What You Don’t Know About Relative Strength Shifts In ETFs Can Hurt You

Pacific Park Financial Inc. | May 02, 2014 03:01AM ET

One of the best web sites for identifying trends in the ETF marketplace is ETFscreen.com. And one of the best features at the data aggregation portal is the Relative Strength Factor (RSf) reporting.

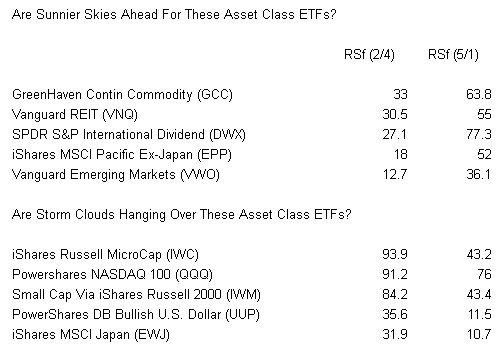

According to ETF Screen, the Relative Strength Factor (RSf) represents a percentile ranking of fund performance relative to all other funds in the universe. While it is measured over an entire year, the factor heavily weights recent performance to identify funds that have been accelerating versus those that have been deteriorating. The higher the percentile rank (0-99.99), the greater the relative strength.

One method to visualize meaningful changes over time is to see the data on a quarter-over-quarter basis. For example, iShares Biotechnology (NASDAQ:IBB) registered a RSf rank of 98.9 at the beginning of February. At the start of May, though, the seemingly unstoppable biotech bellwether slipped to a modest 67.1. Conversely, Market Vectors Small Cap India (SCIF.K) had been woefully unappreciated back on 2/4/14 when it logged in at 23.4. Three months later, SCIF resides in the top decile (98.3) of the exchange-traded fund universe.

These individual stories may meet a criterion for “nice-to-know info.” However, when it comes to chin-rubbing fascination, one usually needs to see shifts in major asset classes.

In spite of the S&P 500 grinding a path to near all-time records, U.S. equities with high price-to-earnings ratios have been losing status. Both NASDAQ-oriented large-cap growth as well as Russel 2000 small-cap growth have been fading; micro-caps too. The fact that these asset groupings are slipping, alongside high-profile sectors like financials and “new technology” (e.g., networking, social media, Internet, etc.), is eerily reminiscent of previous bear market inceptions. (On a philosophical note, how did investors once again find themselves paying the largest premiums for shares of the poorest earnings prospects and/or the least financially stable?)

Rather than ring a bearish bell, it is more useful to address the authenticity of renewed interest in foreign assets. Foreign developed equities from Europe to Asia-Pacific (excluding Japan) have picked up speed. Even emerging markets are demonstrating marked improvement. This has been true in spite of the manufacturing contraction occurring in Japan; it has been happening in spite of an economic slowdown in China and a Russia-Ukraine turf battle. Indeed, it appears probable that confidence is rising with respect to the price-to-sales (P/S) and price-to-earnings (P/S) on overseas equities – something that is far more difficult to justify stateside.

The RSf data has anecdotal backing as well. An industry consulting firm that regularly surveys endowment and foundation money managers found that they are even more bullish about alternative and foreign investments than U.S. securities. Think hard assets, like those that GreenHaven Continuous Commodity (GCC) purports to represent. Think emerging markets as well. Endowment and foundation money say emerging market stocks should finish 2014 as one of the strongest asset classes.

Vanguard FTSE All-World (VEU) is one of the least expensive vehicles for gaining access to foreign equities. Granted, developed countries in Europe and the Pacific represent the bulk of the portfolio. Nevertheless, one can get his/her feet wet in the emerging markets with roughly 20% exposure in this particular basket. At present, VEU is positioned at a new 52-week high and remains well above key moving averages.

Disclosure: Gary Gordon, MS, CFP is the president of Pacific Park Financial, Inc., a Registered Investment Adviser with the SEC. Gary Gordon, Pacific Park Financial, Inc, and/or its clients may hold positions in the ETFs, mutual funds, and/or any investment asset mentioned above. The commentary does not constitute individualized investment advice. The opinions offered herein are not personalized recommendations to buy, sell or hold securities. At times, issuers of exchange-traded products compensate Pacific Park Financial, Inc. or its subsidiaries for advertising at the ETF Expert web site. ETF Expert content is created independently of any advertising relationships.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.