Why BlackBerry Could Get Back On Track Sooner Than You Think

Estimize | Mar 27, 2014 01:42AM ET

BlackBerry Ltd (NASDAQ:BBRY) is set to report FQ4 2014 earnings after the market closes on Thursday, March 27. BlackBerry was once a smartphone pioneer and giant but is now just a shadow of what it used to be. Shares once traded as high as $235 but now sell for less than $10 a pop. In November BlackBerry brought in John Chen as new CEO tasked with the arduous assignment of turning the company around. Chen has stated that his turnaround strategy relies on the enterprise customer. But in April, he has something else up his sleeve. BlackBerry will be launching a low-cost phone in Indonesia, a critical emerging market. The Z3 will be priced under $200 and if it’s successful in Indonesia it could be a critical part of BlackBerry’s turnaround story over the next 2 quarters in which the Estimize community believes BlackBerry will grow revenue faster than Wall Street thinks. Here’s what investors are expecting from BlackBerry this quarter:

The information below is derived from data submitted to the Estimize.com platform by a set of Buy Side and Independent analyst contributors.

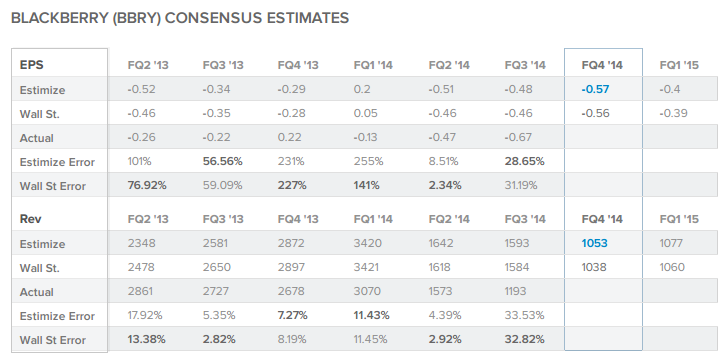

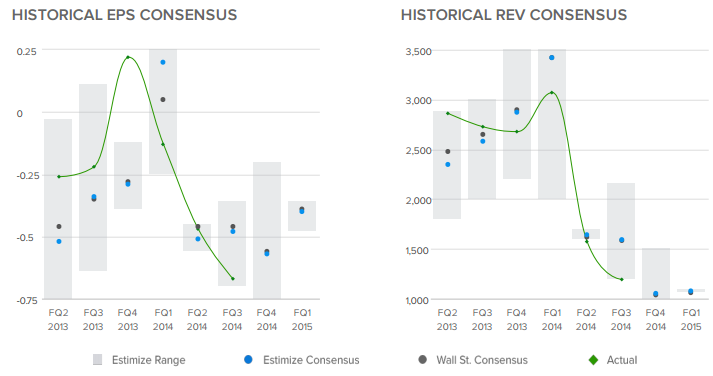

The current Wall Street consensus expectation is for BlackBerry to report -56c EPS and $1.038B revenue while the current Estimize.com consensus from 37 Buy Side and Independent contributing analysts is -57c EPS and $1.053B in revenue. This quarter the buy-side as represented by the Estimize.com community is expecting BlackBerry to miss the Wall Street consensus on EPS by 1c while beating projections on revenue by $15 million.

By tapping into a wider range of contributors including hedge-fund analysts, asset managers, independent research shops, students, and non professional investors Estimize has created a data set that is more accurate than Wall Street up to 69.5% of the time, but more importantly it does a better job of representing the market’s actual expectations. It has been confirmed by an independent academic study from Rice University that stock prices tend to react with a more strongly associated degree to the expectation benchmark from Estimize than from the Wall Street consensus.

The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. In this case there is a small difference between the 2 groups’ expectations.

The distribution of estimates published by analysts on the Estimize.com platform range from -84c to -20c EPS and from $780.00M to $1.510B in revenues. This quarter we’re seeing a wide distribution of estimates on BlackBerry .

The size of the distribution of estimates relative to previous quarters often signals whether or not the market is confident that it has priced in the expected earnings already. A wider distribution of estimates signaling less agreement in the market, which could mean greater volatility post earnings.

Over the past 4 months the Wall Street EPS consensus dropped from -35c to -56c while the Estimize consensus fell from -36c to -57c. Meanwhile the Wall Street revenue forecast declined from $1.381B to $1.038B while the Estimize forecast also sank from a high of $1.336B to $1.053B. Timeliness is correlated with accuracy and falling analyst revisions at the end of the quarter are often a bearish indicator, although in this case revisions were mostly flat going into the report.

The analyst with the highest estimate confidence rating this quarter is anmikyoso who projects -52c EPS and $1.104B in revenue. In the Winter 2014 season anmikyoso is rated as the 38th best analyst and is ranked 31st overall among over 4,000 contributing analysts. All time anmikyoso has been more accurate than Wall Street in forecasting EPS and revenue 60% and 53% of the time respectively throughout 249 estimates. Estimate confidence ratings are calculated through algorithms developed by deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy. In this case anmikyoso is making a bullish call expecting BlackBerry to beat the Estimize community’s expectations on both the top and bottom line.

CEO John Chen has his hands full with BlackBerry’s turn around. The low cost Z3 phones have not yet been rolled out in Indonesia, but if successful Chen says he plans on spread the phone to neighboring countries in Southeast Asia. Until then BlackBerry will mostly have to rely on its enterprise sales which favor the phone for its high security. BlackBerry handsets are still popular at financial firms, in politics, and have one of the most important customers in the country, the President of the United States. This quarter contributing analysts on the Estimize.com platform are expecting BlackBerry to miss the Street’s revenue expectation by 1c per share but beat expectations on revenue.

Get access to estimates for BlackBerry published by your Buy Side and Independent analyst peers and follow the rest of earnings season by heading over to Estimize.com. Register for free to create your own estimates and see how you stack up to Wall Street.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.