Why Are These ETFs Hitting 52-Week Highs?

Pacific Park Financial Inc. | Apr 17, 2013 04:40PM ET

The relative strength of the primary U.S. benchmarks -- the Dow Industrials and the S&P 500 -- distorts the true picture for risk assets today. In fact, we do not even need to look closely to see the cracks all along the wall.

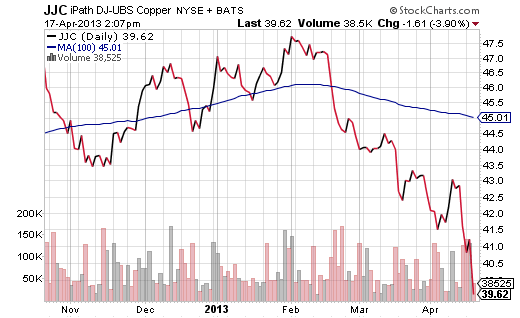

Copper

For example, the most important metal to the world’s economy appears destined for a bear market. Not only is iPath DJ Copper (JJC) well below its 100-day moving average, but the price is nearly 20% below its February peak.

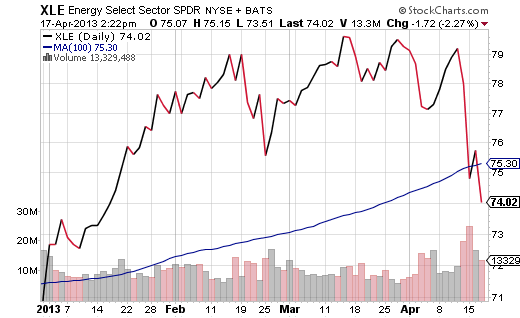

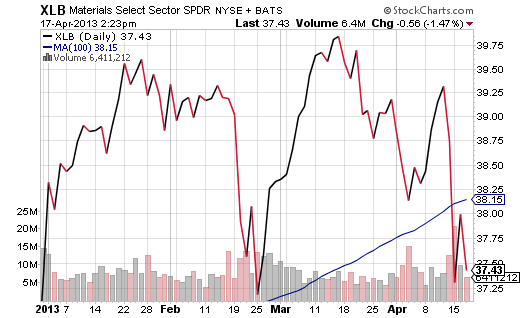

Dr. Copper -- the metal with a PhD in Economics -- may not have the same impact on stock price direction as in previous decades. Yet it is difficult to make a case that global central bank easing can bolster risk assets in perpetuity. In the U.S., SPDR Select Sector Energy (XLE) as well as SPDR Select Sector Materials (XLB) have both dropped below intermediate-term (100-day) trendlines on higher-than-normal volume.

Germany

As if to make matters worse, Jens Weidmann, head of Germany’s Bundesbank, suggested that recovering from the euro-zone debt crisis could take 10 years. The iShares MSCI Germany Fund (EWG) is below intermediate-term trendline support, is negative on its year-to-date returns and sits at its lowest level for 2013.

Minus The U.S.

Simply stated, an all-world stock index that excludes the U.S. demonstrates that equities are standing on shaky ground. The iShares All-World excl. U.S. Fund (ACWX) is barely positive for the current year.

I am not predicting the end of the bull nor the start of a bear. I do not believe that labeling an environment nor pigeon-holing a money manager moves a discussion forward. Instead, I choose to evaluate circumstances as well as make decisions on courses of action.

Here are the circumstances and some potential moves that one could make:

- Investment-grade corporate credit bonds are hitting new 52-week highs. Preferred shares and short-term high yield bonds are doing the same. If you do not own funds like iShares Intermediate Corporate Credit (CIU), iShares Preferred (PFF) or PIMCO 1-5 Year High Yield Corporate (HYS), it is not too late to utilize the income producers in your portfolio.

- Central banks can artificially manipulate interest rates and create a subsequent wealth effect through higher home prices and higher stock prices. However, five years of central bank bailouts, rate manipulation and bank stabilization mechanisms have not created jobs or rising incomes or capital reinvestment. That makes price-dependent, cyclical stocks more vulnerable. Invest in hedge against the falling euro and falling yen . Use WisdomTree Europe Hedged Equity (HEDJ) or WisdomTree Japan Hedged Equity (DXJ) if you choose to invest internationally. Right now, I would not recommend either investment without a bounce higher off of a respective 100-day moving average.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.