Why Did XIV Collapse & VIX Spike When S&P 500 Dropped 'Just' 4%?

Andrew Thrasher | Feb 20, 2018 01:04AM ET

There been a great deal of attention, and rightfully so, to what’s being dubbed ‘Black Volatility Monday’ with the demise of the short volatility ETN (XIV) and the massive spike in the Volatility Index. Kid Dynamite did a nice job outlining one likely reason for XIV’s implosion.

Another view that I think is worth reviewing that also takes a look at how and why the VIX rose by such a magnitude when the S&P 500 only declined by 4% is by Artur Sepp, a Quantitative Strategist for wealth management firm Julius Baer in Switzerland. Sepp has a PhD in Statistics, Masters in Industrial Engineering and a BA in Mathematical Economics and is someone I consider a must-read whenever he puts out research. Recently Sepp wrote a long piece on the recent events that have taken place in volatility and I’d like to share a few pulled quotes and charts below.

With Regards to the actual intraday event in XIV:

The most interesting and yet mysterious incident happened right after cash market close at 16:00 while the futures market was still opened. From 16:00 to 16:15 the intraday gain in the VIX1m futures reached from 45% to nearly 100% indicating the default event for XIV ETN and other short volatility ETP. At the same time the loss on the S&P 500 index futures increased only by about 1.25% to 5.5%. As a result, the more than double spike in the VIX1m futures during this 15-minute period cannot be accounted by the decline in the S&P 500 index futures.

Below is my brief summary of the points Sepp gives for the day’s events. #4 is what’s gotten the most attention and likely had the largest impact:

- There’s no easy way to arbitrage the intraday moves in XIV and unlike ETFs, there are not redemption mechanisms in place for ETNs like XIV.

- If Credit Suisse was hedging its exposure via swaps then their counter-party could have been hedging its own exposure through long VIX futures.

- Retail investors shedding XIV exposure added to pressures at close.

- Re-balancing of short and long volatility products exacerbated the rise in volatility . short volatility ETPs had to buy VIX futures to cover their short positions to get in line w/ their reduced NAV and long volatility ETPs had to also buy VIX futures as their NAV increased.

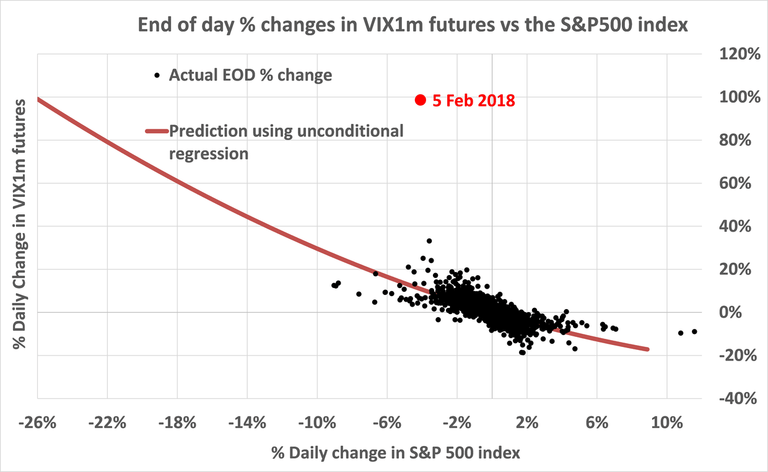

One topic that hasn’t received as much attention is why spot VIX rose as much as it did with the equity index declining by less than five percent. Sepp notes that following a regression model of the sensitivity of S&P to VIX estimates that a -10% decline in the index would result in a 31% increase in VIX front month futures. However, as Sepp’s chart below shows, What happened on February 5th was well outside the norm. Based on the regression model, the S&P would need to decline by 26% to get a 100% increase in front-month VIX.

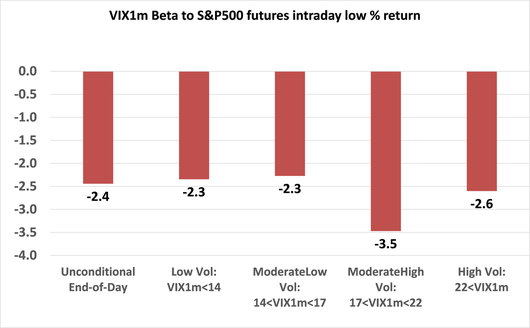

So something must have changed or impacted the sensitivity of the VIX to the S&P 500. Sepp looks at the absolute level of the VIX to determine if the fact that the Volatility Index was at an extremely low-level had any impact on the resulting move. By grouping the VIX into four regimes (less than 14, 14-17, 17-22, and greater than 22) does not have a substantial impact on VIX’s beta.

However, what does seem to have a large sensitivity to the level of volatility, is convexity, which measures the responsiveness of the acceleration in change of prices. As Sepp’s chart below shows, when the VIX is low, the convexity is heightened, meaning the change in the S&P has a much larger impact on the change in the front-month VIX futures. Using the prior -10% drop in SPX would result in a 109% rise in VIX futures under 14 based on convexity alone (e.g. not accounting for beta).

What makes February 5th’s move so interesting is typically the S&P 500 sees its largest downside moves when the VIX is at higher levels. For example, the Flash Crash in May 2010 occurred well off the lows in volatility. Spot VIX opened on May 6th, 2010 at 26, having been under 16 just a few weeks prior. Although, VIX also had been rising going into February 5th, with spot bottoming under 10 in January but VIX still opened on the 5th at sub-20 which as Sepp’s work shows, allowed a much larger impact of convexity to take hold – and the resulting volatility dominoes to fall as they did for volatility ETPs.

Short version: The events that took place on February 5th, while not outside the scope of reason, did occur at near-perfect storm levels with volatility in a regime of heightened sensitivity to convexity. As I discussed in my paper, Forecasting A Volatility Tsunami, low volatility is not a good predictor of spikes in volatility but as Sepp’s work shows, low volatility can provide additional fuel to the volatility fire when spikes do in fact occur. Could this happen again? Mathematically, yes.

While the criminalization of volatility products is overblown in my opinion, likened to the idea that race cars should be banned if an amateur attempts to get behind the wheel and crashes, like all investment products, but specifically those linked to futures, the end-user needs to understand and evaluate what they are buying and the risks involved.

Disclaimer: Do not construe anything written in this post or this blog in its entirety as a recommendation, research, or an offer to buy or sell any securities. Everything in this post is meant for educational and entertainment purposes only. I or my affiliates may hold positions in securities mentioned in the blog. Please see my Disclosure page for full disclaimer.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.