What To Expect From ECB And BoE

Kathy Lien | Aug 01, 2012 08:24PM ET

Two central banks are scheduled to make monetary policy announcements on Thursday. While one is expected to be a big driver of volatility for the financial markets, the other will most likely be overlooked as a nonevent.

Since last week, investors around the world have been waiting with bated breath for the European Central Bank monetary policy announcement. Comments from ECB President Draghi last Thursday sparked speculation of greater activism by the ECB. These expectations were further fueled by similar comments from German Chancellor Angela Merkel and French President Francois Hollande. However, since last week we have not heard a peep from European policymakers and perhaps they are becoming wary of the level of expectations they have created in the market.

What to Expect from ECB

Interest rates are expected to remain unchanged in the euro zone, which means the most likely decision by European policymakers will be to allow the EFSF/ESM to purchase bonds on the primary and secondary market and to reactive the Securities Market Program, which would help reduce sovereign yields and funding pressure. The ECB would have to show some sign of willingness to support these measures either at the meeting itself or during Draghi’s press conference.

The Germans oppose the idea of giving the rescue fund a banking license and until they concede, it can't become a reality. We know that the German Finance Minister supports the idea of using the EFSF to buy government bonds and the French paper Le Monde claims that coordinated action is being planned by the ECB and European bailout fund to lower borrowing costs by buying Spanish and Italian debt. As a result, the most likely decision by European policymakers will be to allow the EFSF/ESM to purchase bonds on the primary and secondary market and to reactive the Securities Market Program, which would help reduce sovereign yields and funding pressure. Taking the deposit rate to negative levels and introducing a third round of long term refinancing operation (LTRO) are also options, but Europe probably needs another near-death experience for either of these to become reality.

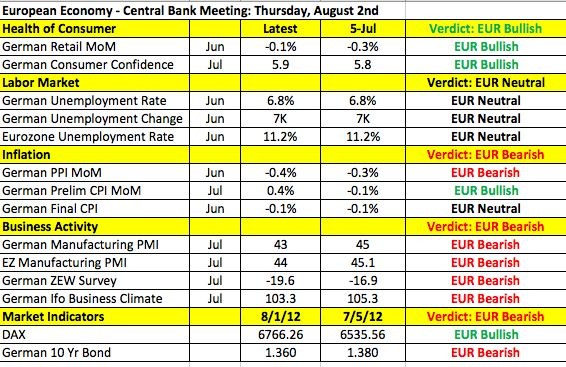

Most of Europe is on hiatus in the month of August and we haven’t received a tremendous amount of European data since the last monetary policy meeting in June. The following table shows how the euro zone and its largest economy (Germany) have performed over the past month. Confidence deteriorated across the region, manufacturing activity continues to contract and retail sales declined for yet another month. The outlook for the euro zone economy is grim and for this reason, the ECB will need to remain in easing mode.

What To Expect From The Bank Of England

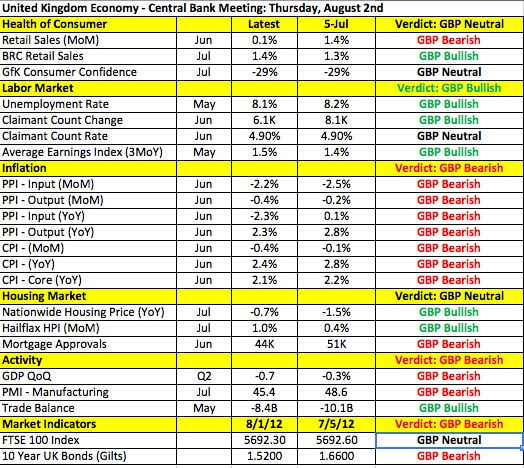

Having just increased asset purchases last month, we are not expecting any action from the Bank of England. As usual, whenever monetary policy is left unchanged, the BoE doesn't release a statement or make further comments. The lack of new information usually makes the BoE meeting a nonevent for the British pound. When that happens, we usually have to wait for the minutes from the meeting, which are released two weeks later. As for the economy, it fell into a deeper recession in the second quarter, consumer demand is weak and manufacturing activity contracted at a faster pace in July. Inflationary pressures remain muted with very little sign of life in the labor market. However, further stimulus from the Bank of England will most likely hinge on developments in the euro zone.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.