrease again in the first quarter of 2021. The nearest future doesn’t look promising:

The near-term economic outlook remains clouded by uncertainty about the resurgence of the pandemic and the roll-out of vaccination campaigns. Persistently high rates of coronavirus (COVID-19) infection and the associated extension and tightening of containment measures continue to constrain economic activity in the short term.

However, investors should always look beyond the near-team outlook. In the medium-term, the situation in the euro area looks much better. As the ECB notes, this is because the current virus wave seems to have peaked in Europe, while the pace of vaccination is accelerating:

Looking ahead, the progress with vaccination campaigns, which should allow for a gradual relaxation of containment measures, should pave the way for a firm rebound in economic activity in the course of 2021.

Furthermore, the European Union’s 750-billion-euro recovery fund has cleared a key court challenge. Last week, the Germany’s constitutional court dismissed objections to the European aid package.

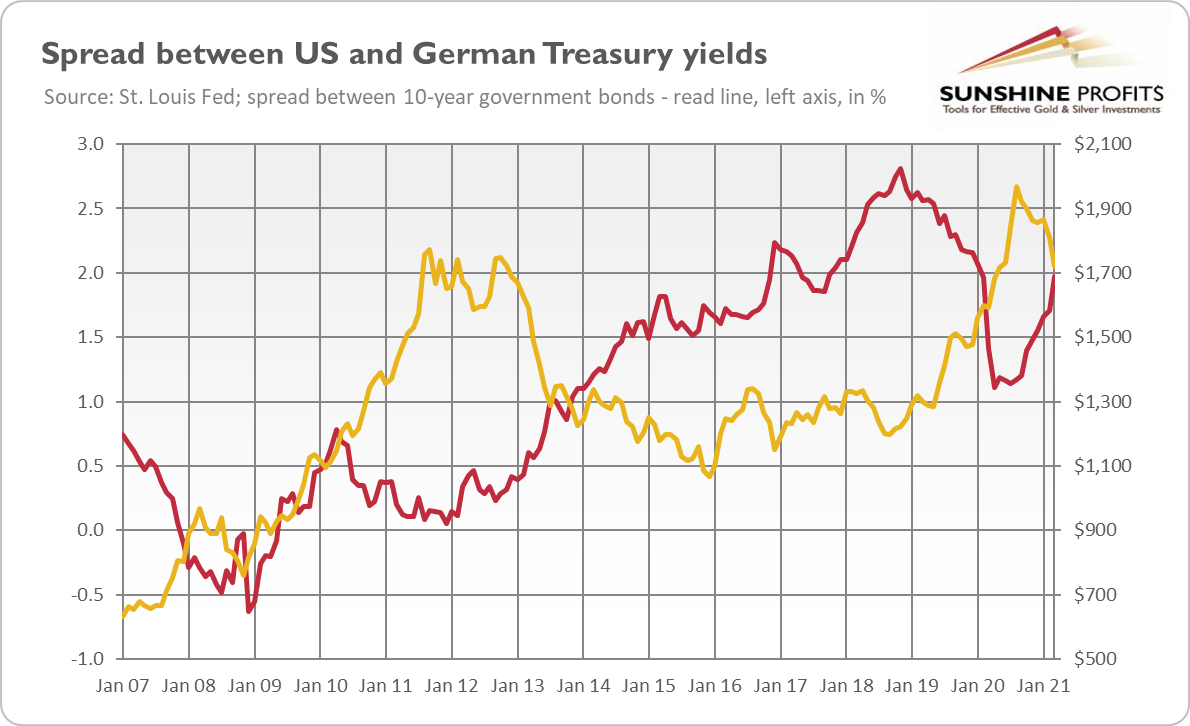

All these factors are positive for the euro and, thus, for the price of gold. As you can see in the chart below, gold was highly correlated with the spread between the American and German long-term government interest rates that started in August 2020 pushed the yellow metal down.

Implications For Gold

The third wave of greenback while supporting gold prices.

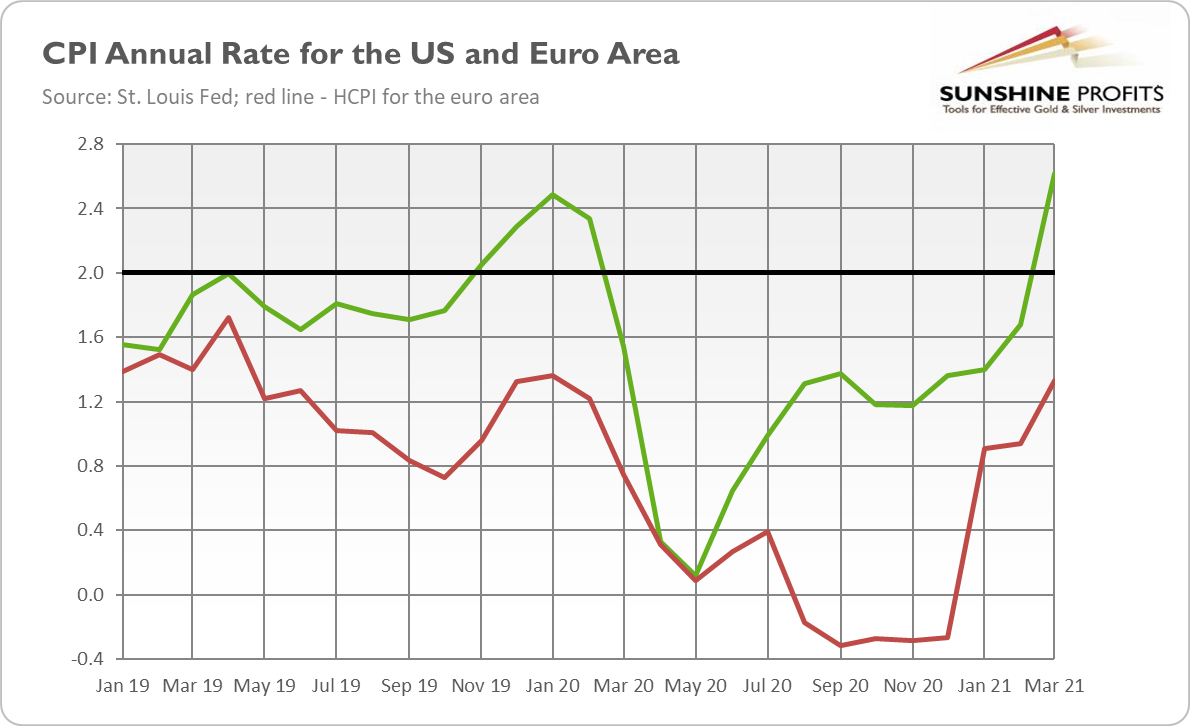

Another positive factor for the purchasing power parity could support the common currency, as well as gold, against the greenback.

What’s funny here is that ECB President Christine dovish bias and easy monetary policy.

Of course, it might be the case that inflation won’t materialize, just like it never did after the reflation , gold initially lags commodities, only to outperform them and shine brightly in later phases.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.