Gold Volatility May Not Be Over Yet

Investing.com | Aug 28, 2020 04:34AM ET

On the eve of Jay Powell’s ground-breaking speech on the new inflation direction for America, I wrote that the gold market was giving few clues on how it was likely to respond to the Fed Chair’s address.

I said so because of a concern that was palpable to me. It was the early hours of Wednesday’s Asian trading and the spot price of gold was persistently down about $10 to $15 per ounce. It was wilting under the strength of the dollar, which had suddenly been transformed from a pariah that almost no one wanted to touch a month ago to a prince charming of an asset.

A $10-$15 slide in gold is, of course, small potatoes in the grand scheme of things. But that the yellow metal was still sliding and not rallying with just over 24 hours left to an event clearly flagged to be gold-bullish, told me that the biggest banks, hedge funds and trading houses might have other plans.

Despite that early weakness, Wednesday produced the biggest daily rally in gold in a week, allowing the spot price to settle above $1,950 the first time since Aug 18. The scene looked set for a re-test of $1,980 on Thursday, which if successful, could usher gold back into the celebrated $2,000 and above highs.

As it turned out, spot gold never quite got to the $1,980 point on Thursday, being stopped at $1,976.60. The benchmark's futures contract on Comex, did set a best of $1,987. From there though, it all was the way down, back to the $1930s for both the spot and futures contracts.

Second Booby Trap In A Fortnight For Gold Longs

Effectively, it was the second booby trap set in a fortnight for gold longs. And, once again, it involved the Fed (the first was from Aug. 11 when the Central Bank’s July minutes telegraphing a well-intended reason for rejecting yield curve controls became a ludicrous trigger for buying the dollar and booting gold).

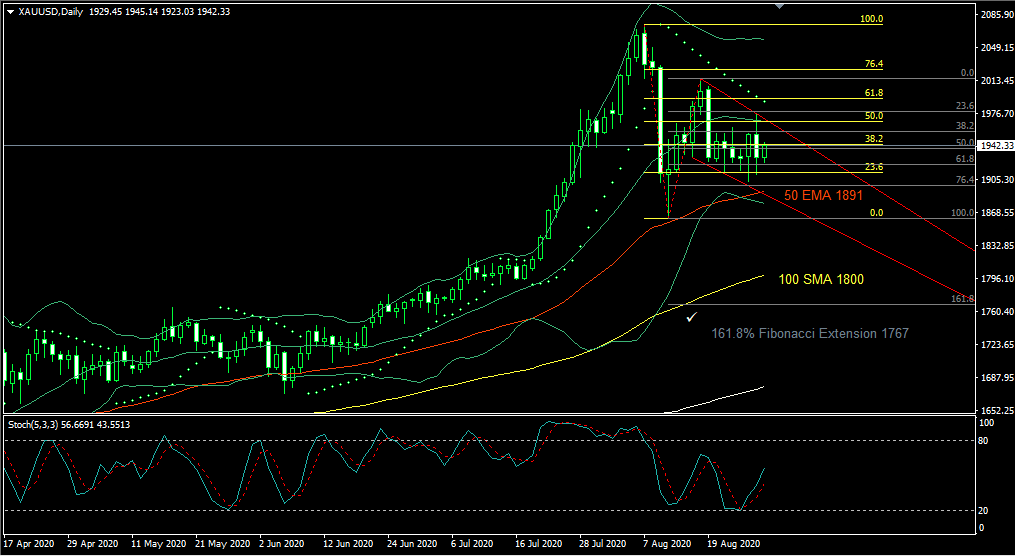

Charts courtesy: Sunil Kumar Dixit

Looking back to Wednesday, I realize I wasn’t wrong that the gold market had exhibited few clues in its final hours ahead of Powell’s speech—that it would respond negatively to a landmark change in the Fed’s way of interpreting inflation to better manage the U.S. economy and employment in the future.

The clues were all there in the media and in the reams of research issued by the banks and major trading houses that had flogged to death over the past week the “news” that Powell would announce an average inflation target. With virtually no element of surprise left in his speech, the Fed chair stuck to the script that had been in print for days.

If anything, he left out the one thing that these traders wanted to hear more of—an unambiguous Fed promise to buy more assets. I don’t blame Powell for refusing to serve more opioids to stimulus-hungry junkies; this was a speech on a new policy framework, not his monthly news conference on rates.

Classic Buy-The-Rumour, Sell-The-Fact

Where gold was concerned, what ensued was a classic buy-the-rumour and sell-the-fact. Oh, the S&P 500 got a free record high by the way, as stocks suddenly looked “red hot” with the Fed intending to leave rates at near-zero for the next few years.

So, it really amuses me to see the financial community trying to explain away Thursday’s market madness to investors’ wisdom in seeing how Treasury yields and the dollar will benefit from the Fed’s new targets, conveniently leaving out real assets like gold from the process. It’s even more laughable to see their justification for the Dollar Index's loss of its crucial 93-handle in Friday’s Asian trading amid a run-up in gold—yes, real assets are in vogue again!

Jeffrey Halley, one of the best market cynics out there, perhaps phrased it best. The senior market analyst for OANDA in Asia Pacific said the Fed’s average inflation target was basically “an admission that recovery is not going to be the nirvana-like V-shape so often postulated by the gnomes of the stock market." He added:

"I expect the word ‘inflation’ to be twisted by the FOMO gnomes of the stock market into another bullish signal. Inflation means company earnings rise, yes? Buy Mortimer, buy.”

FOMO or Fear Of Missing Out, is what prompts investors to load up on risk across multiple markets to profit from anywhere possible.

Halley’s New York-based colleague at OANDA, Ed Moya, also had an interesting observation about how the Fed was evolving into a Bank of Japan by becoming unbelievably “patient” with rate hikes. He said:

“With the adoption of allowing inflation to overshoot their target, the Fed is slowly becoming the BOJ,”

So, what’s in store for gold in this new era of near-zero for longer rates and traders’ manipulation of the Fed’s objectives for their ends?

An ‘Anything Goes’ Outlook

Basically, it’s an ‘anything goes’ outlook. In the immediate term, my view is that we are not done with the downside correction yet— something which independent technical analyst Sunil Kumar Dixit agrees with. He said:

“For gold, rejection at $1967 to 1970 may attract a further sell-off, pushing the metal toward $1,930-$1,915-$1,898 & $1,862. But bear in mind that there will be many buying opportunities on support areas every time the metal is pushed down and it will pop its head higher. They can keep on pushing it down the hill till the higher low is established on the longer time frame, that will mark the reversal.”

That did not mean gold’s nemesis, the dollar, was safe either. He added:

“Any upside move in the Dollar Index may attempt a retest of Thursday’s high of 93.35, beyond which rests 93.48, but the red line is 93.80. I expect the DX to break Thursday’s low of 92.35 at some point, reaching further down to the previous low of 92.11, and take momentary support at 91.85.”

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.