When Euphoria Ends, Gold Bulls Enter The Scene

Sunshine Profits | May 14, 2021 03:55PM ET

Market participants are very optimistic about an economic recovery, but these positive expectations may be exaggerated. The end of this euphoria should be good for gold.

The optimism about the pace of economic recovery from the 2020 the April 2021 edition of the World Economic Outlook – expects at the moment that the U.S. economic output will increase by 6.4% this year, compared to the 5.1% growth forecasted in January.

The euphoric mood has some justification, of course. The vaccination is progressing, entrepreneurs are used to operating under sanitary restrictions, economies are reopening and governments are spending like crazy. At the same time, central banks are maintaining ultra-easy monetary policy , keeping financial conditions loose.

Furthermore, some economic data is consistent with strong rebounding, especially in manufacturing. For instance, the IHS Markit US Services PMI Index registered 60.4 in March, up from 59.8 in February. It’s the fastest rate of growth since July 2014.

Now, the question is how strong the current boom is and how long it is going to last. Well, there is no need to argue that we will see a few strong quarters of GDP growth in the U.S. and other countries. But for me, the euphoria is exaggerated. You see, the current recovery is not surprising at all. As the economic crisis , the Great Unlocking is boosting the global economy.

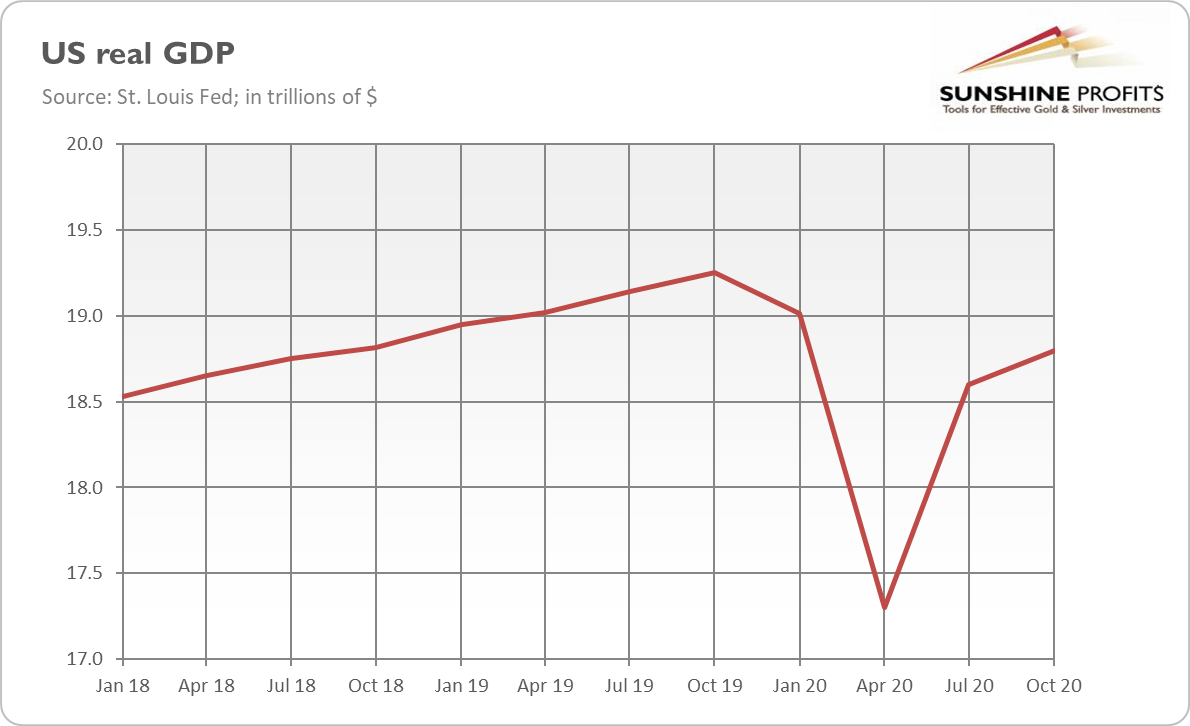

And there is the base effect. There was a low base in 2020, so the seemingly impressive recovery in 2020 is partially merely a statistical phenomenon. Let’s illustrate this effect. In Q2 2020, the real GDP plunged from $19,020 trillion to $17,302 trillion or 9.03% year-over-year, as the chart below shows.

However, the rebound to the pre-recession level would imply the jump of 9.93%, almost one percentage higher! This is how the math works: when you divide a numerator by a smaller denominator, you get a greater percentage. So, it would be alarming if the recovery were not strong after one of the deepest crises in history.

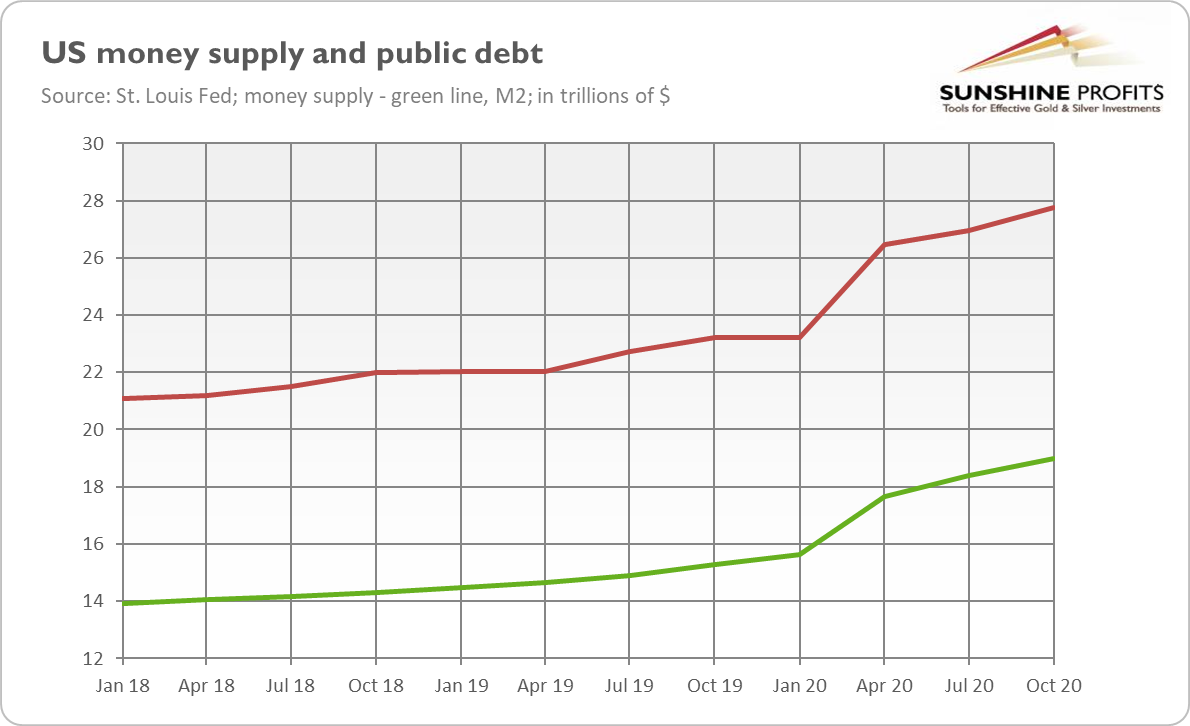

Another issue that makes me more skeptical than most pundits is the fact that the main reason behind economic growth upgrades is massive fiscal stimulus. Uncle Sam injected more than 13% of the GDP in government spending (only in 2020) that ballooned the public debt (see the chart below).

And my three last concerns. First, the job recovery is more sluggish than the GDP recovery. The unemployment rate is still above the pre-pandemic level, while the labor force participation stands significantly below the level seen in February 2020. Second, a full return to normal life will occur if vaccines remain effective. But there is a epidemic left us with deepening inequalities and rising living costs.

What does it all mean for the gold market? Well, the market euphoria about the economic rebound is negative for gold. We have already seen how these optimistic expectations freed the risk appetite and boosted economic confidence, sending bond yields higher, but gold prices lower.

However, just as the doomsday scenarios created in the midst of the epidemic were excessively negative, the current ones seem to be too optimistic. I expect that with the year progressing, these expectations will soften or shift to the medium-term, which could be more challenging. After all, the low base effect will disappear, and both the monetary and financial crisis . After all, the current levels of stock indices are partially caused not by fundamentals, but by the elevating risk tolerance thanks to the central banks standing behind most asset classes ready to intervene in case of problems.

It seems that this process has already begun and the reopening trade is waning. Economic confidence is very high, so the room for further increases is limited. The low-hanging fruits have been collected, and when economies reopen fully, the structural problems will become more important than the cyclical ones. Investors have started to worry about higher inflation, especially because the Fed remains unmoved by rising prices. A jobless recovery would prolong the greenback , creating some downward pressure on the yellow metal.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.