Why Dow Theory Still Works

Blair Jensen | May 24, 2015 02:02AM ET

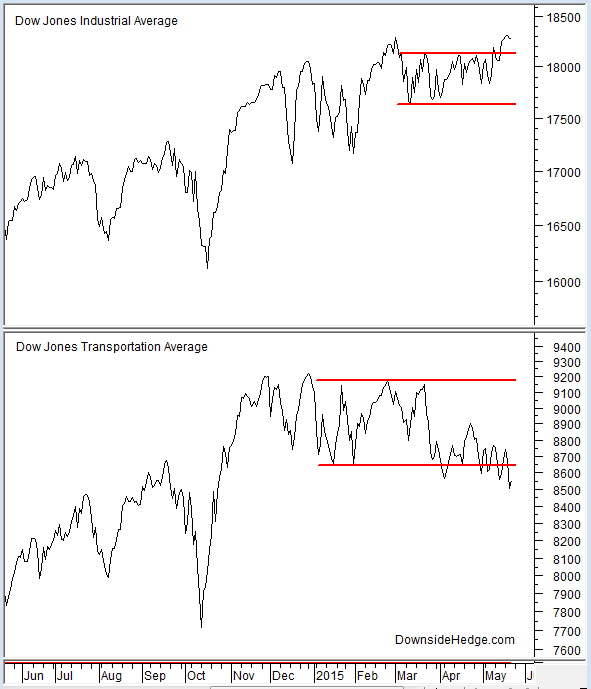

There has been an increase in news stories about Dow Theory lately. Most of the discussion has been focused on the divergence between the Dow Jones Transportation (DJTA) and theDow Jones Industrials (DJIA). As you know I’ve added to the news flow by highlighting the break in opposite directions of Dow Theory lines by the averages . What almost everyone is talking about is the non-confirmation and its implication for the market. The opinions range from “the sky is falling” to “non-confirmations don’t mean anything” or even “Dow Theory is useless so this non-confirmation is nothing more than fodder for idiots”.

I’ve been asked by one of the readers of Downside Hedge to share my thoughts on a recent blog post by a popular market commentator. His article was of the “useless fodder for idiots” variety. I’m happy to respond, but rather than call someone out I’ll focus on the general arguments I usually see against Dow Theory (which the “fodder for idiots” article touched on).

The arguments against Dow Theory generally fall into two categories.

1. Dow Theory is obsolete because our economy is so much different than it was when Dow Theory was created (it was like over a hundred years ago dude).

2. Dow theorists are almost always wrong and even disagree among themselves…insert gasp here…so the theory is bad.

Let’s deal with the most entertaining argument first then move on to the educational one. Dow theorists disagree and are often wrong. Yep, I agree. But to jump to the conclusion that this makes the underlying theory bad would be like saying fundamental analysts can’t agree on earnings estimates and company valuations so fundamental analysis doesn’t work. A person who makes this type of argument simply exposes their own lack of knowledge (or even curiosity) on the subject. A critical thinker would entertain the idea that a bad practitioner doesn’t make a bad theory. Or stated more clearly, the fact that my wife is a bad driver doesn’t mean the car is broke…even if it appears that way to an outside observer. A critical thinker would examine the car before jumping to the conclusion that it’s broke.

Non-critical thinkers hear propaganda they want to believe, refuse to think about it before repeating it, then find themselves eating cat. On the subject of Dow Theory, if you believe that it doesn’t work because of disagreement between practitioners I probably can’t help you see reason…so I won’t try. For others who aren’t sure if the theory works, but are open to debate I suggest you read a book that outlines the theory. Then read some of William Peter Hamilton’s editorials from the Wall Street Journal so you can see how it was used in practice. Robert Rhea’s book is a good starter that contains both. If you’re familiar with the theory and watch it in practice you should have enough information to make your own conclusion if Dow Theory is useful to you.

Before I address the “Dow Theory is obsolete” argument I’ll quickly explain the premise of the theory. Charles Dow and William Peter Hamilton postulate that the stock market acts as a barometer of business that can be used to forecast the market’s future trend. Hamilton’s writing focused on identifying the long term trend of the market then investing and trading in the direction of the trend. To identify the long term trend he used two measures of business activity. 1. The Dow Jones Industrial average (DJIA) which represents production in the broadest sense (meaning the work product of people whether goods or services). 2. The Dow Jones Transportation average (DJTA) to get closer to the consumption side of the equation (be it raw materials or finished goods). He believed that when both productive activity (DJIA) and consumption (DJTA) were rising a long term bullish trend was confirmed. He used a seemingly simple set of rules to determine bullish and bearish trends.

Now on to the Dow Theory is obsolete argument. It goes something like this: It was created like over a hundred years ago dude…and we’re not farmers and manufacturers anymore. Don’t you know were a service and information economy now? Industrials and railroads aren’t relevant to our economy. You might as well go back to 1790 and count P&G shipments loaded onto river barges. You need to get into the 21st century.

My response. Yep, the economy has changed. People don’t count river barge shipments anymore…and Dow Theory today doesn’t rely solely on railroad shipments like it did in the early 1900′s. People familiar with the stock market usually know that the Dow averages have changed components over the years. I’m guessing the changes are meant to reflect a the changing way we do business (and its impact on the economy). Today the transportation average is composed of the following industries; railroads, trucking, marine transports, courier/delivery services, truck leasing, airlines, and car rentals. The current index is a pretty good representation of how demand (or consumption) is satisfied. Notice that it even contains some movement of services via airlines, car rentals, and to some extent courier services.

Like the transportation average, the industrial average has changed to reflect the current underpinnings of productive activity. In the early 1900′s DJIA was made up of mostly raw material and manufacturing companies. I suspect the following industries reflected the drivers of the economy way back then; coal, iron, steel, copper, rubber, leather, and manufacturing.

Today DJIA has the following industries; manufacturing, finance, electronic transactions, insurance, energy, internet, computer, business services, health care, consumer products, retail, and entertainment. Notice all the service and information industries included…a pretty good representation of today’s production.

Conclusion

The changes in the indexes that reflect the changes in production and consumption over the last hundred years is why Dow Theory still works…even if many practitioners are bad drivers.

Now back to my interpretation of Dow Theory and its current implications for the market. As William Peter Hamilton stated in 1904, the thing that matters most is the long term trend. According to my reading of Dow Theory the trend is up and has been since July of 2009. This means your portfolio should be long and you should be looking to buy dips. The current non-confirmation created by a break in different directions from a line should make you sit up and start paying attention. Most non-confirmations are non events. However, this one is significant because it follows a battle between accumulation and distribution. The fact that both indexes didn’t break in the same direction from their lines causes uncertainty in the market which provides us with a small warning. As a result, now isn’t the best time to be initiating new longs. Waiting for a dip that creates a secondary low or a dip that comes after a rally where both averages make new highs (and confirm the long term trend) would be a better time to deploy cash.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.