What The Economic Data Provides, The FOMC Takes Away

MarketPulse | Feb 02, 2017 12:17AM ET

Last night’s US data dump left more than a few investor’s tongues wagging. ADP exceeded even the most optimistic of estimates while the US ISM data printed robustly across the main categories. On the other hand, the FOMC came off a tad dovish as the Fed continues to describe business investment as being “soft”.

The balance of their view remains mostly unchanged. As expected, the statement was not designed to light a fire under a potential rate hike at the March FOMC meeting, although the overall surging ADP data has added a bit of fuel to the debate. However, I caution reading too much into the ADP data as it does not necessarily correlate to an NFP surprise.

US equity indexes remain relatively unchanged on the day, while US Government Bond yields have firmed and offered some support to a struggling greenback after an up and down session. The US dollar was initially backed by US economic data while the dovish FOMC wiped out the dollar momentum.

On the rates front, the market is currently pricing around 25% of a move in March, 40% by May and approximately 80% by June. However, if we see a strong showing on Friday’s NFP data, it would lead the market to increase its March expectations

Australian Dollar

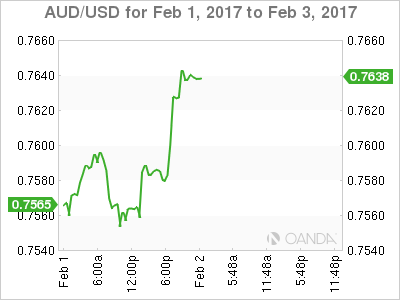

Desperately seeking a trend best describes the Aussie dollars’ fortunes this week. No matter what side of the coin you are on, it's been a tough grind on either flip. Overnight, the bullish US economic data was tempered by a dovish FOMC, and Aussie fortunes shadowed the more general US dollar momentum. But with the greenback unable to exploit on the stronger data, the Aussie should remain firmly bid on dips.

If we were looking for an opening, the soaring December Australia Trade Balance might have provided one, coming in at a record 3.5 billion versus 2.0 billion A$ expected. This print is a pretty big number and very hard to ignore. The desk focus now shifts to the always critical .76.25-35 congested zone.

Keep in mind, as the market continues to debate the course of US FX policy it will take little more than another bully shove from President Trump to send the greenback toppling again.

Japanese Yen

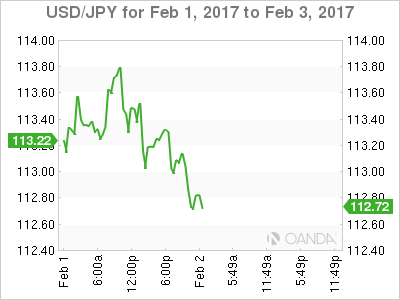

It was a mixed NY session for the greenback which surged to around USDJPY 113.90/95 after the ISM and ADP data but failed to hold onto gains and then slipped on the dovish FOMC. To be honest, the initial move higher was so weak; traders acted out of habit and were quick to sell the dollar back for a small profit.

The Trump Fear Factor has left its footprint all over the USDJPY view. The US administration’s protectionist rhetoric with its real threat of trade conflict is ruinous to the USDJPY upward momentum. The correlation to higher US bond yields is eroding while the markets' acuteness to softer yields accelerates. Very much an asymmetrical risk trading USDJPY off US bond yields in this market. As such, the upside is fraught with peril in this environment

Chinese Yuan

Tension continues to heighten on the US trade front. Investors and corporations are frustrated over the PBoC’s iron-fisted controls over capital outflows, so much so the market is turning into and over a regulated quagmire. If the PBoC continues down this road, they will severely erode investor confidence. How local business seeks to brand globally, given these kerbs on capital outflow is beyond comprehension.

On the currency market front, the CNH continues to trade off broader US moves. The markets remain glued to developments in the US, which are predictably impacting global investor sentiment.

EM Asia

Relative peace on the Ringgit front, likely due to the Lunar New Year as much of the local APAC FX space has been lacking liquidity.

Despite pockets of support, it was difficult to shake my long standing bearish base case scenario. Forget the dovish Fed lean; we have grown to expect that from this sitting of FOMC when geopolitical risk flares. However, we should be focusing on the US economic data which has for the most part been supportive to higher US interest rates and this is where my bearish view lies. With US Bond yields tipped to move higher on the first hint of Fiscal Policy, it is hard to envision the local currencies holding in over the long run.

The KRW has been the star of the region of late as the currency has been able to shift aside the waves of protectionism despair, as cheap valuations on the local equity market continue to attract portfolio inflow. As for proper measures, January’s trade produces stellar export growth +11.2%(YoY), the first double-digit growth since January 2013. The pretty stellar number is hard to ignore as are the cheap equity valuations.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.