What Drove The Sharp Reduction In US Trade Deficit

Sober Look | Feb 10, 2013 02:06AM ET

Some folks in the media are making a big deal out of the US trade deficit decline in December.

The SF Chronicle : - Number of the day: 20.7 percent

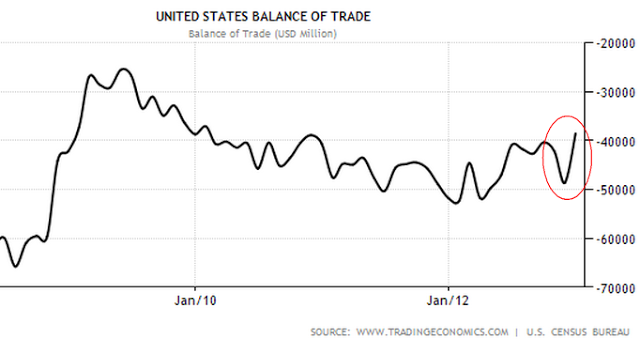

That's how much the U.S. trade deficit shrank in December from the previous month, the U.S. Commerce Department said Friday. The gap between imports and exports was the smallest since January 2010 and much less than the $46 billion expected by 73 economists in a Bloomberg poll. The deficit was cut by record exports of refined petroleum products to countries such as Brazil, combined with lower imports of crude oil. Yes, that's an impressive showing indeed. But let's take a look at the chart, because such numbers should not be viewed in isolation. The decline in deficit follows a sharp increase a month earlier.

The deficit increase in November was driven by hurricane Sandy, and was exacerbated by the Northeast US refineries' shutdowns. Fuel output in November dropped materially. The lower imports in December are therefore distorted by the reversal of the "Sandy effect". Trade deficit excluding fuel in fact declined less sharply than the overall number in December.

This is clearly a welcome result, but the real trend will not be fully visible until the January numbers are out.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.