You do not need a Ph.D. in economics to understand that stocks could possibly run into some problems with the Fed trying to step back while the global growth story is still a little shaky. From Voice of America :

The International Monetary Fund says the global economy is improving following the world’s 2008 downturn, but that it is “much too weak for comfort.” She said the world’s economic fortunes will only advance modestly if key global leaders fail to embrace policies to further job growth and better living standards across the globe. “We could very well be facing years of slow and subpar growth. Some have called it the new normal.”

Indecisiveness Means Higher Risk

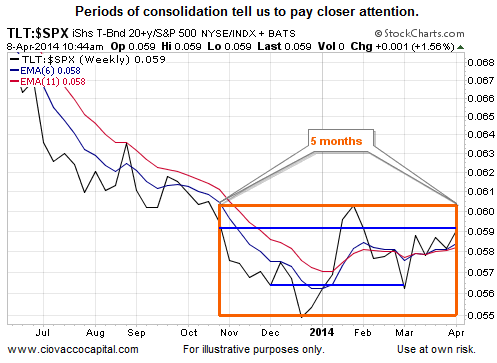

As we have noted many times in the past, when the aggregate opinion about future economic outcomes is positive, stocks tends to perform better than bonds. Conversely, when the aggregate opinion shifts into the “we are concerned” camp, bonds tend to outperform stocks. When investors lack conviction, there tends to be no clear winner between fixed-income and equities. The chart below shows the battle between bonds and stocks has produced no clear winner over the past five months. Before we move to some historical examples of indecisiveness or periods of consolidation, notice the horizontal or sideways look of the chart below.

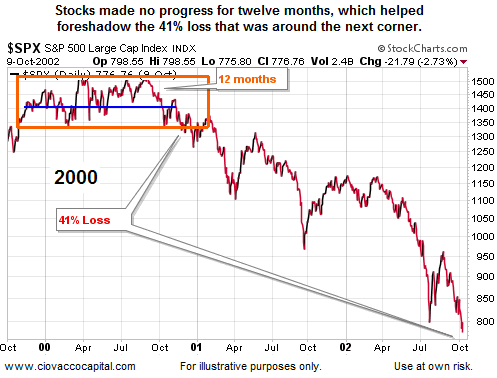

Typically, the longer the period of economic indecisiveness the bigger the move in equities once the logjam is broken. For example, as investors began to realize the expression stocks always go up was a fallacy, the S&P 500 reflected waning bullish momentum by moving sideways for twelve months. Once the period of consolidation resolved itself to the downside, stocks dropped 41% over the next two years.

As shown in the chart below, the present day S&P 500 has made little-to-no progress over the past few months. Waning bullish conviction can be attributed to many factors, including a reduction in QE, relatively tepid job growth, tension between Russia and Ukraine, slowing growth in China, and persistent low inflation in Europe.

Can periods of investor indecisiveness be resolved in a bullish manner? Sure, one example is the 18% gain in stocks that followed a nineteen month sideways market in 1986.

The Key To Catching The Market’s Next Big Move

The takeaway from the historical consolidation examples shown above is investors and traders that remained disciplined during periods of consolidation and frustration were rewarded with an opportunity to profit. The key to success in low conviction environments, as outlined in this week’s stock market video below, is discipline.

Small Caps Valuations Stretched

All things being equal when investors are confident about future earnings, they tend to prefer smaller companies that may be able to deliver superior growth relative to more established blue chips. Another factor is valuations, which may be causing investors to pause before adding funds to the small cap arena. From The Wall Street Journal :

There are lots of ways to determine if a stock is overpriced. For small caps, Doug Ramsey, chief investment officer at investment-research and asset-management firm Leuthold Group, likes to look at the stock price divided by an average of five years of earnings, which he says historically has been the most useful in picking times to buy and sell. By that method, the median small-company stock has a price/earnings ratio of 28.4, well above the historic median of 21.4, according to Leuthold.

The recent relative performance of small caps aligns with the theory that economic fear is gaining some traction relative to economic confidence.

Defensive Staples Trying To Make Turn

The consumer staples ETF (ARCA:XLP) is at the other end of the investment spectrum relative to small caps. Top holdings in XLP include Procter & Gamble Company (NYSE:PG), Coca-Cola Company (NYSE:KO) and Wal-Mart Stores Inc. (NYSE:WMT). From The Motley Fool :

By definition, staples are items that we tend to buy no matter what the economy is doing. That makes companies making or selling staples attractive, as they add a defensive element to a portfolio, bolstering it in downturns. Consumer staples companies also often offer dividends, in part due to their relatively predictable income streams.

In contrast to the emerging weakness in small caps, defensive-oriented consumer staples have been attracting more interest, which indicates increasing concerns about the health of the economy.

Investment Implications – The Song Remains The Same

The big picture is still constructive for equities from an economic perspective. A recession does not appear to be imminent. However, market corrections can occur during periods of economic expansion. Our market model has called for a reduction in equity exposure, which by default means we have more cash on hand. The four reasons presented above could be edited to five since a Dow Theory non-confirmation remains in force. If the economic bears continue to make progress, the model may call for a migration to a mix of stocks (RSP), cash, and bonds (AGG). Since flexibility is a tenet of investment success, it is important that we keep an open mind about bullish resolutions. If progress is made with Russia or if economic data comes in better than expected, buyers could return to the equity markets. Should the bulls regain traction, our short list of potential cash-redeployment candidates would include iShares MSCI Emerging Markets (ARCA:EEM).