What You Need To Know About Rising Rate Equity ETFs

David Fabian | Aug 09, 2017 12:59AM ET

The concept of rising interest rates is one that investors have been worried about for many years. While we have yet to experience an extended period of rising Treasury bond yields in the last several decades, that hasn’t tampered fears of how such an event would unfold and to what magnitude.

Interest rates, like stocks or commodities, go through cycles of rising and falling trends that can have a pronounced impact on your portfolio returns. Fixed-income assets experience the highest level of inverse correlation with interest rates. However, there is also an undeniable impact on certain stock market sectors as well.

Issuers of exchange-traded funds have noted this connection and are recently debuting several diversified equity portfolios designed to outperform in a rising rate environment. Essentially, the fund companies are confident the stocks they have identified as having a low correlation with interest rate fluctuations will outperform if we experience a significant reversal of the interest rate situation in the United States.

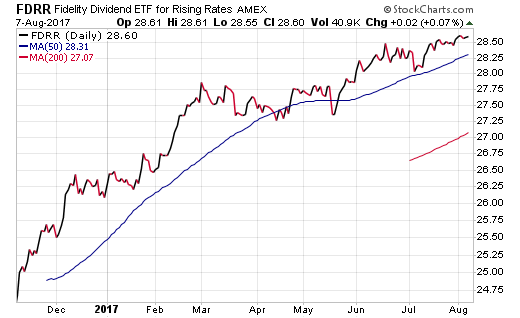

One of the first funds to be released in this innovative category is the Fidelity Dividend for Rising Rates (NYSE:FDRR). This ETF is on the cusp of celebrating its one-year anniversary and has amassed a healthy $152 million in assets over its relatively short tenure.

FDRR is based on an enhanced index designed to own primarily large and mid-cap U.S. dividend paying stocks. The stocks selected for the portfolio must also demonstrate a positive correlation of returns to U.S. 10-Year Treasury yields. The result of this selection criteria puts the portfolio in the “large-cap value” segment among its peer group.

At the sector level, FDRR is highly concentrated in technology, financial, and health care companies. Its top holdings include Apple Inc (NASDAQ:AAPL), Microsoft Corp (NASDAQ:MSFT), and Johnson & Johnson (NYSE:JNJ). The fund currently yields 3.10% and charges a reasonable expense ratio of 0.29%.

The real secret sauce of a fund like FDRR isn’t necessarily its top holdings, which you could find in any number of other large-cap ETFs. It’s really the minimization of certain highly interest rate sensitive sectors of the economy. The portfolio has a very small footprint in telecommunication, utility, and real estate stocks that are common throughout many dividend indexes.

Another recently released ETF in this group and a direct competitor to FDRR is the ProShares Equities For Rising Rates ETF (EQRR ). This fund doesn’t specifically target dividend stocks, but rather seeks out sectors with a high correlation to U.S. Treasury yields and individual stocks with a history of outperforming as rates rise.

The portfolio construction methodology of EQRR allows for greater concentration at the sector level as evidenced by its 30% allocation to financial stocks. That is followed up by 25% in energy and 17% in materials that make up the 50-stock portfolio in its present day form. The index is also reconstituted and rebalanced on a quarterly basis to ensure the holdings are maintaining the attributes necessary for inclusion. EQRR has a dividend yield of 2.62% and sports an expense ratio of 0.35%.

The implementation of either fund within the context of an ETF portfolio will likely be along the lines of a complimentary or tactical position to augment more diversified core equity holdings. The narrower concentration of stocks, alongside the stacking of sector weightings towards a few key areas, will likely lead to periods of varying performance versus a traditional market cap weighted benchmark.

Investors who consider these options should also note that they will likely change over time as individual stock correlations and market trends exert themselves on the underlying holdings.

It’s also worth noting that there is no explicit guarantee these stocks will outperform in a rising rate environment. Every situation will be unique and may not perfectly align with prior periods of correlative price action.

The Bottom Line

While the thesis for both ETFs is sound and the portfolios quite intuitive, we won’t know exactly how they will stack up with respect to performance until we experience a true rising rate environment. Only time will tell how strong these funds prove to be and whether they minimize price volatility or inherently gain momentum.

The views and opinions expressed herein are the views and opinions of the author and do not necessarily reflect those of Nasdaq, Inc.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.