What Hedge Fund Analysts Are Saying About Oracle

Estimize | Dec 13, 2013 02:10AM ET

In the recent fiscal quarter, Oracle (ORCL) has seen gains in its stock in the recent weeks and compared to its close competitors in SAP (SAP) and Adobe (ADBE), which reports on December 12th, Oracle is expected to put up higher numbers due to not only the recent introduction of new data service technology such as an improved version of Exadata but also recent database integration with groups/companies such as the OpenStack Foundation, with a greater focus on cloud-based computing. Oracle is undoubtedly regaining ground after a tumble in the last quarter.

Oracle is expected to report FQ2 2014 earnings on December 18th. The information below is derived from data submitted to the Estimize platform by a set of Buy Side and Independent analyst contributors.

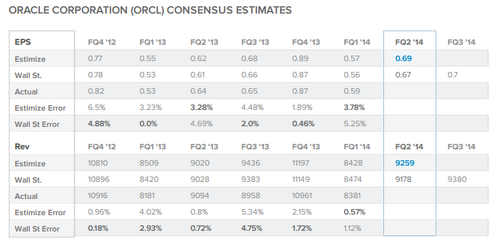

The current Wall Street consensus expectation is for ORCL to report $0.67 EPS and $9.174B revenue while the current Estimize consensus from 13 Buy Side and Independent contributing analysts is $0.69 EPS and $9.259B revenue. The magnitude of the difference between the Wall Street and Estimize consensus numbers often identifies opportunities to take advantage of expectations that may not have been priced into the market. In this case, we’re seeing a bigger differential between the Estimize and Wall Street numbers compared to previous quarters.

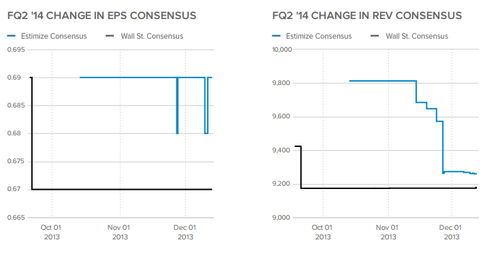

Over the past four months the Wall Street consensus trend for EPS has increased from $0.56 to 0.67 while Wall Street revenue expectations have surged from $8.474B to $9.174B. The Estimize EPS has fallen this quarter with EPS going from $0.57 to $0.69 and revenue increasing from $8.428B to $9.259B.

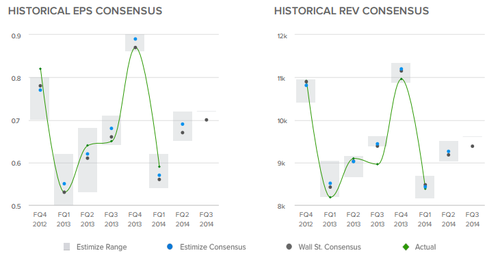

Over the previous 6 quarters, ORCL has beaten the Wall Street consensus for EPS 4 times and revenue 3 times. Over the same time period ORCL has beaten the Estimize EPS consensus 3 times and beaten the Estimize Revenue consensus 3 times.

The distribution of estimates published by analysts on Estimize range from $0.65 to $0.72 EPS and $9.023B to $9.500B in revenues. We’re seeing a larger distribution of estimates this quarter for ORCL than normal. The size of the distribution of estimates relative to previous quarters often signals whether or not the market is confident that it has priced in the expected earnings already. A narrower distribution signaling the potential for greater volatility post earnings, a wider vice versa.

The analyst with the highest estimate confidence rating this quarter is Alex Salomon who projects a $0.70 EPS and $9.105B in revenue. Estimate confidence ratings are calculated through algorithms developed by our deep quantitative research which looks at correlations between analyst track records and tendencies as they relate to future accuracy.

Despite a fall in earnings in the previous quarters, the investor must look at how Oracle’s competitors have also taken similar, if not equal hits to their revenue line. However, the one competency that Oracle has over its competition is its ability to innovate and continue to reinvest in itself. Expect Oracle to continue to advance its flagship properties and further the field of cloud-computing in the near future.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.