When An Index Becomes A Security

Vance Harwood | Jul 24, 2013 04:39PM ET

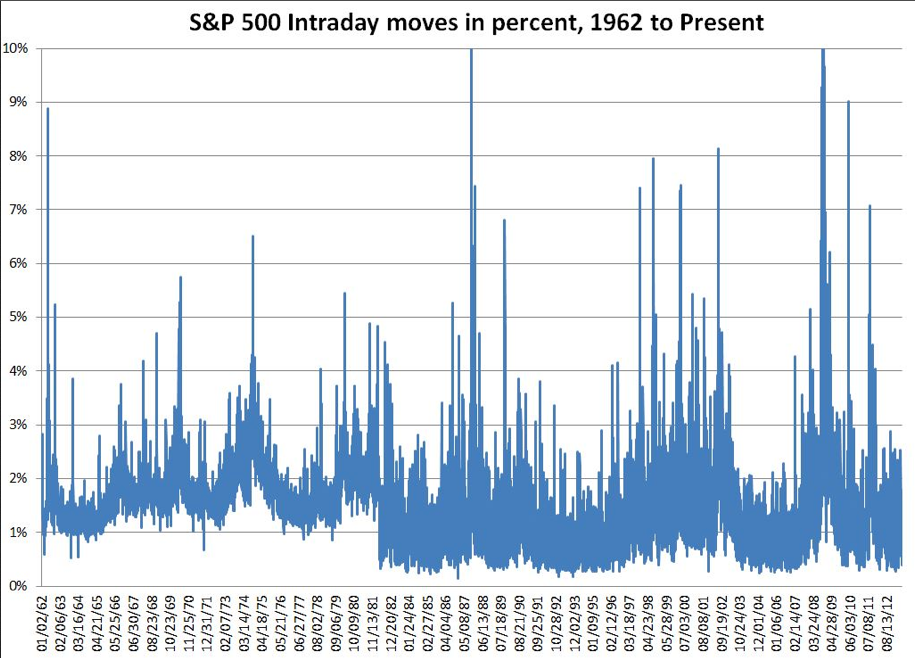

Recently I have been analyzing long-term volatility trends using daily results from the S&P 500 index. One of the things I calculated was the high-low daily range expressed in percentage.

The chart looks like this:

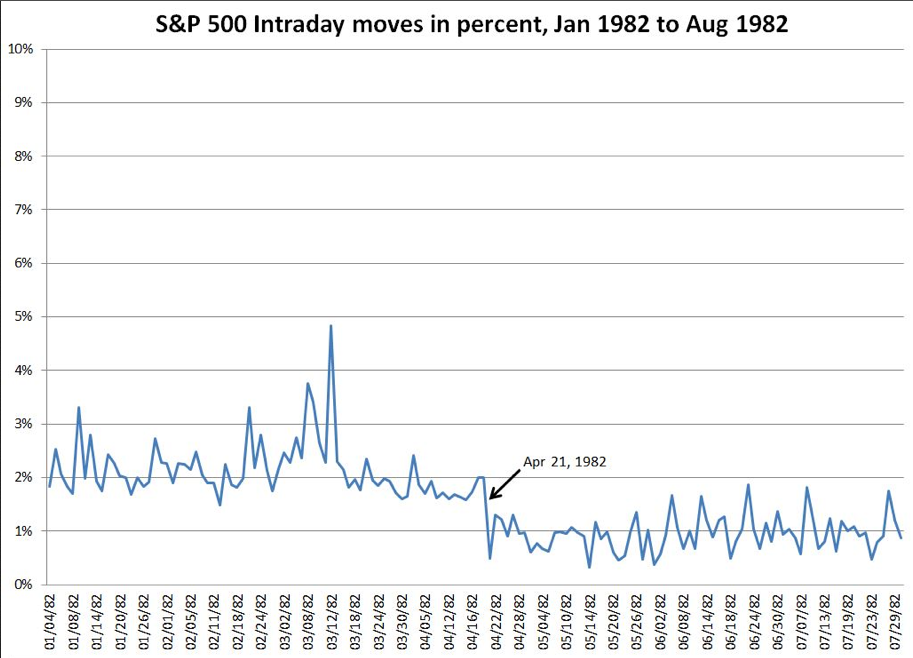

What caught my eye was the drop in the lower bound in 1982. Before 1982, the daily range rarely dropped below 1% and then it dropped instantaneously to around 0.3%. The upper bound did not seem to be significantly affected. I zoomed in on the first half of 1982.

The shift happened on April 21, 1982. That date didn’t ring any bells for me, so I did a Google search and found this.

This was the day S&P 500 Futures started trading. I don’t think the change in the intraday range was a coincidence. The S&P 500 index went from being a metric to an investible security, and the behavior of the entire market was impacted. This change was almost certainly driven by arbitrage. With futures it’s straightforward to capture any signficant differences between what a future is trading at and the value of the underlying stocks (see this post for more info). Arbitrage tends to keep the futures price aligned to the index, but since the underlying stocks are being bought/sold en-masse as part of the arbitrage operation -- without regard to their individual situation it also increases the correlation between stocks in the index.

Since this beginning in 1982, the rise of the tradable index has changed the face of investing, and is one of the key drivers of the increased volatility of the market.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.