Why The Fed Won’t Raise Rates In April, But Should

Blackwell Global | Apr 07, 2016 02:21AM ET

If you listen to the media you have likely been availed of all of the latest opinions from both market pundits and “experts” alike on the future direction of the Federal Reserve’s monetary policy. Unfortunately, much of the market has been largely caught off guard by the Fed’s purported dovishness following March’s policy meeting. However, the worst is yet to come for the Fed as the central bank gets caught between a rock and a hard place as they deal with the dual issues of failed monetary policy and the political ramifications of a looming election year.

The truth of the matter is that the US Federal Reserve has done a terrible job of managing the larger economic and market expectations. 2015 was largely predicated by volatility around every FOMC meeting in the lead up to what was supposedly a tightening phase. Subsequently, the dollar was largely cognisant of the risks of a series of rate hikes and priced in the change in sentiment from the central bank. However, the eventual tightening phase resulted in a mere 25bps rate hike that, arguably, was required just to maintain the central banks reputation.

So here we are now in 2016, facing the same line of rhetoric from the Fed over rate hikes that may or may not eventuate. The year ahead was largely expected to be one of gradual tightening as rates were normalised. However, four months into the year and the central bank is already backing away rapidly from the hawkish rhetoric and instead returning to their much maligned “Data Dependant” statements.

Subsequently, you would be forgiven for questioning just what “data” it is that the Federal Reserve is waiting for to move rates back towards normalisation. In fact, US Core Inflation recently posted an increase to 2.3% in March, firmly above the Fed’s 2.00% target. Subsequently, it would appear that inflation is on the rise. This goes some way to further explaining some of the comments from FOMC members in recent weeks that pointed to acceptance of higher inflation rates in the near term.

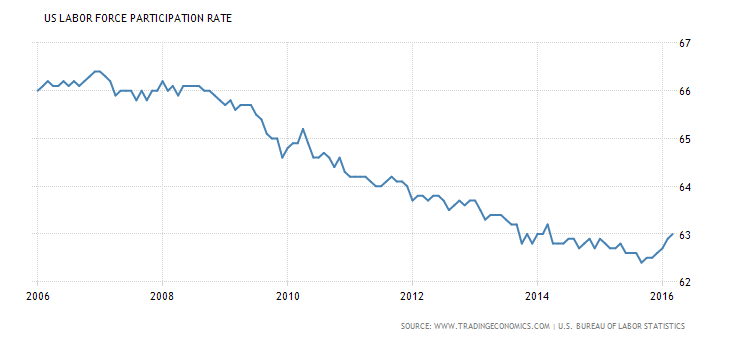

Given the Fed’s dual mandate for stable prices and full employment, it would appear that it must surely be the lack of employment growth which is holding back the central bank from acting. Unfortunately, the labour market statistics don’t support this contention given that the US Unemployment rate is currently hovering around 5.00%, almost the natural rate of unemployment. In contrast, the labour force participation rate has been steadily declining over the last five years but the latter part of 2015 reversed that trend as the rate climbed to 63%.

It would therefore appear relatively strange that the Federal Reserve is so hesitant to get ahead of a market which has growing job strength, whilst core inflation is rising. However, the venerable central bank is clearly looking at a range of indicators outside their traditional dual mandate. In fact, there are some concerning signs emanating from much of the global economy that is likely giving the Fed cause for concern.

The IMF’s much watched global growth forecasts in January pointed to a lacklustre level of growth within the emerging markets. In fact, a chief concern of the monetary fund was a deeper than expected slowdown in China which appears to be in progress as I write. A quick view of Chinese industrial electricity demand or rail freight traffic would give even the most ardent hawk stomach ulcers. Additionally, the ongoing mess in Brazil coupled with recession in Russia is clearly spooking those who monitor the markets. Subsequently, it is highly likely that the Federal Reserve is concerned about their ability to react to slipping global demand whilst in a tightening phase.

However, the primary reason for the Fed being cautious with future rate hikes relates to the mother of all bubbles that the central bank has managed to create. The amount of quantitative easing injected in to the US economy is unprecedented and much of those funds have managed to flow through to financial markets thereby distorting values. You only have to take a look at the S&P 500 to see almost a linear trend over the past few years. Unfortunately, current market valuations are largely predicated upon easy monetary policies. Subsequently, a range of sharp rate hikes could see US equities tumbling and create a nightmare scenario for the central bank.

Finally, there is also a political aspect to the current bout of dovishness as the Federal Reserve Chairperson is anything but A-Political in her views and support. This is especially evident in an election year where interest rate changes can have a significant impact upon the domestic economic debate. Subsequently, it is highly likely that the central bank is playing both sides as they attempt to try and extricate themselves from this “Kobayashi Maru” scenario.

Ultimately, there are plenty of reasons to ignore any hawkish rhetoric from the central bank given the competing demands that they must weigh. In addition, most US recessions have largely been caused (or exacerbated) by the Fed due to the typical lag and timing issues that is inherent with the use of monetary policy.

In conclusion, the Fed is likely to find plenty of reasons to back away from their planned future rate hikes in the coming months. Subsequently, don’t expect the “dot plot” to come to fruition because the central bank is simply unable to normalise rates without killing the very bubble in equities they created…and that will never happen in an election year.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.