What's Gold Really Worth?

Phoenix Capital Research | Oct 30, 2012 02:47AM ET

Since the Financial Crisis erupted in 2007, the US Federal Reserve has engaged in dozens of interventions/ bailouts to try and prop up the financial system. Now, I realize that everyone knows the Fed is “printing money.” However, when you look at the list of bailouts/ money pumps it’s absolutely staggering how much money the Fed has thrown around.

Here’s a recap of some of the larger Fed moves during the Crisis:

- Cutting interest rates from 5.25-0.25% (Sept ’07-today).

- The Bear Stearns deal/ taking on $30 billion in junk mortgages (Mar ’08).

- Opening various lending windows to investment banks (Mar ’08).

- Hank Paulson spends $400 billion on Fannie/ Freddie (Sept ’08).

- The Fed takes over insurance company AIG for $85 billion (Sept ’08).

- The Fed doles out $25 billion for the automakers (Sept ’08)

- The Feds kick off the $700 billion TARP program (Oct ’08)

- The Fed buys commercial paper from non-financial firms (Oct ’08)

- The Fed offers $540 billion to backstop money market funds (Oct ’08)

- The Fed agrees to back up to $280 billion of Citigroup’s liabilities (Oct ’08).

- $40 billion more to AIG (Nov ’08)

- The Fed backstops $140 billion of Bank of America’s liabilities (Jan ’09)

- Obama’s $787 Billion Stimulus (Jan ’09)

- QE 1 buys $1.25 trillion in Treasuries and mortgage debt (March ’09)

- QE lite buys $200-300 billion of Treasuries and mortgage debt (Aug ’10)

- QE 2 buys $600 billion in Treasuries (Nov ’10)

- Operation Twist 2 (Nov ’11)

- QE 3 ($40 billion in MBS monetization per month)

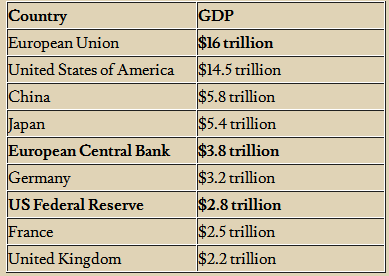

And this is just a brief recap. I’m almost certain I left something out. Indeed, between 2008 and today, the US Federal Reserve has grown its balance sheet from $800 billion to almost $3 TRILLION in size (larger than the economies of Brazil, the UK, and France).

The Fed is not the only bank to engage in such profligate policies either. Thanks to its bond purchases as well as its LTRO 1 and LTRO 2 schemes, the European Central Bank (ECB) has in fact grown its balance sheet even larger than the Fed.

As a result of this, inflation hedges, particularly Gold have been soaring. Gold was, is, and always will be THE ultimate storehouse of value. Mankind was prizing it long before the concept of stocks, mutual funds, or paper money even existed.

So with world central banks printing paper money day and night it is no surprise that Gold is now emerging as the ultimate currency: one that cannot be printed. Indeed, Gold has broken out against ALL major world currencies in the last ten years. The below chart prices Gold in dollars (Gold), euros (Blue), Japanese yen (Red) and Swiss francs (Purple):

Now, a lot of commentators have noted that gold is already trading above its 1980 high ($850 an ounce). What they fail to note is that thanks to inflation, $1 in the ‘70s is worth a LOT MORE than a $1 today.

For gold to hit a new all time high adjusted for inflation, it would have to clear at least $2,193 per ounce. If you go by 1970 dollars (when gold started its last bull market) it’d have to hit $4,666 per ounce.

If you do not already have exposure to Gold, consider getting some now. If you do decide to buy, I strongly urge you to buy actual physical bullion because it is not clear that the various Gold ETFs actually own the bullion they claim to

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.