Why I'm Suspicious Of This S&P 500 Rally

Richard Shaw | Apr 10, 2013 01:05AM ET

Yes, the S&P 500 is in rally mode — new highs and all that, but it is not a comfortable rally. Something is definitely not right. There are several other market indexes that provide indications suggesting this S&P 500 rally does not have good legs.

In a stock rally you might expect these things to happen, but they are not:

- Small-cap stocks tend to lead the large-cap stocks

- Consumer cyclical stocks tend to lead the consumer staples stocks

- High volatility stocks tend to lead the low volatility stocks

- Growth stocks tend to lead the value stocks

- The Broad index tends to lead the high yield index.

Instead of more aggressive stocks leading this rally, we have more defensive stocks leading. It is a bit hard to imagine a rally going on long and far on the back of defensive stocks. It could happen, I suppose, but that’s not the way it is usually done; and that is a reasonable basis for caution.

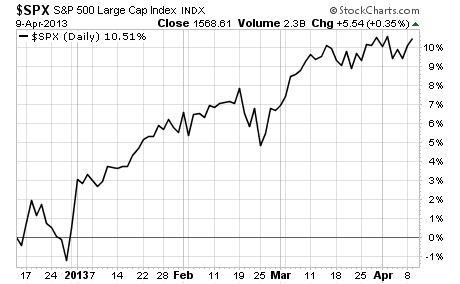

So here is the year-to-date rally. It is up nicely so far in this percentage performance chart.

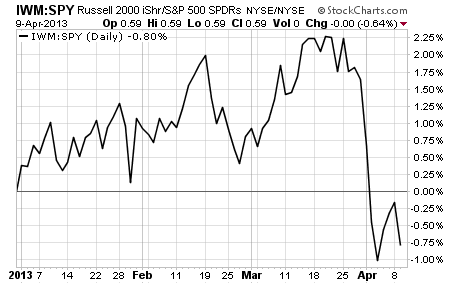

But, here are the non-confirming charts we listed above. Each is a ratio of the performance of one index to the other. To confirm the rally, you would expect the charts to be trending up. A down trending chart is a negative divergence that is some cause for caution. These are all trending down or the uptrend has recently been broken.

Russell 2000 Small-Cap / S&P 500 Large-cap

S&P 500 Consumer Cyclicals / S&P 500 Consumer Staples

S&P 500 High Volatility (Beta) / S&P 500 Low Volatility

S&P 500 Growth Stocks / S&P 500 Value Stocks

S&P 1500 Index / S&P 1500 High Yield Dividend Aristocrats

There is also no confirmation from key countries such as Germany (EWG), China (GXC) and Brazil (EWZ). Japan (EWJ) is rallying, but only on enthusiasm for an all-in/last-ditch effort at stimulation.

We would feel a lot more confident in this S&P 500 rally if the small-cap stocks, growth stocks, high volatility stocks and cyclical stocks were in the lead, but they are not.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.