What China And Google Tell Us About The Market Right Now

Cam Hui | Aug 12, 2015 01:14AM ET

In my last post written on Sunday (see You can't hurry tops!), I had postulated a rally to test the old SPX highs and possibly make marginal new highs. The market promptly went up on Monday. Overnight, the PBoC announced a 1.9% devaluation of the RMB against the USD. The market interpreted the move as panic by the policy makers in Beijing and a general risk-off environment followed.

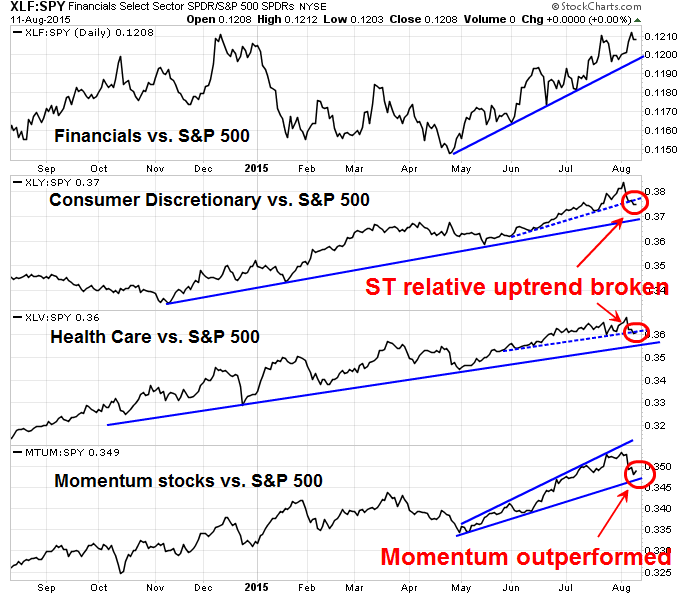

We know that we can't anticipate central bank interventions and announcements, but we can learn about the character of the market by the way it reacts to news. In my last post, I wrote that I would be watching the relative performance of the leadership sectors, namely Financials (via Financial Select Sector SPDR (ARCA:XLF)), Consumer Discretionary (via Consumer Discretionary Select Sector SPDR (ARCA:XLY)) and Health Care (via Health Care Select Sector SPDR (ARCA:XLV)), which comprise over 50% of the weight of the SPX. As long as the relative strength of these sectors held up, the bull case was intact.

Here is what has happened since. As the chart below shows, the relative uptrend of Financial stocks (top panel) remains intact. However, the short-term relative uptrends (dotted lines) of Consumer Discretionary (second panel) and Health Care (third panel) stocks were violated. Their longer term uptrends, however, remain intact.

While these developments are discouraging for the bull case, there is a silver lining. The relative uptrend of the high beta momentum stocks is still in place. In fact, momentum stocks (via iShares MSCI USA Momentum Factor ETF (NYSE:MTUM)) outperformed on Tuesday even as the market got clobbered.

We can also see this effect by the way the market reacted to the corporate reorganization at Google (NASDAQ:GOOGL), whose stock price soared on Tuesday despite the negative tone of the market. Felix Salmon wrote about the bullish and bearish points to the reorganization. Here is a sample of the more bearish elements.

B is for boredom. Larry is the founder and CEO of one of the most successful companies on planet Earth, but the company more or less runs itself at this point, and Larry doesn’t want to be judged on margins and earnings and boring things like that. He wants to be “in the business of starting new things.” So he’s handing over Google, along with all of its management headaches, to Sundar Pichai. And he’s keeping the sexy entrepreneurial stuff for himself.Get The News You Want

Read market moving news with a personalized feed of stocks you care about.Get The AppI is for impossible, and the dreaming thereof. Shareholders don’t like that kind of thing, but Larry is clear that he doesn’t answer to shareholders.

M is for management. Larry doesn’t know how to manage Google. Google – the entity which is being taken over by Pichai – is already a hydra-headed beast, encompassing not only search but also other multi-billion-dollar businesses including Maps, Chrome, YouTube, and (oh, yeah) the world’s biggest mobile operating system, Android. Keeping all those moving parts working in some vague sync is very, very hard work, and it’s not clear that Larry Page is the person to do it. Giving Pichai the job could mean that Google becomes more successful than it would otherwise have been.

Q is for quixotic. Larry can change Google’s name, but he can’t change its business. Google will continue to drive Alphabet’s business, and its reputation, for the foreseeable future, and for most purposes it will continue to make sense to consider the two to be identical. Everything else – Alphabet minus Google, essentially – is a “Larry tax”. At least unless and until it starts paying off.

V is for Valleythink. A company as large, vague, and ambitious as Alphabet could only exist in Silicon Valley. The financial idea is that the enormous profits flowing out of Google will then get reinvested into thousands of other businesses – partly through Google Capital and Google Ventures, which are separate Alphabet subsidiaries. No one whose name isn’t Warren Buffett has managed to sustain this model. And Warren Buffett isn’t investing in an attempt to change the world and make trillions of dollars, he’s investing for predictable returns.

The market could have interpreted the reorganization as the company had grown too large for Larry Page to manage. He just wants to transform it into a conglomerate (which only people like Warren Buffett have managed successfully) and Page just wants to use Google's cash flows to fund his special projects such as self-driving cars and human longevity. (Don't forget how acquisitions like Zagat's worked out.)

The positive market reaction to the reorganization news is still an indication that the bulls are still in control of the tape, though barely. The bull scenario of the market testing old highs and making new highs is therefore still in play.

Short-term reaction

Despite my mild bullishness for the next few weeks, I would remain cautious on stock prices for the next several days. These are the breadth readings of net 20-day highs-lows for the SPX as of Monday`s close (before Tuesday`s sell-off), which indicated that the market was overbought and due for a pullback (via IndexIndicators ):

Despite the weakness seen on Tuesday, RSI readings are nowhere near oversold levels where we might see a bounce. I would therefore anticipate that the SPX would break down through the triangle depicted below and test support, first at the 2065-2070 level, and possibly further support at about 2040.

The downside move is likely to be short and sharp. My inner trader moved to cash Tuesday morning. He doesn't believe he is nimble enough to play the short side and he would prefer to wait for oversold readings to take a long position.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.