Why And When We Are Not Losing Money If We Buy Back An Option For More

Dr. Alan Ellman | Jul 17, 2016 01:27AM ET

Exit strategies for covered call writing and selling cash-secured puts all start with buying back the option. Frequently, the cost to close our short option positions will be less than the premium generated initially from the option sale. This is because of the impact Theta (time value erosion) has on our option premiums. However, students of options know that there are other factors that influence our option premiums collectively known as the Greeks. So while Theta is causing premium to decrease in value, Vega (changes in implied volatility of the underlying security) and/or Delta (changes in the share price) can actually cause the premium value to accelerate. On the surface, it would appear that if we bought back an option for a higher price than initially generated in order to initiate an exit strategy, we will have lost money but that is not necessarily the case. Specifically, I am referring to the mid-contract unwind exit strategy (pages 264 – 271 of the Classic version of the Complete Encyclopedia and pages243 – 252 of Volume 2 of the Complete Encyclopedia) and rolling options on or near expiration Friday. In this article, we will focus on the calculations and strategy philosophy of rolling options where we buy back an option for a higher price than originally generated. A case will be presented for why we are not losing money.

The initial trade

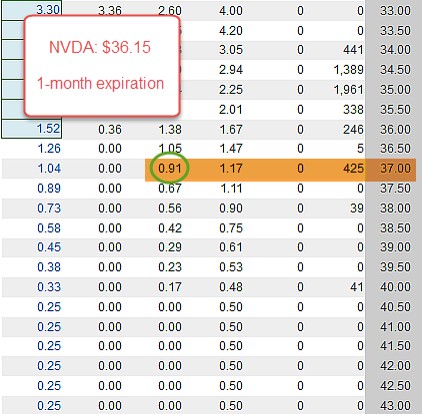

Nvidia Corp. (NASDAQ:NVDA), a stock on our Premium Watch List at the time this article was crafted, was trading at $36.15. Let’s have a look at the 1-month options chain:

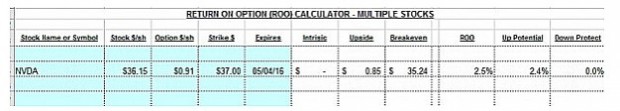

We see that the 1-month out-of-the-money $37.00 call option generates an initial return of $0.91 per share without negotiating the bid-ask spread. Let’s use this published stat as our worst-case-scenario return and feed this information into the multiple tab of the Ellman Calculator:

Our initial 1-month return is 2.5% with the possibility of an additional 2.4% if share price moves up to the $37.00 strike by expiration. This represents a potential 4.9%, 1-month return.

Evaluation of the “deal” we just entered into

Prior to entering into this trade, we agreed to sell our shares at $37.00 at any time prior to contract expiration. We know our shares cannot be worth more than $37.00 while we are obligated to the option parameters. In return we receive an unrealized initial profit of 2.5% with the potential for a 1-month total return of 4.9%. This is what we agreed to.

What if the share price is greater than $37.91 by contract expiration?

The formula for option premium is:

Premium = Intrinsic value + Time value

This means that if the stock price is greater than $37.91, the cost to close will be greater than the premium initially generated ($0.91). On the surface it would appear that we should not buy back that option and suffer a loss. But let’s dig deeper and evaluate our choices. First, if the strike is in-the-money (lower than current share market value), we have maximized our initial trade a realized the 1-month 4.9% return. So far so good. There are two paths we can take from here:

- Allow assignment and use the cash the following week to enter a new covered call position

- Roll the option (buy back the near month $37.00 and sell the next month same or higher strike option)

***When deciding between these two choices, the original option premium amount is never factored in. That is history as we had a successful outcome in month #1. Now it’s contract month #2. Since Theta has eroded almost all the time value of the $37.00 near-month call option, there will be an option credit if we sell the next month $37.00 call since Theta has not as yet had the opportunity to erode that month’s time value. As an example, if the price of NVDA at expiration is $38.50, the cost-to-close would be $1.50 + a few pennies of time value. Let’s say $1.55, more than the $0.91 originally captured from the initial sale (remember, we do not factor this in now…just a reminder). The next month’s $37.00 call option will generate $1.50 of intrinsic value + time value greater than $0.05, let’s say $0.85 for a total premium of $2.35. Our cost basis when making this (rolling) decision is $37.00, the maximum our shares can be worth during the initial contract. Let’s now feed this into the Ellman Calculator:

The “What Now” tab of the Ellman Calculator shows us that by rolling out, after having maxed our original trade, we can capture a 2.16%, initial 1-month return with 3.90% protection of that profit (different from breakeven). If this return meets our goals, we roll the option. If not, we allow assignment (take no action and our shares will be sold the day after contract expiration).

Discussion

Buying back an option at a price higher than the original option sale frequently does NOT represent a net loss. In this article, we explored a scenario wherein the original option trade generated a maximum return and the ensuing closing of the short option position was tied into an option sale the following month resulting in a net initial gain the next month as well. The decision to roll the option versus allowing assignment should not be clouded by factoring in the initial option sale.

Market tone

Global stocks appreciated this week on hopes for further global monetary and fiscal stimulus. The Bank of England did not cut rates this week but indicated that an easing policy is likely. Oil prices moved up as well. The Chicago Board Options Exchange Volatility Index (VIX) declined to 12.67 from 13.68 last week. This week’s reports and international news of importance:

- Retail sales in the US rose 0.6% in June while May sales were revised down to a 0.2% rise from an initially reported 0.5%

- This week’s Beige Book from the US Federal Reserve stated that economic activity increased at a modest pace in most regions

- The S&P 500 Index set intraday records each day this week, the first time that has happened since 1998

- Theresa May was appointed Conservative Party leader and prime minister of the United Kingdom this week

- Japanese Prime Minister Shinzo Abe laid out a plan to boost domestic demand with a $100 billion fiscal stimulus

- Also boosting Japanese markets this week was a 90% jump in shares of Nintendo (T:7974) after its Pokemon Go game became an international sensation

- Well-planned fiscal stimulus helped China maintain its 6.7% growth rate in the second quarter of the year

- Ireland’s 2015 gross domestic product figures were revised this week to 26.3% from an earlier 7.8% estimate

- 84 people were killed and over 200 injured in Nice on Thursday as a gunman drove a truck into a crowd watching Bastille Day fireworks along the French Riviera. The attack is the seventh in France since January 2015

THE WEEK AHEAD

- The UK reports June retail sales on Thursday, July 21st

- The European Central Bank’s Governing Council meets to set interest rates on Thursday, July 21st

- Global flash purchasing managers’ indices are released on Friday, July 22nd

For the week, the S&P 500 rose by 1.49% for a year-to-date return of +5.76%.

Summary

IBD: Market in confirmed uptrend

GMI: 6/6- Buy signal since market close of July 1, 2016

BCI: Moderately bullish. I plan to favor out-of-the-money strikes 2-to-1 for the August contracts, a bullish stance. Since we are in the heart of earnings season we look to the eligible stocks in “white” cells of our member reports and all ETFs. There will also be several stocks that will report during the first week of this 5-week August contract time frame and thus become eligible after the reports pass (assuming no egregious report results). There should be adequate eligibility to fill our portfolios given the bullish market environment. There are so many events, concerns and even some distractions that we deal with as we invest our hard-earned money. For me, corporate earnings is still the most important factor to consider.

WHAT THE BROAD MARKET INDICATORS (S&P 500 AND VIX) ARE TELLING US

The charts continue to point to a bullish short-term outlook. In the past six months the S&P 500 rose by 15% while the VIX declined by 55%, an impressively bullish picture.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.