Why It’s Not Really About Deutsche

Alhambra Investment Partners, LLC | Sep 27, 2016 03:34AM ET

For quite some time now I have been writing (constantly) about “something” going in “dollar” markets and funding markets all over the world. Chinese markets related to “dollars” have been the most prominent in their disorder, but there is a degree of causation that runs from eurodollars to China and perhaps back again. In other words, Chinese illiquidity is not strictly speaking all about China; it is more so a reflection of both China’s importance at this point in time as the central pivot in global economic and financial flow as well as the overriding “dollar” conditions as they relate to that pivot.

The more time that passes the more the contours of the “something” continue to round into view, now funding risks .

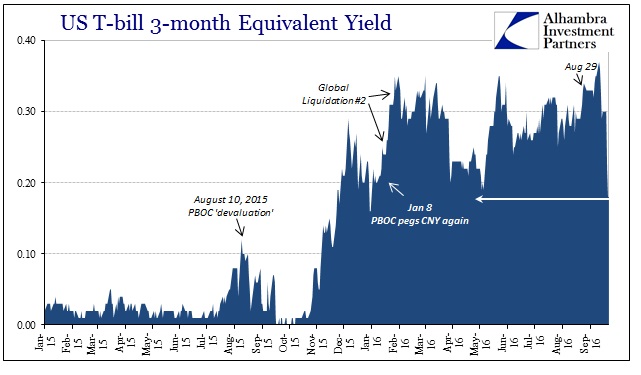

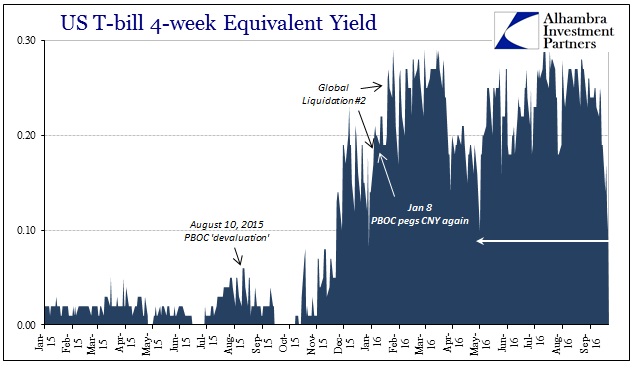

In both of those instances, the responsible party narrowing the TED spread was the T-bill part. There is an established tendency for bill rates to rise whenever the Chinese are in “dollar” trouble; expressed usually as either a peg or perhaps, as now, a “line in the sand” for CNY depreciation. So we have indications, as now, that when the TED spread is declining as a matter of a noticeable rise in T-bill rates it is likely Chinese “dollar” transformations that are reactive to the troubling nature of “dollars” and China.

The 3-month bill rate peaked at 37 bps on the 12th and 36 bps on the 13th. Since then, bill rates have declined which should have been a welcome sign of relief here and across the Pacific. But buying in bills hasn’t been steady and normal; instead it has been akin to an almost buying panic. This is anything but normal, as Friday the 3-month equivalent yield fell to 18 bps, the lowest of 2016.

Equivalent yields moved back up slightly in trading today, but overall are significantly less than they “should” be given money market behavior elsewhere. Working backward from LIBOR using a TED spread equivalent to pre-2007 behavior (describing a “normal” risk environment), we would expect the 3-month bill to be trading somewhere between 55 bps and 65 bps in equivalent yield or even just close to that range; thus, rising from where rates were even in the middle of September, not falling dramatically in what looks like “flight to safety.”

That is truly the most meaningful contribution of bills acting in this manner, given that banks have essentially a choice of risks that is further (supposedly) bolstered by the Federal Reserve’s attempt at a rate corridor. Any connected financial institution with spare cash can lend it unsecured at LIBOR to other financial institutions at about 85 bps (3-month), buy a 3-month T-bill, or park it overnight at the Fed to get 25 bps IOER. A 3-month bill yield of around 18 bps makes no sense except for the fragmented monetary system that the mainstream wishes were not a reality.

At the very least, the spread between LIBOR and T-bills should be somewhat tamed by other parties especially primary dealers with enormous amounts of “spare” liquidity (the useless, inert bank reserves created by QE’s). If there is little additional risk in unsecured interbank markets, dealers should be if not supplying cash in naked fashion then at least liquidating bills and lending that cash at equivalent LIBOR. Instead, dealers are buying bills and eschewing unsecured eurodollar markets.

The difference between the 3-month bill yield and 3-month LIBOR is, of course, the TED spread. It is an indication of risk because of the choices suggested above. If dealers and other related counterparties are far more interested in panic buying of bills than taking advantage of a hugely widened spread then we are forced to admit the possibility of perceived liquidity risks (or credit risk).

The mainstream has increasingly turned to money market reform (2a7) as a way to deny that there is much meaning in either rising LIBOR or the more important risk indications via TED. Since the point is debatable, corroboration is demanded. There is none for those advocating a benign 2a7 interpretation, while quite a bit for TED as risk. Not only are there all the other global eruptions of “something”, there is also another singular reference to interbank illiquidity akin to TED but secured instead of unsecured.

Since the early days of the eurodollar decay, repo fails have been a surefire signal of global funding problems. There was an unmanageable outbreak of repo fails in UST collateral that starting in November 2007 would not let up until Bear failed; while another larger, truly unimaginable outbreak was ignited in mid-September 2008 at the “Lehman moment” coinciding with the absolute worst of the entire panic period. Even more recently we have found repo fails to be a very good indicator of troubling inflections in global “dollar” liquidity, such as in June 2014 at the very start of this “rising dollar.”

Though repo fails had suggested somewhat calmer conditions in August, they have surged again in September. For the week of September 14, total fails (combined “to receive” and “to deliver”) jumped to $685 billion from $385 billion the week before. That was the highest since the spike in March this year, the second highest since 2008 (coincident to the Japanese FX problems).

What is even more interesting and telling is that repo fails have been on a clearly upward trajectory since the middle of August last year – the very point at which the “dollar” broke the PBOC’s resolve to peg CNY (meaning “supply” missing “dollars” to China’s financial sector at a price the eurodollar market was increasingly unwilling to accept).

Therefore, repo fails suggest still growing illiquidity in secured dollar funding tracing back to the week of August 10, 2015. Simultaneously, the TED spread suggests still growing illiquidity in unsecured funding tracing back also to last August and the same week (day).

In other words, we have repo fails surging, rapidly rising TED, and near-panic buying in treasury bills afterward – and all with elements that include Chinese flavor. I wrote just a week ago about this “something”:

Such drastic changes and blown expectations immediately call our attention to the “dollar.” Why has the PBOC sacrificed its post-August 2015 liquidity regime to stick CNY at around 6.68 to 6.685 – not even 6.70 anymore? The fact that Chinese money markets are now such a huge and obvious mess can only mean that whatever it is about the “dollar” that caused this shift has been judged as the greater of these two “evils.”

It is absolutely ridiculous the lengths that are being taken to avoid acknowledging the increasingly troubling global “dollar” shortage. We can debate and argue what is causing this “something”, but the evidence for it and for what it is has become is overwhelming.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.