Why “We’re All USD/JPY Traders Now”

Matthew Weller | Aug 26, 2015 04:27PM ET

“We’re all Keynseians now” – Milton Friedman

The above quote is often misattributed to US President Richard Nixon, when he closed the gold convertibility window. Regardless, the phrase “We are all _____ now” has since become part of the lexicon for anyone trying to make a broad generalization about the current zeitgeist.

Amidst the recent global market turmoil, I’d like to postulate that “We are all USD/JPY traders now.” That’s because USD/JPY has become the de facto measure of risk appetite of late, leading to correlated moves in equities, commodities, bonds, and even other currency pairs. The most salient short-term example of this phenomenon is the recent roller coaster ride in US equities.

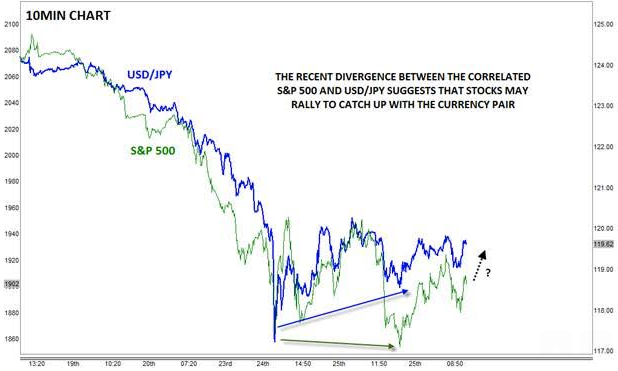

Both USD/JPY and the S&P 500 began to sell off in earnest last Thursday, with the drop accelerating until the absolute panic bottom on Monday morning. From there, the two instruments rallied back to regain some of the previous losses by midday Tuesday before turning sharply lower once again. Both USD/JPY and the S&P 500 bottomed ahead of Wednesday’s Asian session and chopped around in volatile ranges.

For day traders, it’s worth noting that USD/JPY has formed its intraday tops and bottoms slightly ahead of the US stock market index; furthermore, USD/JPY has gone on to set higher lows since Monday’s panic bottom, whereas the S&P 500 hit a minor lower low Tuesday night. The currency pair’s current bullish divergence with US stocks suggests that we could see an equity rally in the short term (in other words, the green line on the chart below may “catch up” to meet the blue line), which could create the widely-awaited oversold bounce.

That said, if you share my colleague Fawad Razaqzada’s longer-term concerns about USD/JPY, it could also bode ill for global stocks. As we noted yesterday, this week’s massive drop has done plenty of technical and psychological damage, and the pervasive “buy the dip” mentality that has characterized the past four years has been broken.

One way or another, though, it looks like “We’re all USD/JPY traders now.”

Source: FOREX.com

*NOTE: Correlations can change and there are other factors beyond USD/JPY that impact the S&P 500.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.