DoubleLine Total Return As A Core Bond Holding

David Fabian | Nov 06, 2015 05:11AM ET

Long time readers of our blog know that we are proponents of active management in the fixed-income world. Certain funds, and fund managers, have proven to be successful navigators in the complex environment of security selection, duration, and risk management. For that reason, we continue to recommend to our clients that they step outside the confines of a benchmark index to seek greater returns or reduced volatility as a result of interest rate fluctuations.

One long-term core holding in our Strategic Income portfolio has been the Doubleline Total Return Fund (DBLTX). This actively managed mutual fund is governed by Jeffrey Gundlach, who has risen to fame as one of the premiere fixed-income experts in the world. DBLTX invests more than 50% of its portfolio in mortgage-backed securities, but can also hold assets like Treasuries, corporate bonds, and cash when needed.

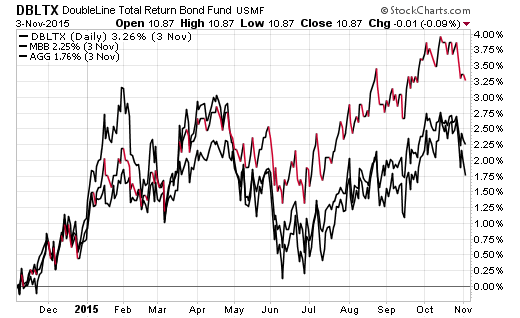

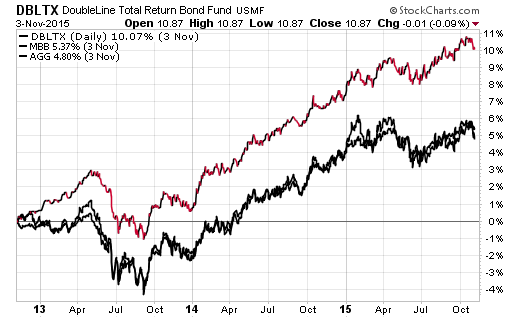

Over the last year, Gundlach and his team have added a significant measure of alpha over a diversified bond index such as the iShares Core U.S. Aggregate Bond ETF (N:AGG). For an accurate comparison, I have also over laid a sector-specific mortgage index in the iShares MBS ETF (N:MBB) as well.

DBLTX has returned nearly double the gains of AGG and has also significantly outperformed the dedicated mortgage index over the last 52-weeks. If we widen the time frame to 3 years, you can see how substantial this performance gap has become.

I am a staunch advocate of ETFs and believe that they are one of the best tools in an investors’ arsenal. However, you simply can’t find this unique bond strategy in an ETF at this time, which is why we have continued to stick with the marginally more expensive mutual fund strategy. The manager has earned that higher fee through superior performance, which is just what you want to see when you are paying a premium versus cheaper passively managed indexes.

Now the question becomes – how much more juice can a fund like DBLTX squeeze out in relative performance versus its benchmark moving forward?

It’s important to remember that DBLTX is not a “go anywhere, do anything” strategy. It’s going to behave like a bond fund, not like a stock fund or alternative investment strategy. The manager has guidelines that allow a certain degree of flexibility, but it is ultimately going to be directed by the interest rate and credit environment in any given year.

While the timing is difficult to ascertain, there will almost certainly be periods of sharply rising interest rates on the horizon. I believe that this is where the managers of active mutual funds such as DBLTX can add the most value versus passive indexes.

Treasury and investment grade-heavy benchmarks with intermediate term durations are going to underperform in a rising rate environment. The longer the duration or higher quality the bonds, the greater volatility that index will endure. However, an actively managed fund that can lower its duration and adjust its holdings to coincide with pockets of value or momentum will likely continue to earn its keep and outpace the competition.

The Bottom Line

Doubleline has been in the right places at the right times over the last several years. However, that doesn’t make them infallible to an incorrect call on interest rates or underperformance as bond market trends change. As with any active strategy, it’s important to regularly monitor the fund’s performance versus its peer group and benchmark to ascertain that they are achieving returns in line with your goals and realistic expectations.

Disclosure: FMD Capital Management, its executives, and/or its clients may hold positions in the ETFs, mutual funds or any investment asset mentioned in this article. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.