Why Consumer Confidence Is A Relative Indicator

Sober Look | Oct 08, 2012 02:44AM ET

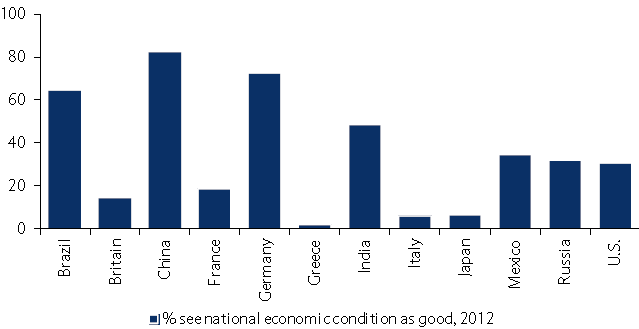

Relying on the absolute levels of consumer survey indicators is usually fruitless. Cultural and historical factors impact how consumers answer questions about the economy. The chart below from Barclays compares consumer views of national economic conditions - percent of survey participants that see them as "good."

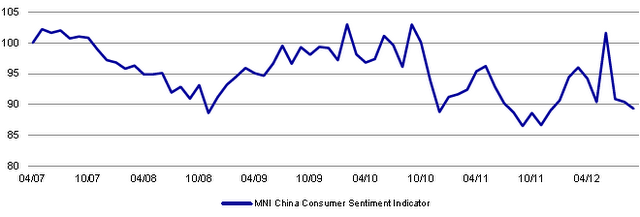

Some of these certainly make sense - such as Greece, the UK, and Italy for example. But from this measure one would think China's consumers are ecstatic about their nation's economy. The reality however is a bit different. The headline MNI China Consumer Sentiment Indicator for example shows a trend that is anything but upbeat.

MNI: The MNI China Consumer Sentiment Indicator dropped for the third month in a row in September to its lowest level since December. The Indicator fell to 89.3 from 90.4 in August. Sluggish economic data and a lack of new government policy stimulus contributed to weaken sentiment. The drop in headline sentiment was due to weak views on current conditions, which fell to 91.3 from 95.0 the month before.

A similar situation is developing in Germany (see this article ). With all such survey indicators, relative moves and trends are usually the only meaningful measures.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.