What Is In Store For Steel’s Long-Term Cycle?

MetalMiner | Nov 25, 2015 02:41AM ET

Typically steel buyers look at short-term steel cycles — inventory cycles. These are what drive short-term pricing trends. Lets face it. Most buyers think in terms of what their next purchase will be or, maybe at this time of year, the next year’s requirements.

However, from time-to-time, it’s worth sitting back and looking at the big picture; the long-term; over-the-horizon. It’s a useful thing to do. It provides some perspective.

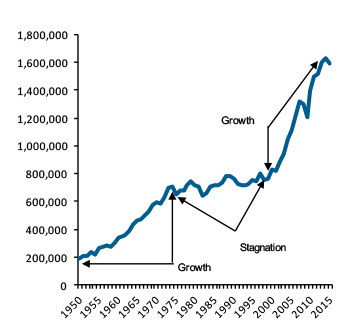

The chart highlights global steel output since 1950. Very simply, we can look at 3 cycles.

- 1950-73 – steady growth. Post-war investment in North American infrastructure; the development of the automobile; reconstruction in Europe and the emergence of Japan. All drove steel production and consumption higher.

- 1973-98 – stagnation. The oil shock; light-weighting in cars, packaging, construction and increased efficiency. The end of investment in Europe and North America led to demand falling and only partially offset by the growth in emerging Asia.

- 1998-2014 – the emergence of China. A country of 1.4bn people industrialised and moved from the country to the city; a development model specifically based on steel-intensive capital investment.

Global Crude Steel Production ( 000 metric tons)

Steel prices since 1950. Source: Steel-Insight.

….and now?

The first two cycles lasted 25 years; the last one has been 15 years.

Europe, North America and Japan (25% of global steel consumption) are mature consumers where steel consumption will perhaps grow 1% over the longer-term, and even that is under threat from aluminum in the automotive industry and lightweighting and efficiency elsewhere.

China (50%) has peaked. Construction is 70-80% of demand and that is a one-off use of steel. Once cities and roads are built, they don’t need to be renewed for a while. Steel consumption has peaked and could fall by 20% from here over the next decade.

Emerging economies (25%) were expanding, but in many cases, they were investing the super-profits of commodity gains from oil, metals and agriculture — from China. Without that bulwark, capital expenditure may plummet.

That means we could be in for a long period of stagnation and decline — 15-20 years based on previous cycles. It will be marked by mill closures, job losses and low prices. Yet the last period of stagnation gave birth to the minimills and a whole new dynamic group of steelmakers. It is not all doom and gloom.

Steel-Insight is a steel industry price-forecasting publishing company, based in Toronto. James May, the firm’s managing director, has been a steel industry analyst for 15 years and advises some of the major global steel trading companies, steel producers and steel consumers on the outlook for steel pricing and industry trends. For more information, visit www.steel-insight.com.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.