Why China’s Market May Get Worse

Investment U | Jul 16, 2015 01:08AM ET

By now you have no doubt heard about the clobbering China’s stock markets have undergone. In the past four weeks, Chinese stocks fell 30%. Roughly $4 trillion of value was destroyed.

But it’s about to get worse.

The Chinese government is doing everything it can to artificially prop the market higher. Aside from cutting interest rates, that is. As Jonathan R. Laing writes in this week’s Barron’s:

Initial public offerings have been suspended to marshal resources for market defense. Pension funds and insurers are being pushed to lift their allocations to Chinese stocks. The state has ordered brokerages not to sell any stock and to set up a kitty of $20 billion to buy blue chip Chinese stocks. Corporate executives, directors and insiders with substantial stock positions have been forbidden to sell holdings over the next six months. Regulators have also discouraged short-selling. And perhaps most important, trading has been halted indefinitely in over half the listings on the two Chinese exchanges to make the defensive measures easier to execute.

So clearly China is making some drastic moves. But what do you think will happen when brokerages or corporate executives are once again allowed to sell stock? Or when trading opens in stocks that are currently halted?

It’s impossible to stop a market slide with regulatory measures - or by simply not permitting selling of shares. The U.S. tried this during the financial crisis when it forbade the short sale of financial stocks. During that time, the Dow fell almost 19%. And the Financial Select Sector SPDR (ARCA:XLF), which tracks 90 companies in the financial services industry, dropped 25%.

After the 9/11 attacks, which took place during a bear market, the U.S. markets were closed until September 17. When they reopened, stocks fell 12% in one week.

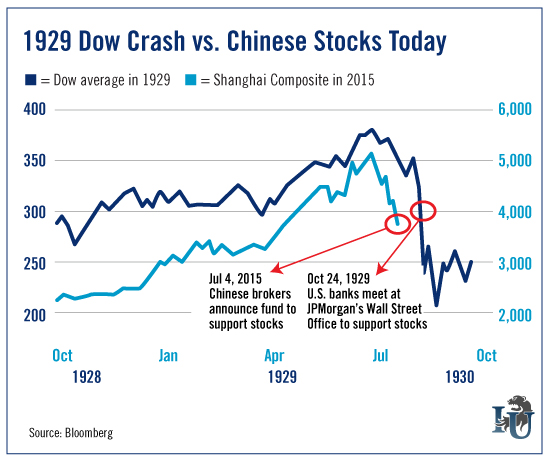

And in 1929, Wall Street banks started buying up shares to try to artificially keep prices from falling beyond the 30% they already had. It was virtually the same story as what’s happening in China today. In fact, you can see on the chart below that right now Chinese stocks and the Dow from 1929 look quite similar.

The Dow continued to fall hard after the banks stepped in. I expect the Chinese markets to do the same.

Money flows to where it’s treated best. But when it’s locked up by regulators and not permitted to flow in and out of investments? As soon as that cell door finally opens, it flees and often doesn’t return.

And why would it? Who is going to trust a market after having access to his or her money restricted?

It’s understandable why regulators would try to slow down a mass exodus from the markets. But history has shown that it doesn't work. Instead, it can lead to the opposite result - intensified selling once restrictions are lifted.

Chinese regulators only have to look at the two most recent bear markets in the United States for a reason to let the markets seek their own levels.

One could argue that the Fed is an enabler when it comes to U.S. stocks. The Oxford Club’s Editorial Director, Andrew Snyder, has gone so far as to say the markets have an “addiction” to our current interest rate environment. But it’s hard to make the case that extremely low rates haven’t been an important factor in our six-year bull market.

There is a big difference, however, between keeping rates low and prohibiting stocks from trading or investors from selling.

In the near term, Chinese stocks are likely to be volatile. There may be some big swings higher and lower. But by keeping investors frozen in positions, they are all but assuring a tidal wave of selling once they unlock the doors.

Investors who want to speculate on a further drop in Chinese stocks can buy puts on iShares China Large-Cap (ARCA:FXI). And those who really want to roll the dice can buy the Direxion Daily FTSE CHINA Bear 3x Shares (NYSE:YANG). This ETF aims for 300% of the inverse performance of the FTSE China 50 50 index. So if the index goes up 1%, the ETF will drop 3%. If the index falls 10%, the ETF will rise 30%.

The 3X ETF is not for the faint at heart. In the past year, it’s had a price range of between $48.80 and $188.40. It’s currently trading around $78. Last week, its smallest trading range was over three points. In short: This ETF is going to move a lot, and you need to be able to handle the action. If that’s not for you, don’t worry; there are plenty of other China ETFs to choose from.

The Chinese government is making all of the wrong moves when it comes to its stock market. Shareholders of many Chinese stocks are going to get hurt. But speculators who time it right can make a lot of money when it crashes.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.