What’s Going On With Gold And The Stock Market?

Doug Eberhardt | Feb 28, 2017 01:14AM ET

Today’s Trades

We played Direxion Daily Junior Gold Miners Bear 3X Shares (NYSE:JDST) from the weekend and bailed at 14.20 from the 13 entry with our remaining 1/2 shares. Went long JDST again for a quick stop out after the 10:00 data on Home Sales came in bad so we stopped out quickly and got long JNUG at 10.60 and called it a scalp only since we were now red on the weekly Friday.

It didn’t want to continue higher after hitting 10.90 and we jumped ship and went long JDST at 14.20 and sold 1/2 at 15.42 for 8.59%, sold remaining shares at 16.02 for a little over 12%. Went long again 16.42 but with a different setup and new stop loss in place. Took 10% from that trade on 1/2 shares and another 7% after getting stopped out on remaining shares. We got long JNUG 1/2 shares after market.

Meanwhile our Direxion Daily Russia Bear 3X Shares (NYSE:RUSS) and Direxion Daily FTSE CHINA Bear 3x Shares (NYSE:YANG) are up again, small loss in Direxion Daily Brazil Bull 3X Shares (NYSE:BRZU) going against the trend. Very small loss in VelocityShares 3x Inverse Natural Gas linked to S&P GSCI Natural Gas Excess Return (NYSE:DGAZ) and ProShares Ultra VIX Short-Term Futures (NYSE:UVXY) (always put a warning out on UVXY). iShares 20+ Year Treasury Bond (NASDAQ:TLT) is down but we are still up from entry. Missed the fun in Direxion Daily S&P Biotech Bull 3X Shares (NYSE:LABU). Got a point from ProShares Short VIX Short-Term Futures (NYSE:SVXY).

Economic Data for Tuesday

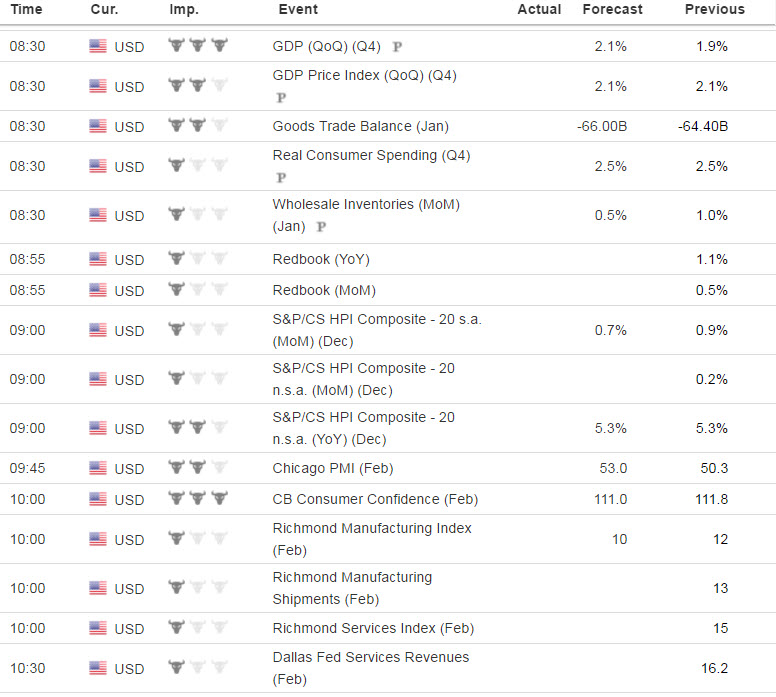

Lots of market moving data on Tuesday and 3 Fed members speaking. GDP somehow surprises to the positive and you’ll see the market take off higher. We’ll know before the open which if it is positive or negative will effect the entries on the long the market ETFs. Consumer Confidence on Tuesday too. I would be hard pressed going long a market that has another GDP disappointment, so we’ll keep an eye on our entries and stops.

Stock Market

Had terrible data with Core Durable Goods Orders and Pending Home Sales and market goes up. The Trump effect is in full force as witnessed by new green weekly’s again in some of the long the market ETFs.

Foreign Markets

Entered Direxion Daily Emerging Markets Bear 3X Shares (NYSE:EDZ) although EDZ and YANG are not green on the weekly yet. RUSS doing just fine. We will look at taking some profit when we hit the levels outlined in the Trading Rules. I thought we might get more out of Direxion Daily Brazil Bull 3X Shares (NYSE:BRZU) after 2 days in the Cold Corner section, but it couldn’t get going after the initial pop.

Interest Rates

TLT is still waiting for the market to turn down for a run. Up and down and up and down in a range. Buying the dips has worked well with it.

Energy

VelocityShares 3x Inverse Natural Gas linked to S&P GSCI Natural Gas Excess Return (NYSE:DGAZ) also thought we could get more after 2 days in the Cold Corner but it moved up too much overnight to make any good profit off of it.

Precious Metals and Mining Stocks

Monday was crazyville in the miners and we enjoyed almost every minute of it. Direxion Daily Junior Gold Miners Bull 3X Shares (NYSE:JNUG) is getting ready for a run but we’ll let it prove it some for us first. We don’t have to catch the exact bottom to make good profit. But I challenge anyone to have called the JNUG and JDST trades better the last month or so. Hopefully you are making all the right moves, taking profit and keeping stops and possessing the willingness to change your mind no matter how bad some say everything is.

Hot Corner (the biggest movers – 3% or more – or new ETFs that are green on the weekly – those in bold are consecutive days in the Hot Corner):

JDST, DUST, LABU, DGAZ, BIB (SPXL, BIB, LABU, SVXY, DUST, JDST all turned green on the weekly today).

Cold Corner (the biggest moved lower 3% or more that are green on the weekly and or weekly/monthly or turned red on the weekly – those in bold are consecutive days in the Cold Corner):

JNUG, NUGT, LABD, UGAZ, GDXJ, BIS, VanEck Vectors Gold Miners (NYSE:GDX)

I added the following to the Trading Rules today.

With the addition of the analysis I had a 3rd party accumulate for the trades since the beginning of the ETF Trading Service again in August, I personally am seeing things more clearer with the addition of the table in the nightly report that tracks green weekly’s. The problem is, we haven’t had any new ones of late. RUSS was/is and it has been a good move. UWT though was not. But with the addition of the two new rules I have seen the potential for profiting is still there. And I have to say the benefit to you is there.

The biggest complaint that traders have with the service is; “I don’t have time to follow all the emails.” That’s understood. But what you will see with this new table is when an ETF first turns green on the weekly, you can buy it the next market day open and 1. use a stop if for any reason it doesn’t continue to move higher right away (stops are listed in the nightly report) 2. take profit where the nightly report says to on 1/2 shares – which means you can calculate those percentages and put in a sell limit order immediately and go about your day. 3. if for any reason it went down and you got stopped out, the next day it more than likely will go back up again and if it opens green/up for the day, buy it. 4. Take profit on 1/2 shares or more shares no matter what when up 10% on some of these. 5. Be willing to buy the 1/2 shares back again on a day when the ETF is up for the day (green/positive), or breaking to a new high or when it turns green on the monthly. 6. Take profit on half shares on any ETF that spikes up quickly. Those are gifts. 7. Don’t just trade one ETF one way. At times you can buy the opposite ETF as a hedge because of news of the day or price action. These ETFs don’t go straight up. 8. Enjoy your trading and get used to taking profit. We don’t hold these ETFs until they turn red.

Notice that Feb. 8th on the report had the mining ETFs at their highs and your stop loss would have triggered much higher than where they ended up by the time they went red.That may be a lot to soak in, but the more I fine tune this Service, the more you can profit from it. If you can’t trade the day in and day out stuff, then don’t do it. Trade the table and BE PATIENT for a green weekly ETF. The weekly green ETF’s will give you the best chance at profit when they first hit.The day trades are the most risky. If you are new to the service and just start trading my calls for day trades, they have more risk associated with them. One or two days a week we’ll catch some good streaks. But other times in choppy markets it’s more difficult.

Lastly, if you haven’t set up a separate email for these alerts, and they clutter up your email box, you are not doing yourself a favor. You need to read the Trading Rules and set up a separate email just for these ETFs with a gmail account. Don’t let trading interfere with your personal life. Don’t let trading overwhelm you. Use the alerts to your cell or desktop for the day trades or if you want to swing trade, be patient for the green weekly ETFs, keep stops and take profits.Hope that helps you profit.

Green Weekly’s

It’s difficult for me to add green weekly’s that are long the market on a day when we had terrible data. Everyone knows this market is built on fluff, but my job is to let the market tell us what to do and follow it. The Green Weekly’s are buys at the open tomorrow except for JDST which we already scalped 10% on 1/2 shares per the rules and with a 5% trailing stop from the high sold the remaining 1/2 shares for a 7% gain.

As you know, we had our favorite JNUG and the others turn red on the weekly and had already locked in our longs and jumped on JDST early. Today we got the icing on the cake with it hitting a big move up with some programmed selling and we hit our 10% goal almost twice today with our combined JDST trades.

Disclosure: Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with capital you can’t afford to lose. This is neither a solicitation nor an offer to Purchase/Sell futures or options. No representation is being made that any account will or is likely to achieve gains or losses similar to those discussed in this outlook. The past track record of any trading system or methodology is not necessarily indicative of future results.

All trades, patterns, charts, systems, etc. discussed in this outlook and the product materials are for illustrative purposes only and not to be construed as specific advisory recommendations. All ideas and material presented are entirely those of the author.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.