Why Analysts Expect Facebook Stock To Keep Going Higher

Estimize | Dec 13, 2013 02:14AM ET

This morning Facebook (FB) shares took off after its subsidiary, Instagram, announced its latest feature, Instagram Direct. Instagram Direct will allow users to send private picture messages and discuss them with up to 15 others.

In September, just before announcing its launch of paid advertisements, the photo-sharing company told the Wall Street Journal it had over 150 million monthly users. In today’s release co-founder Kevin Systrom claimed that over half of them are on the app every single day. When you have 75m+ users using your app every day, advertisers will pay a pretty penny to reach them. While 150 million users is no small change, the app still has much more room to grow into. Parent company Facebook touted an impressive 1.19 billion active users as of September, 2013. With such a gigantic base of users and continued development of new features, prospects for revenue and earnings growth are looking robust, but the Wall Street expectations don’t match up to hedge fund forecasts.

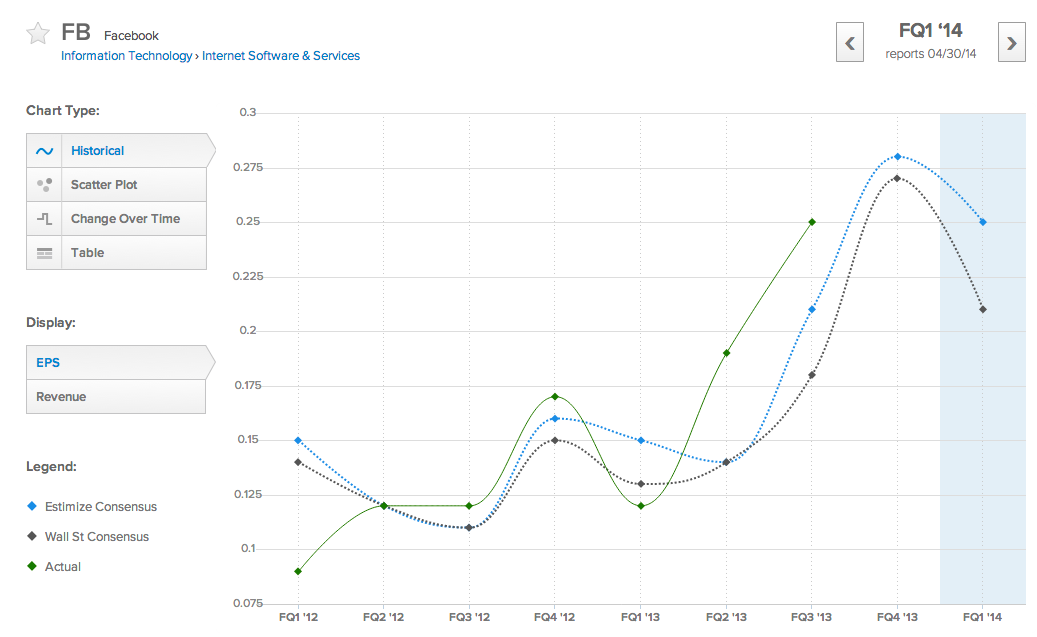

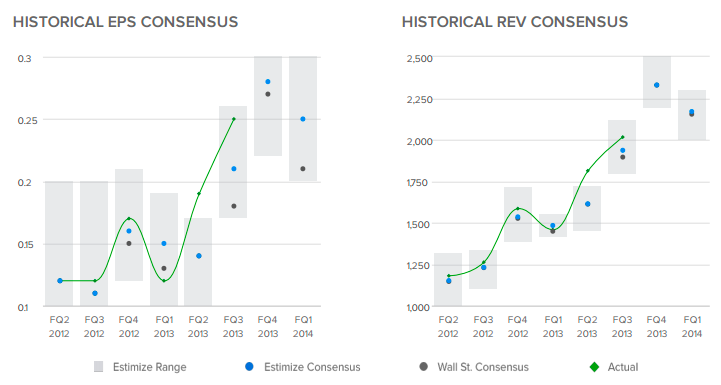

Throughout 2013 sell-side analysts that make up the Wall Street consensus have consistently underestimated the growth rates of social media companies. Looking forward to the next 2 earnings reports we see further evidence of Wall Street under-representing the market’s expectations for Facebook. The information below is derived from data submitted to the Estimize platform by a set of Buy Side and Independent analyst contributors.

The Estimize consensus is more accurate than Wall Street 69.5% of the time because it represents unbiased market expectations. By tapping into a wider distribution of over 3,300 contributors including hedge fund analysts, asset management firm analysts, industry experts, and students Estimize is better able to capture the true market outlook.

Looking forward to the next 2 earnings periods buy side and independent analysts are expecting Facebook’s earnings, including the new revenue stream from Instagram, to exceed the sell-side’s expectations for a third and fourth straight quarter. In the upcoming FQ4’13 report which is expected at the end of January the Wall Street consensus and Estimize community are expecting similar numbers to be posted. For the next quarter out, FQ1’14, there is a much bigger differential in the expected EPS. The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. Our quantitative research suggests that an upwards pre-earnings drift is associated with approaching an earnings report with a large differential between the Estimize and Wall Street expectations as we are seeing for FQ1’14. For more information about pre-earnings drift and strategies quant.

Our community seems to agree that Facebook will be no exception to the recent trend of social media companies beating Wall Street expectations.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.