What Happens To Gold If The Dollar Collapses?

Przemyslaw Radomski, CFA | Dec 06, 2012 10:55AM ET

Today’s essay is the first of a two-part commentary on U.S. debt and the dollar collapse.

On numerous occasions we have gone back in our commentaries to the year 1971 and U.S. President Richard Nixon’s decision to cut off the ties between the greenback and gold. Today, we revisit the topic in search of the implications it has for the price of the yellow metal.

Recent History

Prior to 1971 the most prominent world currencies had been regulated by the Bretton Woods system. Under this agreement, the U.S. agreed to link the dollar to gold. This meant that any amount of dollars handed over by a foreign government or central bank would be exchanged for gold at $35 per ounce. Such an arrangement had a particularly important consequence for money creation. Namely, the U.S. government shouldn’t issue more paper money than it had physical gold to back this money up. In practice, it was rather improbable that all the dollars would have to be exchanged for gold at once, so the U.S. government in fact issued more money than it could have paid for with gold, but the main restriction was in place: debt numbers couldn’t be inflated to unsustainable levels.

In 1944 when the Bretton Woods system was introduced, the relation of U.S. debt to the official Treasury gold reserves stood at $319.90 per ounce of gold. This meant that there was $319.90 of borrowed money for every ounce of gold the U.S. had. With the price of gold at $35, a quick calculation shows that the U.S. gold reserves could have paid for about 10.9% of its debt. At first, it might seem that there was a lot of debt compared to gold assets. On the other hand, however, such a ratio was similar to reserves required from commercial banks by the regulator. In a way, the U.S. operated like a bank (with a lot of differences, of course).

By 1970, partly due to the Vietnam War, the U.S. began running consistent deficits. The government printed more dollars to meet its obligations and the amount of debt per ounce of gold surged to $1,172.56. The coverage of debt in gold went down to 3.1%. The ability of the U.S. to keep up to the promise to exchange dollars for gold was put into question. Nixon, fearing a situation in which foreign central banks would make a collective bank run on Fort Knox, decided to cease to exchange the dollar for gold and directly break the Bretton Woods agreement.

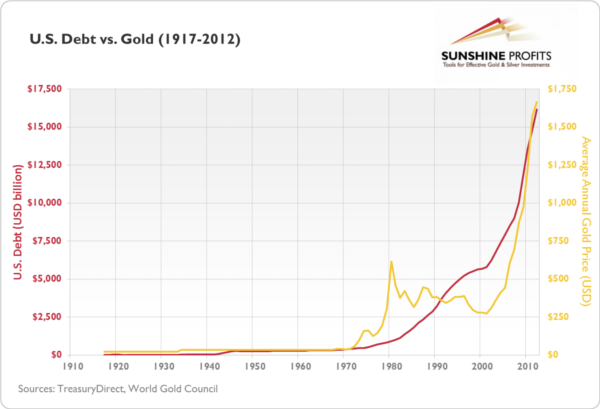

From that moment on, the dollar has been a fiat currency, that is a currency not backed by a physical asset, just by a promise of the government to accept payments (taxes) in it. But, as we’ve just seen, promises can be broken and right now the ability of the U.S. to pay its debts off in the future is also being put into question. To see why, take a look at the chart below.

Since 1970 U.S. debt has gone up from $370.9 bln to $16,159.5 bln, which is a more than 41-fold increase (!). Since 2000 gold has appreciated along with the ever sharper increase in debt. A similar chart was discussed in our commentary on gold and silver portfolio structure .

Thank you for reading.

Przemyslaw Radomski, CFA

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.