What Event Could Trigger The Next Market Correction

Blog of HORAN Capital Advisors | Jul 03, 2014 01:44AM ET

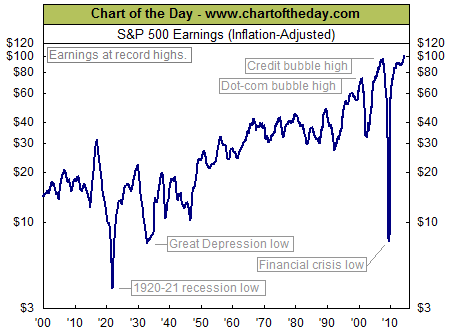

"With earnings season just around the corner, today's chart provides some long-term perspective on the current earnings environment by focusing on 12-month, as reported S&P 500 earnings. Today's chart illustrates how earnings declined over 92% from its Q3 2007 peak to Q1 2009 low which brought inflation-adjusted earnings to near Great Depression lows. Since its Q1 2009 low, S&P 500 earnings have surged to all-time record highs. To further illustrate the significance of the current corporate earnings recovery, consider that the run-up in real earnings from Great Depression lows to credit bubble peak took over 74 years. The run-up from financial crisis lows to today has been similar in magnitude (actually slightly more) but was accomplished in a mere five years. In the end, S&P 500 earnings are currently at all-time record highs."

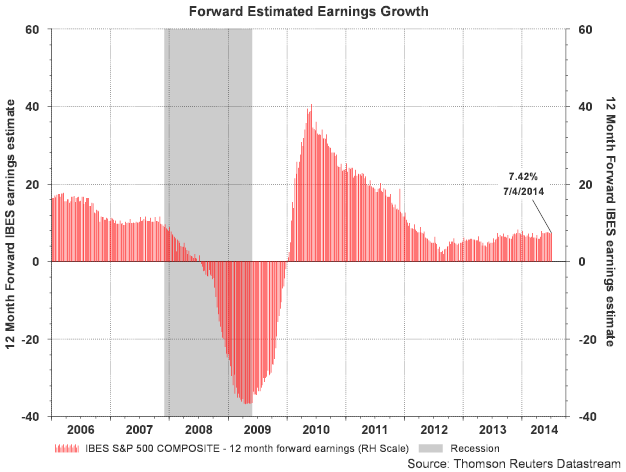

"Since hitting a peak in negative EPS guidance in Q4 2013, companies in the S&P 500 have issued fewer negative EPS preannouncements and more positive EPS preannouncements for the second consecutive quarter. For Q2 2014, 84 companies have issued negative EPS guidance and 27 companies have issued positive EPS guidance. The number of negative preannouncements is below the record high of 95 set in Q4 2013, and the number of positive preannouncements is above the record low of 17 also set in Q4 2013. If these are the final numbers for the quarter, it will mark the lowest number of negative EPS preannouncements since Q4 2012 (79) and the highest number of positive preannouncements since Q4 2012 (34). (emphasis added)"

"New orders, as they are in Markit's manufacturing report released earlier this morning, are the key highlight of the ISM report for June, overshadowing the headline composite index which held steady at 55.3. New orders rose 2.0 points to a very strong 58.9 which point to acceleration for general activity in the months ahead (emphasis added). Production, at 60.0, is already very strong as are imports, at 57.0 for a 2.5 point gain."

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.