5 Reasons Why Junk Bonds Are A Great Buying Opportunity Now

Rida Morwa | Jan 23, 2016 06:15PM ET

Summary

- The High-yield bond sector has been thrown into turmoil because of falling oil prices. High yield Bond spreads are at a multi-year high.

- Mainly “oil related companies” and certain areas in the emerging markets are at risk. However the entire sector is being dumped indiscriminately.

- I will provide in this article 5 strong reasons why certain Junk Bonds offer a “great opportunity to buy”.

- I will also highlight 5 Criteria to keep in mind when looking to invest in high yield Junk Bond Closed-End Funds (CEFs).

Situation in the High-Yield Bond Sector

Sentiment towards high-yield debt has deteriorated this month after sliding for much of last year. The market has been unable to escape this month's pronounced decline for equities and oil dropping below $30 a barrel. Popular high-yield junk bond ETFs have fallen to lowest since 1967 . Stricter mortgage loan regulations adopted by banks after the last financial crisis have contributed to financial stability. Large banks have largely pulled back from mortgage lending to those with weak credit histories.

5- Aggressive Quantitative Easing (QE) across the World

With Europe, Japan, and China all facing deflation and lower growth, they are all likely to increase their continued aggressive Quantitative Easing (QE), by further easing money supply and lowering interest rates. This will keep supporting demand for high yield products, including dividend stocks and Junk Bonds. Furthermore since October 2014 . Unattractive Treasury yields returns will keep demand for high-yield products strong, especially for income-hungry investors, baby boomers, and retirees.

Five Criteria to keep in mind when looking to invest in "high-yield" Junk Bond Closed-End Funds (CEFs)

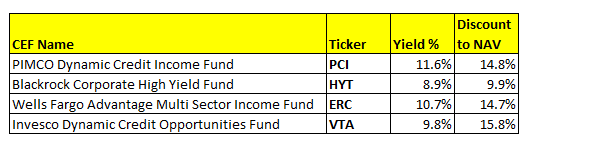

Closed-End Funds (CEFs) currently offer one of the best way to enter the Junk Bond sector, as discount to Net Asset Value (NAV) is running high, thus providing some of the highest dividend yields. The following is a small list of such CEFs with their corresponding yield and discount to Net Asset Value:

Naturally, not all the Junk Bond space is safe. If an investor is looking to invest in high yield today, I would suggest looking for a

Closed-End Fund with the following 5 criteria in mind:

- Little or no exposure to the oil and gas sector.

- Low exposure to the lowest-grade CCC bonds, which are much riskier with higher default risk.

- Low exposure to China and other Asian emerging markets.

- A fund with an active management strategy that avoids high-risk areas.

- A high discount to "Net Asset Value" (NAV) providing an opportunistic buying opportunity.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.