What Can Stop The Copper Rout?

ING Economic and Financial Analysis | Jul 20, 2018 07:40AM ET

Copper briefly dipped below $6k yesterday raising the question, how low can it go? At least near-term trade war sentiment seems able to push the market where it likes since the physical indicators are fairly soft unless scrap tightens significantly, and demand is also going into seasonally slower periods. Here are all the things we're keeping an eye out for.

Fresh shorts could be vulnerable

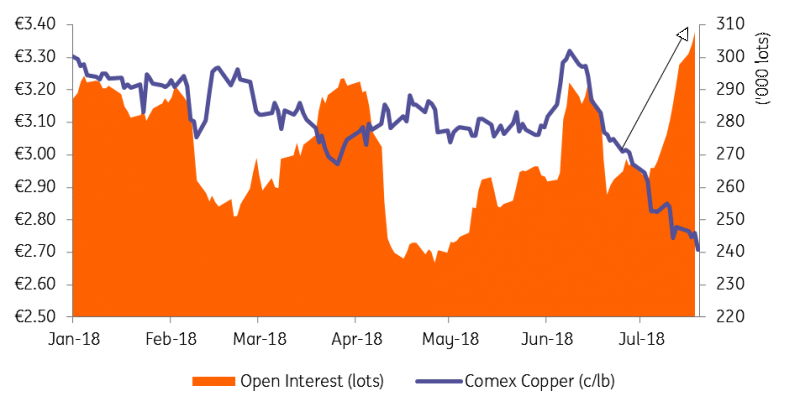

Open interest on the Comex Copper contract has risen 17% since the start of July, as prices have tumbled 8%, indicating a fresh amount of short positions being added to profit from the downside. We take the Comex contract to be more skewed by speculative flows rather than industrial activity indicating the fresh short interest is largely from the CTA, fund community rather than industrial. Traders should be wary that these less sticky position holders might be quickly prone to cover or take profits if the trade rhetoric dies down or the dollar takes a turn.

Retail friendly Shanghai open interest isn't behaving the same way. Open interest is down, and we suspect a good amount of the larger Chinese funds are also taking speculative Comex positions with the divergent flows - suggesting a preference to short copper in dollar terms rather than in CNY.

Comex Copper open interest rises as funds short global trade

The CNY correlation is phenomenal

The ten-day correlation between the LME copper price (in $/mt) and the CNY/USD is nearing 90%. A correlation this high hasn’t been seen since the yuan was first liberalised in mid-2016 and the devaluation made a long SHFE vs short CME copper arbitrage the topical trade for shorting the yuan. Yesterday, this correlation meant LME traders watched the red metal challenge the psychological $6k and drop down over 3% from the markete open but on the Shanghai Futures Exchange (SHFE) the market showed little volatility (in CNY/mt).

A good deal of the higher correlation might come from the fact that the People's Bank of China is tolerating greater market volatility in the daily fixing of the yuan, but the macro story matches up as well. The dollar is benefitting from safe haven flows while a trade war puts China's export contribution at risk with potential knock-on effects into wider business sentiment. As an example, the Shanghai stock index is down 9% since the start of June.

Likewise, copper is being targeted vs the dollar because of the risks trade wars pose to global growth and with it demand -even though, 49% of demand comes from China which actually makes it a more globally diversified metal than others. But, it's copper's high base in manufacturing which sees it more closely correlated with trade than those more construction-related metals. If the trade war becomes more global and starts to impact other significant copper consumers such as Japan, Germany and Korea, then copper could well be more vulnerable than moves in the yuan.

Our China economist, Iris Pang, now expects yuan to continue its fall and so far is on track to hit 7.0 by year end. The forecast was downgraded because new policies to open up the Chinese market to foreign investors are now expected to stem capital outflows and give the central government more confidence in a weaker yuan. The key concern for copper traders is that if this correlation holds up, this is going to be very bleak news for prices.

We don’t think that’s the case and the correlation will weaken. First off, while the CNY/USD may keep sliding, ING expects the dollar to turn against other key currencies like the EUR. Our house view is that the US trade rhetoric is likely to die down from Q4 and even reach a compromise, stemming the safe haven inflows. We expect that will undermine the short copper/long USD flows as well as to embolden copper consumers to begin restocking at ex-China regions.

There has been concern about the impact of the emerging market currency devaluation which could effectively reduce the copper consumers purchasing power. But all things considered copper is still much cheaper across the currenices. While its true copper weighted by our consumer currencies have recently been falling less than in dollar terms prices, it is still down substantially year-to-date. These are decent discounts vs the start of the year so once business confidence returns (either on a trade deal or at least for the rhetoric dies down and trade policies to be stable) we would still expect a healthy amount of consumer stocking to resume.

CNY and Copper move in closer sync

Copper outperforming in consumer currencies but still cheaper ytd

It's not just paper

The weak sentiment isn’t confined to the paper markets. The physical Chinese copper premium is also down 15% since the beginning of June. To us, the drop shows downstream uncertainty with traders and the industry less willing to build heavy stocks amid the macro unease.

Given the lack of tightness apparent in physical markets beyond short covering, dollar turn and improvements in the trade sentiment the physical market is unlikely to provide much in the way of momentum at least in the near term.

The physical indicators in Europe and the US are holding up better although not stellar. The return of the LME into a contango will support the financing of metal rather than pressuring spot sales. We identify most of the robust premium in the US with tight freight costs rather than incremental demand and Europe while it has seen a sizeable drawdown in stocks (LME down 60% since mid-April) is entering its seasonally quieter summer period. Only a sizeable pullback in the scrap supply contribution is likely to see physical conditions in these regions provide suitable direction to market prices.

Chinese copper premium also tumbles with macro sentiment

In scrap we trust

Our clients want to know which fundamental responses can steer copper prices from here on. But the truth is that typical mine supply reactions are fairly lagged, and consumers are caught up in the same macro uncertainty. It's entirely possible that in the meantime sentiment can send copper prices where it likes. Supply from scrap is typically the most reactive and has our full attention right now, but tightening signs are looking slower in the US compared to Europe.

Copper is now trading within the cost curve for miners so that the marginal operations (c.10%) will be losing money at today’s prices. However, history tells us that any decent supply reaction from miners will probably take a few quarters and so isn’t likely to support prices in the very near term. We are also unconvinced that consumers will seize the lower prices because of the general business uncertainty rolling over from the trade wars. As highlighted, the Chinese premium is showing the lack of aggressive Chinese stocking, and now we're getting closer to seasonally slower periods for demand anyway.

Scrap supply has a proven price reactive relationship. When prices drop, both the collection and sales from scrap dealers dries up. It’s also a sizeable portion representing c.20% of copper production (in smelters and refineries). If including the scrap used directly by fabricators (in place of the cathode) the copper scrap contribution is about 10Mt and just under 50% of the market. The total contribution from copper scrap units increased by over 500kt last year as prices rose and indeed capped the rally/supply shortage from the dip in mine supply. The question now is whether it will do the opposite that prices have dropped.

In Europe, scrap discounts from the LME have indeed begun to widen since Copper fell reversed from $7k reflecting a tightening taking place but it’s still far from stellar. The less scrap which is made available to the market the less of a discount it is expected to be sold at vs the LME price. German scrap has indeed tightened to levels not seen in well over a year, and French discounts are also sliding. In Italy though^, scrap discounts have barely receded at all; this region remains caught in a pocket of tightness with Leghorn copper premiums still up 25% YTD.

In the US, however, a scrap reaction seems to be slower than usual. American Metal Markets reports discount is only just starting to edge down and clearly lagging the sell-off on Comex. The discount for No one copper scrap to refiners has dipped by only one cent or 6% since mid-June. The industry says consumers are too well stocked already to sufficiently tighten the market and that US scrap overhang is larger than usual following import restrictions into China. The US has historically been the largest supplier of copper scrap to China and sent over 500kt in 2017.

Signs of European scrap tightening as discounts in France/Germany slide ($/mt)

Content Disclaimer: The information in the publication is not an investment recommendation and it is not an investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument.

This publication has been prepared by ING solely for information purposes without regard to any particular user's investment objectives, financial situation, or means. “For more from ING Think go here .”

Original post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.