Which Way The Euro? A Look At FXE Euro-Tracking ETF

Jay Kaeppel | Jun 21, 2018 12:45AM ET

The advent of ETF’s has opened a vast array of opportunities to investors that was previously hard to reach. One category that applies is the commodities markets. Most investors are not built emotionally and/or financially to endure the rigors associated with trading commodity futures. Not that I have any problem with commodity futures in general. Traders who understand the leverage and who manage risk properly can achieve great things. But the fact remains, that they are not “right” for a lot of individuals.

As always, opportunity is where you find it. Ticker FXE (Guggenheim CurrencyShares Euro ETF) tracks the euro and ticker SOYB tracks soybeans. Investors can trade these ETFs just like they trade shares of stock. While these vehicles do not offer the leverage of futures contracts, they do offer exposure. Both the euro and soybeans have gotten crushed lately. Is there an opportunity there? Let’s take a closer look.

Ticker FXE

To examine the euro we will look at the spot euro futures contract. In Figure 1 we see the recent decline – a direct result of a strong US dollar.

Figure 1 – Euro sells off hard (Courtesy ProfitSource by HUBB )

Figure 2 displays a monthly chart of the euro since trading inception. The chart includes a fairly arbitrarily drawn “equilibrium” line to help give a sense of where we are from a very long-term perspective.

Figure 2 – Weekly Euro (Courtesy ProfitSource by HUBB )

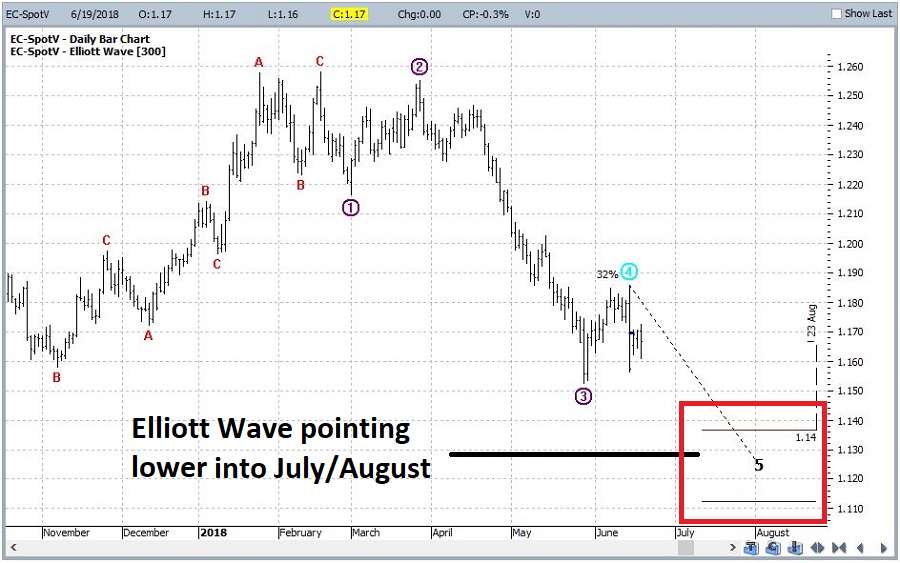

Figure 3 goes back to a daily chart and shows the latest Elliott Wave count generated from ProfitSource by HUBB. It is presently projecting another leg lower into July or August.

Figure 3 – Daily Euro with Elliott Wave (Courtesy ProfitSource by HUBB )

Finally, Figure 4 shows the annual seasonal trend for the euro from one of my favorite websites, www.sentimentrader.com . As you can see in Figure 4, the projected low in Figure 4 coincides pretty closely with the start of a strong second half seasonal upward bias.

Figure 4 – Euro Annual Seasonality (Courtesy www.sentimentrader.com)

So is now a great time to jump in? Perhaps not. But here is my off-the-cuff thinking: If the euro looks really lousy in late July into August it might present an excellent buying opportunity for ticker FXE.

Next: Ticker SOYB (Soybeans)

Disclaimer: The data presented herein were obtained from various third-party sources. While I believe the data to be reliable, no representation is made as to, and no responsibility, warranty or liability is accepted for the accuracy or completeness of such information. The information, opinions and ideas expressed herein are for informational and educational purposes only and do not constitute and should not be construed as investment advice, an advertisement or offering of investment advisory services, or an offer to sell or a solicitation to buy any security.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.