Will The Dollar Rally Or Fade On Fed Powell’s Comments?

MarketPulse | Feb 27, 2018 05:23AM ET

Tuesday February 27: Five things the markets are talking about

Jerome Powell makes his first public appearance as new chair of the Federal Reserve today.

He starts with the release of his prepared testimony at 8:30 am EST, followed by an appearance before the House Financial Services Committee starting at 10 am EST.

Note: He returns Thursday to answer questions from the Senate Banking Committee, beginning at 10 am EST.

Expect today’s testimony to be heavily scrutinized as capital markets want to know Powell’s views on inflation, and how much of a risk it is or is not, and his views on the need for stricter banking regulation.

Investors will also want to know how he gauges the implications of current market conditions for Fed policy – are easy financial conditions and elevated asset value reasons enough to hike rates more than would otherwise be the case? Fed fund futures are pricing in three Fed hikes (+58%) and the possibility of a fourth (+21%).

Does the new Fed chief view the recent market volatility as a healthy development for markets that had looked unusually strong over the past 12-months?

Ahead of the US open, European equities struggle for direction as the dollar edges a tad lower with Treasuries steady.

1. Stocks mixed results

In Asian overnight trading, equity markets generally climbed higher after gains during yesterday's US session.

In Japan, the Nikkei share average hit a three-week high, led by gains in large-cap and exporters’ shares as easing in U.S. bond yields overnight-improved sentiment. The Nikkei rose +1.1%, its highest close since Feb. 5. The broader TOPIX rose +0.9%.

Down-under, the Aussie S&P/ASX 200 closed at its highest in more than three-weeks on Tuesday, supported mostly by Resources stocks, which ticked up on a slight rise in metal prices. The index rose +0.2% at the close of trade. In South Korea, the KOSPI closed up +0.7% after the Bank of Korea (BoK) left their seven-day Repo rate unchanged at +1.5% as expected.

In Hong Kong, stocks fell from their three-week highs overnight, as investors took profit ahead of Fed Chair Powell’s first congressional testimony. The Hang Seng index fell -0.7%, while the China Enterprise Index lost -1.5%.

In China, stocks snapped a six-session winning streak, led lower by real estate and resource firms. At the close, the Shanghai Composite Index was down -1.1%, while the blue-chip Shanghai Shenzhen CSI 300 was down -1.4%.

Note: The market continues to ponder the impact of certain amendments in the wording of China’s constitution, which would allow President Xi Jinping to stay in office indefinitely.

In Europe, regional bourses struggle for direction as investors await the first public comments from new Fed Chair Powell later this morning. The U.K.’s FTSE 100 Index increased +0.4% to the highest in more than three-weeks.

U.S stock futures are set to open in the ‘red’ (-0.2%).

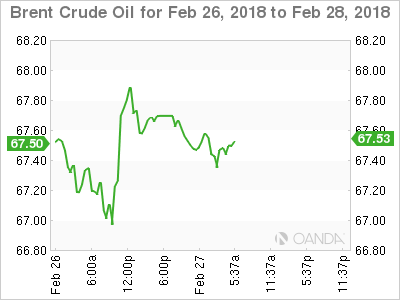

2. Oil prices lower as rising U.S supply outweigh demand, gold unchanged

Oil prices have erased their earlier overnight gains as investor concerns about rising U.S oil output offset signs of stronger demand and faith in the ability of OPEC production curbs to curtail supply.

Brent crude futures are down -12c, or -0.2%, at +$67.38 a barrel. While WTI crude for April delivery is down -13c, or -0.2%, at +$63.78 a barrel. The contract yesterday rose to its highest since Feb. 6 at +$64.24.

Climbing US production is overturning global oil markets, coming at a time when OPEC members – including Russia – have been withholding output to prop up prices.

According to the IEA’s Executive Director Fatih Birol, the US will overtake Russia as the world’s biggest oil producer by 2019 at the latest.

The market will take its cues from this week’s inventory reports – the American Petroleum Institute (API) is scheduled to release its weekly data later on this afternoon, followed by the EIA on Wednesday.

Ahead of the US open, gold prices are trading steady, as the ‘big’ dollar remains little changed while investors’ await Fed Powell’s first congressional testimony for clues on the future pace of monetary tightening. Spot gold is up +0.1% at +$1,334.26 an ounce.

3. Sovereign yields contained

According to the latest positioning data from the Chicago futures exchanges, speculators are making their biggest ever short-term bet on higher US interest rates and are also slowly beginning to rebuild their bets on lower US stock market volatility.

The amount of speculative net short positions in Eurodollar futures rose to record -3.65m contracts in the week ended Feb. 20.

Note: Money markets are pricing in a rate hike at the conclusion of the Fed’s March 20-21 policy meeting – this will be the sixth hike in the current cycle, with another two this year factored into market pricing.

The CFTC data also showed that speculators continued to reduce the record long position in VIX futures. They reduced that net long position by 15,013 contracts in the week to Feb. 20, following a reduction of 11,255 contracts the week before. This brought the net long VIX futures position down to 59,550 contracts from a record high 85,818 on Feb. 6.

The yield on U.S 10-year Treasuries fell -1 bps to +2.86%, the lowest in two weeks. In Germany, the 10-year Treasuries advanced +1 bps to +0.66%, the first advance in a week and the biggest gain in more than a week. In the U.K, the 10-year Gilt yield fell -1 bps to +1.509%, reaching the lowest in four-weeks on its sixth consecutive decline.

4. Dollars mixed results, waiting for Powell

The US dollar trades mixed ahead of the US open, rising slightly relative to most currencies and is down sharply versus Bitcoin (BTC +4% $10,731) as the market waits for the new Fed Chairman’s “Humphrey-Hawkins” testimony before Congress.

Today, Powell makes his debut before the House Financial Services Committee beginning at 10:00 am. However, as is always the case in such instances his prepared text will be released at 08:30 am.

Dollar ‘bulls’ believe that his testimony could boost the dollar if he stresses a positive US economic outlook and the prospect of more interest rate rises.

Dollar ‘bears’ would view any dollar rally as short-lived and a good opportunity to position for more USD weakness. In this scenario, the market has preferred to be buying EUR/USD and AUD/USD, and sell USD/JPY.

Ahead of the U.S open, the DXY dollar index trades -0.1% lower. The EUR/USD has rallied +0.2% to €1.2340, though the dollar has rallied against some other currencies: AUD/USD is down -0.1% at A$0.7847, USD/JPY is up +0.1% at ¥107.02.

5. ECB: Loans to firms, M3 money supply rose last month

Note: With the eurozone economy heavily dependent on bank lending, analysts watch lending data closely as an indicator of the economy’s health.

Data this morning from the ECB showed that lending to firms picked up at the start of the year.

Lending to firms grew by +3.4% on the year in January after growing +3.1% in December. Lending to households rose +2.9% on the year in January, matching the pace set the previous month.

The ECB’s key indicator of the money supply, M3, grew by +4.6% on year, in line with both the previous month and market expectations. The three-month average stood at +4.7% vs. +4.8% (e).

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.