What Are Stock Market Leaders Telling Us Now?

Chris Ciovacco | Mar 04, 2014 11:56PM ET

Ukraine Fears Ease

Monday and Tuesday have been about the conflict in Ukraine. Monday’s news was fear related; Tuesday’s news was better. From Bloomberg :

U.S. stocks rose, with the Standard & Poor’s 500 Index rebounding to a record from its biggest loss in a month, as comments from Russian President Vladimir Putin signaled the Ukraine crisis won’t immediately escalate. “On a very short-term basis, everything you’ve seen in the market has everything to do with the Ukraine,” Kevin Caron, a Florham Park, New Jersey-based market strategist at Stifel Nicolaus & Co., which oversees about $160 billion, said by phone. “But over last 2 weeks, the market has moved higher with the exception of yesterday. The bet has been made that the economy continues to expand and most of the disruption we’ve seen has been from the weather.”

Leadership Speaks To Economic Confidence

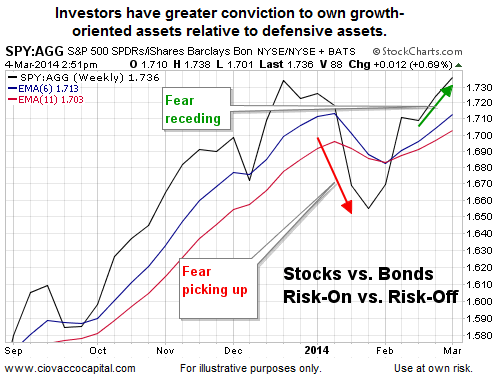

As we explained using a 2008 example in this recent video clip , during bear markets or risk-off periods investors tend to gravitate toward defensive assets, such as bonds (AGG), and away from growth-oriented assets, such as stocks (SPY). The observable evidence, as of Tuesday, continues to side with the bullish case for stocks and the economy.

Budget Proposal From President

With mid-terms looming in the fall, those facing re-election typically shy away from controversial programs, meaning the term “non-starter” may apply to much of President Obama’s budget. From The Wall Street Journal :

President Barack Obama proposed a $3.9 trillion budget package Tuesday peppered with new taxes on upper-income Americans and businesses, plus numerous spending initiatives aimed at bolstering education, research and low-income work programs. Many of the proposals are likely to meet a cool reception on Capitol Hill, where both parties are preparing for November elections that could change the balance of power on Capitol Hill.

Investment Implications – No Core Changes Monday or Tuesday

Based on our market model’s read of the evidence, we have increased exposure on the growth side of our portfolios six times since the market’s risk-reward profile began to improve on February 7. Monday’s sell-off did not inflict any significant damage, and thus we held our long positions in U.S. stocks (SPY) and technology stocks (QQQ). If stock bulls can carry Tuesday’s momentum forward, we may cut back on our bond exposure (TLT) later this week.

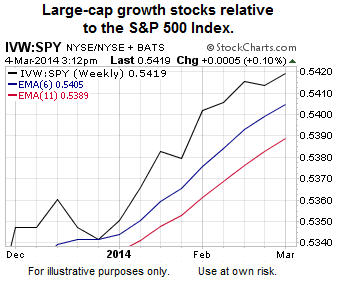

Our short list of investment candidates has an undoubtedly risk-on bias: large-caps (Schwab US Broad Market ETF, (SCHB)), technology (SPDR Select Sector Technology ETF, (XLK)), large cap growth (iShares S&P 500 Growth ETF, (IVW)), mid-caps (SPDR MidCap Trust Series I ETF, (MDY)), small cap growth (iShares Russell 2000 Growth, (IWO)), and health care (SPDR Health Care ETF, (XLV)).

Using Hard Evidence As A Guide

While risk-on periods always battle countertrend rallies, making decisions based on the weight of the evidence will typically keep you aligned with the markets. The market has been giving “the weight of the evidence remains bullish” clues for several weeks. The S&P 500 made a new closing high Tuesday, which means the evidence has been a generous guide.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.