Which Assets Will Benefit From QE?

Tiho Brkan | Oct 22, 2012 01:15AM ET

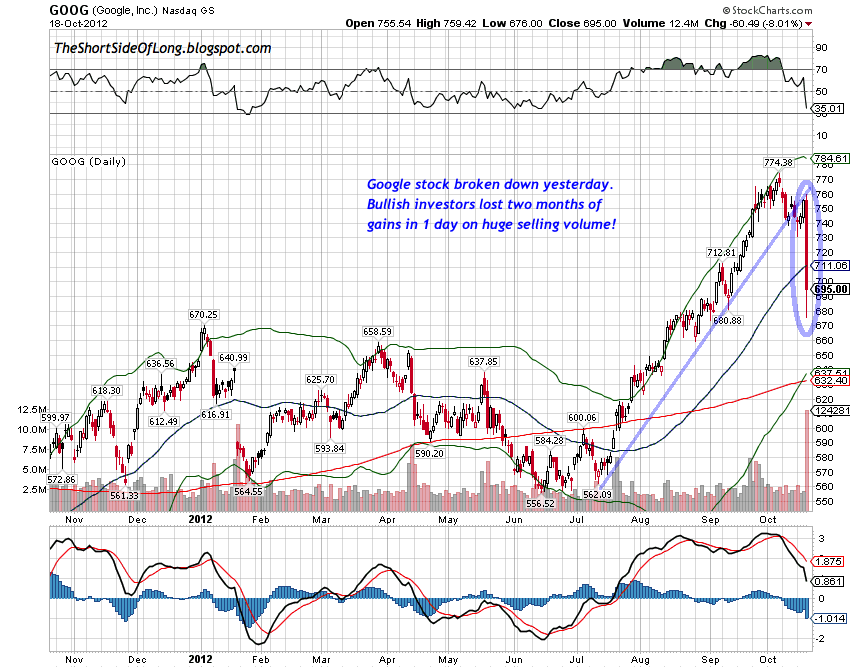

Equity market internals continue to deteriorate, especially in the Technology sector, which transitionally has had leading characteristics. Thursday night we saw that Google (GOOG) broke down due to disappointment in revenues and earnings. Other major components that have been struggling as of late include all the big names like Apple (APPL), Microsoft (MSFT), IBM (IBM), Intel (INTC), Amazon (AMZN), Advanced Micro (AMD), HP (HPQ), Dell (DELL) and many others. Percentage of stocks within the Nasdaq 100 index that are above 50 MA stand at 42%, while those above 200 MA stand at 52%. bubble-like record fund inflows into Junk Bond market, a very dangerous signal.

- Long Positioning: Long focus is towards the secular commodity bull market, with positions in Precious Metals (weighted heavily towards Silver) and Agriculture. A small individual position in Sugar was recently added. Call options are held on Japanese Yen (long dated OTM).

- Short Positioning: Short focus is towards the secular equity bear market, with positions in Dow Transports, Technology, Discretionary, Industrials and Junk Bonds. Put options are held on Apple, Amazon and recently Salesforce (long dated OTM). Put options are held on Pound and Loonie (long dated OTM).

- Watch-list: A major short in due time will be US Treasury long bonds, as they are extremely overbought and in the midst of a huge bubble. While Grains have exploded, Softs present amazing value for investors. Japanese equities are down about 80% from their all time high over two decades ago and offer great value.

Disclosure: I've purchased long dated OTM calls on the Yen.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.