Why US Natural Gas Prices Are So Low - Are Changes Needed?

Gail Tverberg | Mar 25, 2012 03:56AM ET

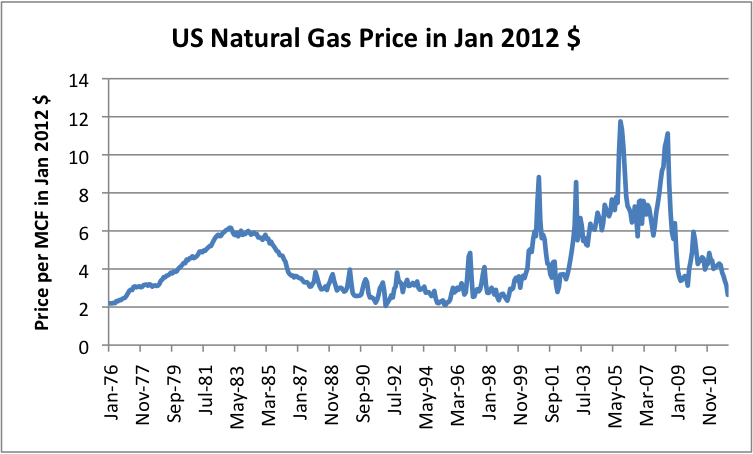

US natural gas prices are at record lows–about where they were in 1976, and at the low points in the 1990s, in today’s dollars (Figure 1).

Figure 1. US wellhead natural gas prices based on EIA data, adjusted to January 2012 price levels using US CPI All Urban Price data.

There are several reasons why US natural gas prices are so low:

- Our pricing system is based on short-term supply and demand, and storage facilities are limited. It is very easy for supply to overwhelm the system, and prices to drop very low in response, if there is a mismatch.

- US demand for natural gas has been fairly flat for the last 10 years, regardless of price. Of the four major uses for natural gas ((1)residential heating, hot water, and cooking; (2)commercial heating, hot water, and cooking; (3) industrial demand; and (4) electricity), only electrical use has been growing.

- Supply does not drop very quickly, even if prices fall, because producers need to continue to extract natural gas in order to repay loans and to comply with use-it-or-lose-it lease terms.

- Today’s prices appear to be far below the cost of production for some providers, leading to the likelihood of a shakeout.

- Unless price levels are higher and more stable, it is not clear that natural gas supply will grow over the next 10 or 20 years, making long-term investment in new uses (for example, vehicular use, Executive Order with respect to Natural Defense Resource Preparedness gives the Energy Department broad powers if problems arise that are deemed to create a national emergency. These powers would seem to include determining who gets what in terms of supply.

Trying to transition quickly from one energy system to another is untrod ground. I am not sure I have a good pricing solution. Perhaps someone else does.

Note:

(1) Having high natural gas prices is helpful in assuring long term natural gas production, but such prices are still not a guarantee of long-term production. There are many interactions with the rest of the system. For example, if there are high oil prices and high food prices, there may be civil unrest which disturbs natural gas production. Or imported parts, necessary for further drilling may not be available. Or there may be general financial problems, that prevent getting loans needed for further production. Or it may turn out that shale gas wells do not continue to produce as much gas as hoped, for as long as hoped, and the wells are no longer profitable, even at the higher prices.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.