What Is Portfolio Margining?

Dr. Alan Ellman | Jan 03, 2015 10:57PM ET

Covered call writing and selling cash-secured puts are conservative strategies for risk-averse retail investors. This is why I feel most of us should be trading in cash accounts (no borrowing) and sheltered accounts whenever possible. For those of us who have higher -risk-tolerance and are experienced investors looking for higher returns, margin accounts may be appropriate.

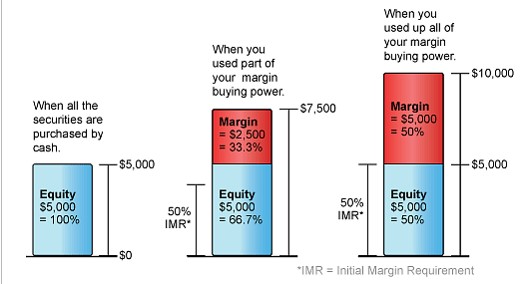

A margin account is a brokerage account where the broker lends money to the investor to purchase stocks or ETFs. The loan is secured by account stocks and cash. The investor may be required to deposit additional cash or sell some shares should the stock price decline. By using borrowing as leverage, gains and losses are magnified. Let’s have a look at margin requirements under traditional and more recent SEC-requirements:

Regulation T or Reg T

This is the Federal Reserve Board’s regulation that governs the amount of credit a broker may extend to its clients for the purchase of stocks or ETFs. According to Reg T we may borrow up to 50% of the purchase price of these securities. This is known as initial margin. The New York and Nasdaq Stock Exchanges also require a minimum margin of $2,000.00 or the full cost of the purchase, whichever is less. A maintenance margin of at least 25% of the total market value of the securities is required at all times, not just when purchased. Many broker-dealers require higher-than-minimum initial and maintenance margins.

Initial margin requirements

Portfolio margining

Under SEC-approved Portfolio Margin rules certain customers can increase the leverage beyond Reg T requirements. The way it works is that highly correlated securities can be offset against each other when calculating margin requirements. For example, if a stock is purchased along with a protective put, Reg T rules would require a deposit of 50% of the value of the stock plus 100% of the purchase price of the put. However, when portfolio margining is used for the calculations, the decrease in overall portfolio risk would also result in a lower margin requirement.

With portfolio margining, margin requirements are accomplished utilizing a risk-based pricing model that calculates the largest possible loss for each position. This model is known as the Theoretical Intermarket Margining System (TIMS). Each night, the Options Clearing Corporation uses this model to distribute TIMS parameter-requirements information to participating brokerage firms. The specific requirement per portfolio will reflect the actual risk of the positions in the account and may be higher or lower than the traditional Reg T requirements.

Who is eligible for portfolio-based margining?

Not every investor is eligible for margining and requirements are broker-based usually requiring a certain minimum amount of cash in the account, a certain net worth and a minimum level of trading experience. Check with your broker for the specifics of your situation.

Goal of portfolio margining

In the end, the margin requirement will be based on the specific risk and trading strategy of our portfolios and will allow us to be margined in a way similar to professional traders. Let me re-emphasize that in my humble opinion, most of us should be trading in cash accounts.

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.