Why Markets Have Remained Resilient

Michael Panzner | May 10, 2012 02:23AM ET

I'm sure there are many rational individuals who, like me, have wondered why the stock market has in recent days remained fairly resilient despite mounting evidence that the European debt crisis is spiraling out of control and economies in Europe, China, the U.S. and elsewhere are hitting the skids.

In fact, the buying that has appeared when the market has been under pressure, seemingly like magic, has a frantic, almost panicky quality to it, as though those who are scooping up shares are much less concerned about getting the lowest prices than they are about making sure the market stops falling.

At first, I chalked it up to the fact that equity traders have shown, time and again, that they are very a little slow on the uptake when it comes to interpreting macroeconomic developments (the events of 2007 immediately come to mind), and have put their faith in "decoupling" and other bogus Wall Street theories.

Alternatively, I figured it might have something to do with investors' maniacal faith, bordering on psychotic delirium, in never-ending rounds of quantative easing, even though a growing number of monetary policymakers have indicated that they are not in favor of further accommodation.

Then I saw this report at Business Insider:

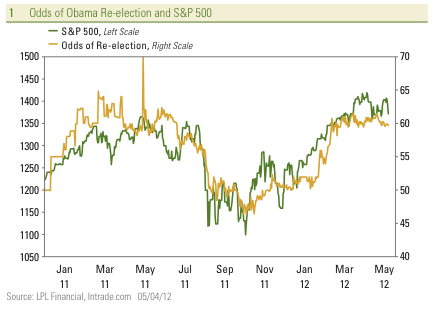

Here is a chart we've seen before. It's Obama's re-election odds against the S&P 500. The two have been greatly correlated and continue to be so as the election nears.

At that point it hit me. Call me a cynic (and maybe even a conspiracy theorist), but as Occam's Razor suggests, maybe the simplest explanation is the one that's best.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.