Wheaton Precious Metals: Poised For Higher Silver Prices

Modest Money | Aug 13, 2019 05:01AM ET

Last week, China let its currency, the RMB, drop to the lowest value since 2008. The currency is now trading at just over 7 yuan to the U.S. dollar. This prompted the U.S. Treasury Department to quickly accuse China as a currency manipulator. NPR cautions that this event may lead to “an unusual kind of currency war, one in which the U.S. would intervene to counteract the effects of China’s weakened currency or both countries would even take steps to increase the value of the other’s currency relative to their own.” The advantage of having a cheaper currency is to become more competitive with one’s exports and grow the economy faster. But the problem is that a devalued currency could increase internal inflation within a country, and make it more expensive to buy products and services from other countries.

One way investors can protect themselves against the effects of higher inflation is by acquiring and holding hard assets. Traditionally real estate and commodities have been favored in times of high inflation. Gold and silver are among the most common types of hard commodities pursued by people who want to hedge against inflation. But how do you decide which metal is the better one to buy?

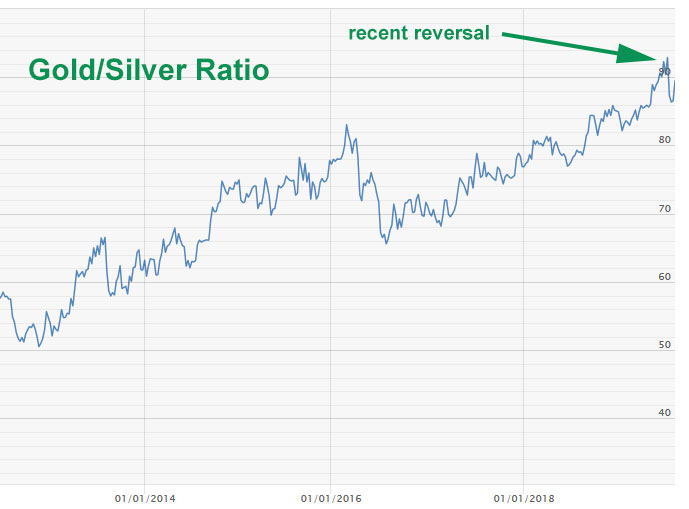

One way to determine whether gold or silver is undervalued is by looking at the gold to silver ratio. The premise is that there is a certain amount of gold and silver in the world that hasn’t really changed over the course of humanity. So if gold and silver are both mined with their rarity in mind, then the ratio of usable gold and silver in the world should stay relatively consistent. This means if the gold to silver ratio becomes too high relative to the historical average, then silver must be undervalued relative to gold. This is the current state of the markets. Over the past 20 years or so the average ratio had been about 60. This meant for every 1 ounce of gold, investors can trade it in for 60 ounces of silver. But in more recent years gold has been outperforming silver so that the ratio had risen to over 90. But as the graph below indicates, the ratio appears to have reached a peak last month. This may represent a reflection point, which is a positive sign for silver going forward.

One way to invest in Silver is to buy stocks in silver streaming companies. These businesses typically have contracts with existing mining companies to buy their silver at a fixed cost, and resell it for a profit in the open market. One of the largest silver streaming company is Wheaton Precious Metals Corp (NYSE:WPM). Wheaton originally only streamed silver, but over the last couple of years, it has also been streaming gold. Wheaton’s revenue is roughly evenly split between silver and gold sales. It currently has entered into 23 agreements with 17 operating partners, including vale, Newmont Goldcorp and Glencore (LON:GLEN). About 70% of silver production comes as a by-product from base metal and gold mines. This characteristic, along with the Company’s bullish sentiment for long-term silver prices, was the basis for creating Vancouver-based Silver Wheaton in 2004.

Last week the company released it’s 2nd quarter financials for 2019. The report says Wheaton “generated over $100 million in operating cash flow and had attributable gold production of over 100,000 ounces. Through the first half of 2019, Wheaton is on track for record annual gold production and reconfirms 2019 gold equivalent production guidance.” Gerard Ferguson CEO & Portfolio Manager at Jemekk Capital Management is bullish on WPM. He thinks the company is “diversifed by geography and assets. They’ve settled their CRA problems well. A low-risk play on precious metals that trades at a discount to its peers.” Ferguson has a price target that is 7% higher than the stock’s price today. If the price of gold or silver continue to rise as they have this year so far, then companies like WPM will surely have a great return in 2019.

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.